Disruption by digital media and regulatory change will drive consolidation in the audiovisual sector

The Internet is transforming much of the audiovisual sector, including creation, production, distribution, consumption and monetisation of content. This transformation is occurring rapidly and is having a profound impact on both the audiovisual value chain and the business models of stakeholders.

The European Union is simultaneously making critical changes to legislation and regulation of the audiovisual sector and the Internet. We highlight some of the important issues that are at stake in this article and consider some of the potential impacts on players’ business models.

The rise of digital media and IP distribution is transforming the sector

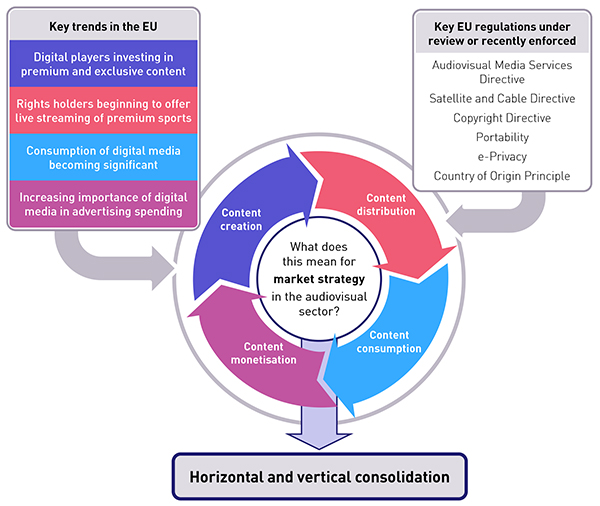

Recent events have illustrated four key trends in the audiovisual sector.

- New (digital) market players have become significant investors in premium and exclusive content. Netflix plans to invest USD6 billion in content in 2017 (an increase from USD5 billion in 2016), according to its CEO Reed Hastings. This is comparable to the UK’s total annual spend on network TV programmes (GBP6.5 billion in 20151) and five times more than the total annual investment in scripted content by all French TV channels (EUR1.2 billion in scripted audiovisual and cinema content in 2015, excluding sports, news and other non-scripted content2).

- Rights holders are beginning to offer live streaming of premium sports. Rights holders are starting to broadcast some significant and valuable content live on OTT platforms in addition to traditional linear TV. For example, La Liga and Mediapro in Spain announced an agreement with Facebook in February 2017 to use the social media platform to broadcast the Copa del Rey in countries where they have not sold the rights to a TV operator. Facebook broadcast the semi-finals of the tournament in over 40 markets, including Brazil, Italy, Russia, Thailand and the UK.

- Consumption of digital media is becoming significant, if still lower than that of traditional TV. Google recently announced that 1 billion hours of video are viewed on its YouTube platform every day – a significant milestone. This means that users spend an average of one hour per day watching content on YouTube. This is still significantly less than the four hours per day that European people spend watching traditional TV and consumption of online content varies significantly among different age groups (young people are much heavier consumers of online content than older segments). However, consumption of digital media is becoming significant and this has already affected advertisers’ spending across various media types.

- Advertisers’ are placing increasing importance on digital media in their budgets. Digital advertising overtook TV advertising in France in 2016 in terms of market share (29.6% of the advertising market compared to 28.1%3). We expect that digital advertising will also overtake TV advertising in the USA in 2017.

The audiovisual sector has undergone vertical and horizontal consolidation during these transformations, and more is expected. ITV (an integrated producer/broadcaster from the UK) very recently acquired a majority stake in French television production group Tetra Media Studio. Mediawan (a special purpose acquisition company targeting the media content and entertainment industries) also recently acquired its first target, Groupe AB (a French player in production, distribution and aggregation of TV content in Europe). Mediawan indicated that this was a “first step towards building a leading independent premium content platform.” A potential partnership between Vivendi in France and Mediaset in Italy has also been rumoured.

European policy makers are revamping critical regulation governing the audiovisual sector, including online content

European Union legislation governing the audiovisual sector is in flux. This includes the Audiovisual Media Services Directive (AVMSD), the Satellite and Cable Directive and the European Union Copyright Directive, as well as other work on issues such as portability, e-privacy, Internet video platforms and the country of origin principle. Some of the revisions to the AVMSD suggested by the European Commission in May 2016 are still being debated, including advertising, promotion of European works and the roles of intermediaries and platforms. For example, the new AVMSD may require VOD and SVOD platforms to promote European content to a certain level. This would be achieved by imposing a minimum quota for European content in their offers and obliging platforms to give prominence to European works in their catalogues.

These reforms should catalyse the ongoing transformation of the sector and may even exacerbate some of the trends previously described. Some argue that these changes could destroy the current ecosystem or disincentivise investments in small EU countries. Stakeholders and investors in the sector must understand these reforms and how they will limit, constrain or accelerate the key developments and transformations in the audiovisual market if they are to position themselves appropriately and make informed decisions.

Figure 1: Diagram showing relationship between key trends and regulatory changes in the European audiovisual sector and their likely impact on market strategy

Changes to European regulations may affect future consolidation within the audiovisual sector

European players require increased investment to scale-up their own activities and to counter the US and global players that have recently entered their national markets. Some players have no desire to expand their operations globally, but the changing regulatory environment may require them to address a larger market. Audiovisual content rights may no longer be defined by national borders within Europe and some claim that portability is the first step towards pan-European licencing. Players that are unwilling to expand to a global market should nonetheless consider addressing a unified linguistic, cultural or geographic market (for example, a Mediterranean or Nordic one), or even a pan-European one. This is likely to lead to more consolidation or partnerships within the audiovisual sector.

Similarly, we are witnessing significant consolidation in the production sector. Scale is also important to production and the impact of new quotas for European content (which may be imposed on SVOD platforms by the revision of the AVMSD) remains unclear. Producers must have a pan-European (or global) dimension and distributors deep and attractive catalogues if they are to negotiate deals with global players, such as Amazon and Netflix. Modifications to the country of origin principle or to territoriality of rights may also strengthen the trend for consolidation, although the impact of these modifications will require careful assessment. However, consolidation will require players to correctly identify the catalogues of rights that have regional, European or global appeal and ensure that new partnerships can be correctly targeted. They will need to understand trends, projections and new usages to achieve these aims.

Analysys Mason has broad experience in the audiovisual sector – we have previously written a report and a series of articles on the impact of regulation and IP on the audiovisual value chain.4

1 The Communications Market 2016, Ofcom. Available at https://www.ofcom.org.uk/__data/assets/pdf_file/0026/17495/uk_tv.pdf

2 Les chiffres clés de la production audiovisuelle en 2015, CSA. Available at http://www.csa.fr/Etudes-et-publications/Les-chiffres-cles/Les-chiffres-cles-de-la-production-audiovisuelle-en-2015

3 Observatoire de l’e-pub, 2016 Report, SRI. Available at http://www.sri-france.org/wp-content/uploads/2017/01/17%C2%B0-ED-OBS-EPUB-SRI_PWC_UDECAM-FY16.pdf

4 For further details, see Analysys Mason’s Report A study on the impact of the Digital Single Market on the sports audiovisual ecosystem in Europe and our recent articles on the media sector