Analysys Mason carried out a commercial due diligence of a Sigfox Operator in Europe on behalf of a financial investor

Project experience | Transaction support

The problem

- A financial investor interested in acquiring an Internet of Things (IoT) operator specialising in low-power wide-area (LPWA) connectivity, including its network and connectivity operations, commissioned Analysys Mason to provide commercial support in the review of the operator’s business plan and provide independent revenue and cost driver inputs for the development of a buy-side equity case

The solution

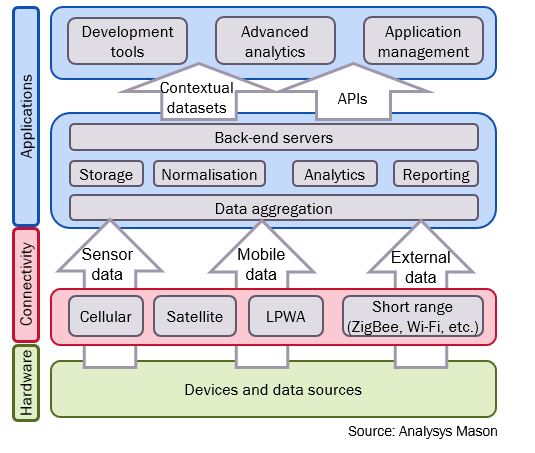

- We carried out a 360-degree review of the IoT operator’s new strategy by validating the strategy, the positioning in the value chain, relationship with Sigfox Corporation, technological roadmap and comparison against other IoT platforms, and competitive advantages in the market segments that management decided to address

- this review ended in a market sizing exercise for the whole IoT market and the use cases addressed by the operator

- We carried out independent interviews with customers and prospects to validate the pipeline and their perception of the operator

- Finally, we reviewed the business plan prepared by management and prepared a comprehensive set of inputs to support the client in developing an equity case

- The review covered all key value drivers in the plan:

- connectivity, hardware and consultancy revenue

- cost and capex items and potential future efficiency gains

Figure: Value chain of the IoT ecosystem

The result

- The inputs provided by Analysys Mason assisted the financial investor in making the bid decision for the LPWA operator

Our client, a financial investor, commissioned Analysys Mason to carry out a commercial due diligence of a Sigfox Operator, which resulted in our client making the bid decision for the LPWA operator