Supporting a major reinsurer's assessment of complex refinancing decisions in multi-million-dollar deals

“The implementation of a tailor-made framework for commercial and technical due diligence has significantly empowered our clients' credit committees to handle investment decisions across diverse markets and asset types with efficiency and confidence.”

- Miltos Andriopoulos, Principal, Analysys Mason

The challenge

Against a backdrop of complex refinancing decisions, we helped InsuranceCo manage risk and streamline decision-making through structured assessments of its investment opportunities

InsuranceCo,1 one of the world’s largest reinsurers, was seeking to invest in the digital infrastructure market as part of its portfolio investment and diversification strategy. The company was interested in participating in large refinancing deals – valued in the hundreds of millions of dollars – as a secondary lender within a consortium that includes a leading syndicated bank and other lenders.

InsuranceCo faced the challenge of having to compare, and rely on, a wide variety of due diligence assessments that had been prepared for the different targets. These assessments were developed for equity transactions across various asset classes and geographical regions, incorporating a diverse range of benchmarks and KPIs. This variety led to complexity and inconsistency, resulting in potentially incomparable assessments that increased risks, reduced transparency and caused delays in obtaining approval from the credit committee.

Our approach

Adapting a framework to bring order and comparability to a diverse mix of styles and systems

Analysys Mason worked closely with InsuranceCo’s senior underwriting team on a series of projects to tailor the standardised framework of InsuranceCo’s refinancing systems to the intricacies of the digital infrastructure sectors. Using this tailored framework, it was possible to bring comparability to a highly varied array of digital asset classes, geographical regions and KPIs. Our assistance to InsuranceCo included the following:

- Tailoring of a standardised due diligence template: a consistent and structured framework for digital infrastructure investments was used to standardise the due diligence process.

- Focus on key metrics to the digital infra class: the tailored framework emphasised benchmarking different assets in a systematic manner (including previous investments) across the most relevant metrics to achieve efficiency and uniformity in the assessment of different assets.

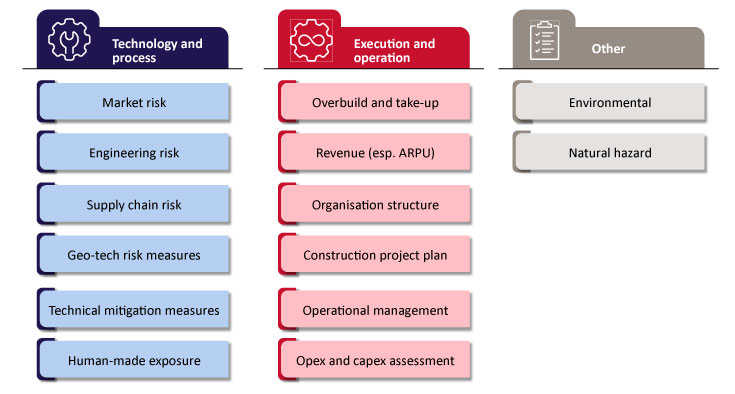

Illustrative example of risk areas assessed in the tailored framework

Source: Analysys Mason

The application of this tailored framework reduced risk by bringing greater structure to the assessment of different projects. It gave the client the data and insight it needed to ensure that the digital investments under consideration were aligned with its risk tolerance and investment goals, enabling them to participate effectively in consortium deals.

The impact

Streamlining the decision-making and authorisation process

We helped guarantee the efficiency of InsuranceCo’s refinancing systems: the adoption of a tailored standardised framework of commercial and technical items enabled quick and robust decision-making by the credit committee on digital infrastructure opportunities, regardless of their geographical location or asset type.

The multi-disciplinary and global experience of our project team, leveraging regional and asset-specific experts enabled the study to focus on the most critical items for the lender case to reach a conclusion in an efficient and swift manner.

1 The client is a major reinsurer, whose name has been withheld for confidentiality.

Contact

Miltos Andriopoulos

PrincipalRelated items

Predictions

GPUaaS revenue will quadruple in the next 5 years, powering new data-centre investment opportunities

Predictions

AI adoption is surging, but <25% of portfolio companies’ AI tools will fully succeed in 2026

Predictions

France is likely to be the next major European market to go from four to three mobile operators in 2026