Commercial due diligence support to a holding company as part of its USD300 million investment in data-centre operator ChinData Group in China

Project experience | Transaction support

The problem

- Our client, an investment-oriented holding company, was evaluating the opportunity to expand its data-centre footprint beyond South Korea. The client was considering investing in ChinData Group, a data-centre operator primarily focused on the Greater China market (with further assets in India and Malaysia)

- We supported our client in performing commercial due diligence of the target, including a deep analysis of its anchor tenants and the hyperscale data-centre market in China

The solution

- We identified the key success factors for a hyperscale operator in China, and assessed the target and its key competitors across these criteria

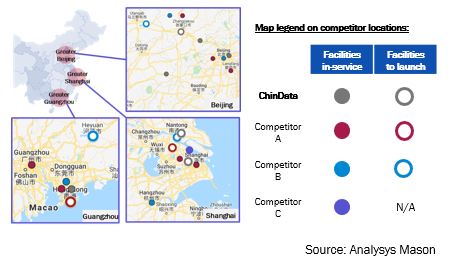

- In particular, we assessed the competitive advantage gained by the target’s concentration of facilities within Zhangjiakou, in Greater Beijing, and potential barriers to entry and regional substitutability

- We performed statistical analyses on relationships between several data-centre indicators, including power usage effectiveness, facility size, ambient temperature and capex per megawatt (MW)

- We reviewed the target’s key customer contracts and the revenue risk associated with its anchor customers

- Finally, we performed a full business plan assessment, reviewing all key revenue, capex and opex drivers for reasonableness and risk

Figure: City coverage of players near Beijing, Shanghai and Guangzhou

The result

- The work we carried out was instrumental in informing our client’s final investment decision; after successful regulatory approval, the business invested USD300 million in ChinData Group

- Our work was instrumental in informing our client’s final investment decision

We performed commercial due diligence of the target, including a deep analysis of its anchor tenants and the hyperscale data-centre market in China