We helped a national regulatory authority in the Middle East to conduct an international retail price benchmarking exercise on fixed and mobile retail tariffs

Client project | Strategy

The problem

- Our client, a national regulatory authority in a Middle Eastern market, wanted to develop a benchmarking study comparing the prices of mobile and fixed telecoms products on the retail market in the country with similar products offered in the region and in comparable markets across the globe

- Analysys Mason was commissioned to conduct this retail price benchmarking exercise over a four-month period

The solution

- We agreed on the benchmark countries with our client, and then determined which operators were to be considered in each country based on a minimum market-share threshold – overall, we considered 79 mobile operators and 69 fixed operators across 24 benchmark countries

- A set of mobile and fixed ‘base’ plans on offer in our client’s market was provided by our client, including a mix of entry-level and high-end plans

- We disaggregated the features of each plan to determine which components should form the basis of the comparison (and which should be excluded), and to develop suitable usage assumptions when necessary

- We collected data on pricing and features across relevant plans in each benchmark country, and calculated an overall cost to achieve similar features as those included in the base plans

- For each base plan, we qualified the lowest-cost equivalent across operators surveyed in each country

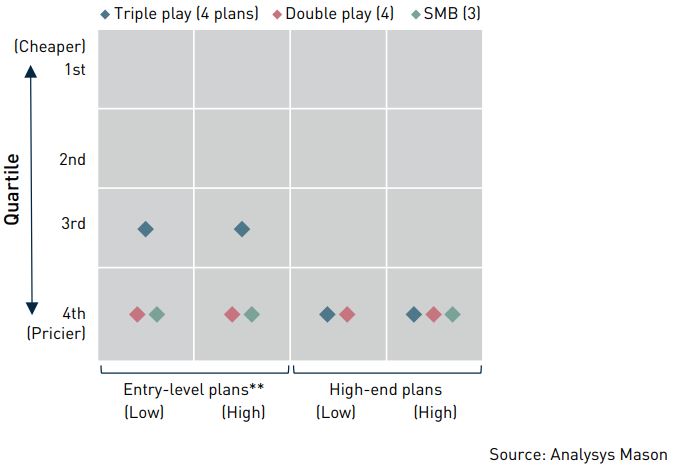

Figure: Overview of price competitiveness* of operator’s fixed plans considered in the benchmark

The result

- Our study concluded that operators in our client’s country were significantly more expensive than benchmark operators on fixed plans, whilst they ranked more competitively on mobile plans (across entry-level plans especially)

- Our client is expected to use this information as a key input to further discussions with operators

* Price competitiveness expressed in the form of quartiles (first/second/third quartile): operator ranks among 25%/25–50%/50–75% lowest-cost plans included in the benchmark; ** Note that for simplicity we divided each set of four triple-play/double-play plans into two entry-level plans (low and high) and two high-end plans (low and high). Only three SMB plans were included: we have considered these to comprise one entry-level (low), one entry-level (high), and one high-end (high) (i.e. no high-end (low))

We were commissioned by our client, a Middle-Eastern telecoms national regulatory authority, to conduct an international retail price benchmarking exercise, with the objective of comparing the prices for mobile and fixed services in the country against prices in other countries