Commercial due diligence of Hyperoptic, an MDU-focused FTTP operator in the UK

Project experience | Transaction support

The problem

- Our client, an international investment firm, was looking to make an investment in Hyperoptic, a vertically integrated fibre-to-the-premises (FTTP) operator with a focus on multiple-dwelling units (MDUs) that was planning to expand its FTTP footprint in Tier-1 cities across the UK

- Analysys Mason was commissioned to carry out commercial due diligence and to support our client through the potential investment

The solution

- Our work focused on answering a number of key questions on behalf of our client, including:

- the benefits and drawbacks of Hyperoptic’s proposed strategy, and the defensibility of its key differentiators (e.g. ability to access MDUs due to wayleaves secured from landlords) against competitors

- Hyperoptic’s expected unit economics, and implications of being vertically integrated instead of providing wholesale access to other retail operators

- the likely evolution of the UK competitive and regulatory environment in the market for broadband services

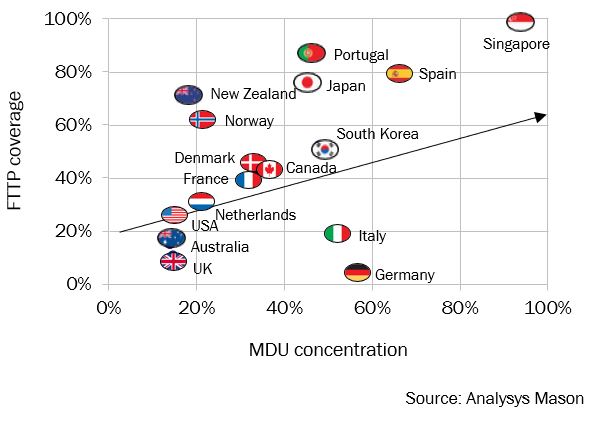

- what insights could be drawn from international benchmarks and case studies of similar urban-focused FTTP operators

- In addition to conducting analysis to answer the client’s key questions, we also conducted a thorough review of Hyperoptic’s proposed business plan and the achievability of projected roll-out targets, take-up, ARPU and costs

Figure: FTTP roll-out vs MDU concentration

The result

- The resulting report was used by our client in order to inform its decision of whether to invest and (alongside ad-hoc support and workshops provided by Analysys Mason) was instrumental in informing our client’s internal assessment of the potential value of a deal

On behalf of an international investment firm, we conducted commercial due diligence of Hyperoptic to support our client through the potential investment