Operators are taking four approaches to grow revenue

Operators continue to seek growth from connectivity, but are looking for ways to support this revenue and gain new sources of income. Operators are adopting four broad strategies to achieve growth (Figure 1), which we will explore in this article.

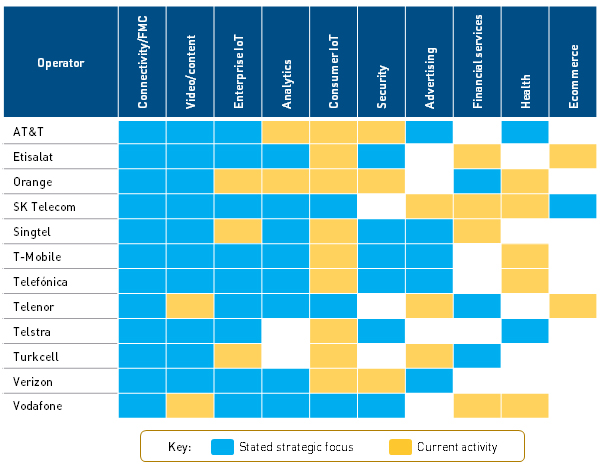

Figure 1: Four types of growth pursued by telecoms operators [Source: Analysys Mason, 2017]

A consensus is emerging that operators should focus on growth that supports their core connectivity business, and that their explorations of new areas (if any) should be limited to a small number of opportunities. The days of pursuing tens, or even hundreds, of new project ideas (internally or through investment in start-ups) are over for most operators. We believe that this new approach is correct: operators should focus on a manageable number of initiatives in which they can leverage their unique assets.

Operators must also be realistic about the likely impact of any new initiatives – given the scale of their core business, anything adding 5% to revenue should be considered a success. Opportunities in adjacent markets can also serve to complement the core business by supporting ecosystem growth or strategically extending an operator’s role in the value chain.

1. Connectivity remains an area of focus, and even growth

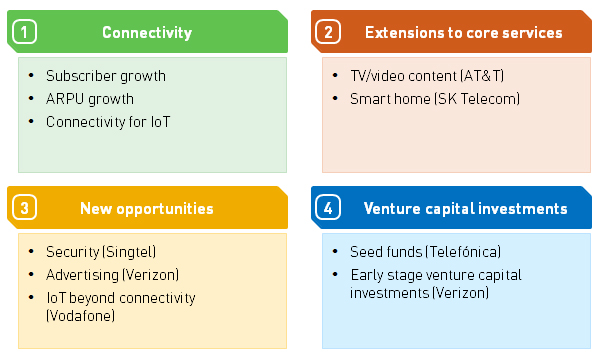

Connectivity is responsible for more than 90% of most operators’ revenue. It remains an area of strategic focus and operators hope do more than manage the decline of connectivity revenue. For example, AT&T believes that demand for mobile video can still generate revenue growth and that improvements can be made in core metrics, such as ARPU and churn.

Sources of growth from connectivity include:

- acquiring new subscribers either in growing or emerging markets or by increasing market share in more-developed fixed or mobile markets

- moving customers up pricing tiers faster than unit prices fall, where competition allows

- improved segmentation (potentially using analytics to enable price discrimination)

- fixed–mobile convergence (FMC) to benefit from lower churn rates and potential upsell

- IoT and the connection of new ‘things’.

2. Operators are also considering proximate services as a source of growth

Most operators are also considering services that are proximate to their connectivity offerings, which are intended to reinforce or leverage this core business. Examples of these include TV/video content and smart home solutions.

Many of the services in this category are lower margin than operators’ core connectivity business, and investment plans must acknowledge this. Concerns about real margin dilution can be set aside if the services support an operator’s core business. These new services may provide the following benefits for operators:

- extending their position in the value chain to insulate their core business from encroaching rivals

- bundling additional services to maintain the value of existing ones (‘more for more’ pricing) and possibly slow down erosion of weaker elements in the bundle

- decreasing churn by bundling services, notably by associating higher churn services with lower churn ones

- building ecosystems to support other activities – for example facilitating online payments to support a content business.

3. Some operators are focusing on a small number of new service areas

In terms of new opportunities, operators are increasingly focusing on (and investing heavily in) a small number of specific, qualified services. For example, Verizon has invested many billions of dollars in advertising and IoT/fleet management, but has placed much less emphasis on other areas.

This represents a shift in thinking from early digital services divisions that were launched and quickly closed down, such as Telefónica Digital (2011–2014). These digital divisions explored many areas – typically ten or more – with limited investment (often less than USD10 million for each area), and had little success. It is symptomatic of the problems of this approach that many of the services that survived were actually communications services (for example, Appear.in by Telenor).

The areas being explored now (such as advertising, IoT beyond connectivity and security) all exploit operators’ existing assets (such as their brands, sales channels, connectivity services or customer bases), but are less ‘proximate’ to the core business than those described in the previous approach. They are designed to generate new revenue streams, not reinforce existing ones.

We believe that the most attractive of these opportunities will be nationally bound, require a high level of investment and benefit from some degree of regulatory protection.1 These may provide barriers to entry, which will limit competition.

There are exceptions to this nationally-bound approach. In particular, Singtel has only limited scope for local expansion, as it is the dominant telco within the city state, and is therefore considering international opportunities for growth. It is making billion-dollar investments in advertising (through Amobee and further acquisitions) and in security (with Trustwave). Growth for both Amobee and Trustwave will mostly come from markets where Singtel has no presence as a network operator.

Figure 2: Strategic growth opportunities for selected telecoms operators, June 2017 [Source: Analysys Mason, 2017]

4. Venture capital investments have become a more doubtful approach for operators, but some are still pursuing them

A small number of operators are continuing to pursue early stage investments in start-up companies – most notably Telefónica, but also Orange and Verizon.

Telefónica’s approach is to invest small sums in a large number of technology start-ups (over 400 investments so far), most of which are not working with Telefónica and are developing technologies that have no obvious application for the operator. Telefónica is focusing on Latin America and believes it can uncover unique opportunities in the region, as few other investors are present.

However, most operators have reduced their start-up investment activities. They do not have the resources to discover or lead investments, and often struggled to derive any mutual benefits from them.

Exceptions to this trend are start-ups that have an obvious link to the operator’s core business and mutual benefits that are easily exploited. Actility is an example of this. It has developed a platform for the IoT networking technology LoRa, and its investors include Orange, Swisscom and KPN, all of which have national LoRa networks.

This article was based on Analysys Mason’s recent Report Telecoms operator growth strategies: case studies and analysis, which provides case studies on the growth strategies of 12 operators around the world. For further details of this report or of how Analysys Mason can advise operators on growth strategies, please contact Tom Rebbeck or Stephen Sale.

1 For more information, see Analysys Mason’s Telecoms operators should avoid competition with tech giants when selecting vertical market opportunities.

Downloads

Article (PDF)Authors