Red-flag business plan review for a large multi-country operator group that was considering selling its stake in an African opco

Project experience | Transaction support

The problem

- Our client, a large multi-country operator group, was considering selling its stake in an African mobile operator to the other major shareholder of the mobile operator. As defined by the shareholder agreement, this sale required an independent third party to review and possibly adjust the business plan to be used for the valuation of the stake

- Analysys Mason was hired to pre-empt the “independent third-party review” process and inform our client on the expected adjustments, and issues that might arise from this process. Our role also involved helping our client prepare to address potential downsides that might be suggested by the independent third party – including on market developments and historical performance versus previous business plans

The solution

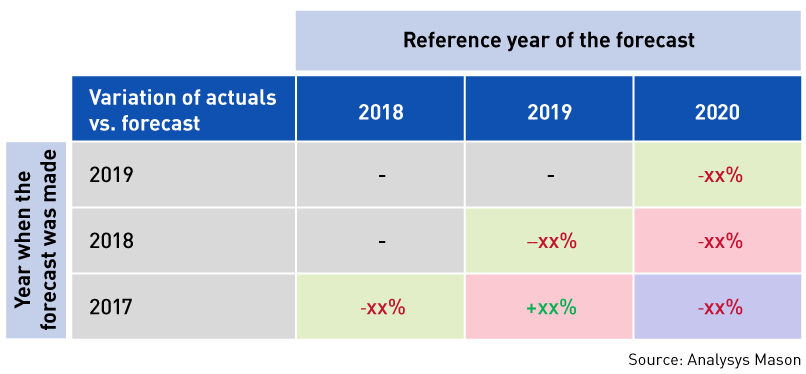

- We conducted a red-flag review of the mobile operator’s business plan, together with comparative analysis of business plans for previous years against actual performance, thus identifying areas of potential concern to the independent third party

- we highlighted the areas where an independent third party was most likely to make adjustments and helped our client prepare material to avoid negative adjustments to the valuation

- We also reviewed recent regulatory developments and market developments to quantify how specific adjustments which might be suggested by the independent consultant would affect the valuation

Figure: Illustrative comparison of actuals vs. forecast business plan targets

The result

- Our work gave our client a clear view on potential conclusions of the independent third party, and enabled it to be fully prepared to defend a favourable valuation of its stake; we provided a list of potential issues that could arise during the process and the supporting evidence we had developed for submission to the third party

- As a result of our work, the valuation process ran smoothly in a manner that was highly favourable to our client

Our client, a large multi-country operator group, was considering selling its stake in an African opco, which required an independent third party to review and possibly adjust the business plan to be used for the valuation of the stake. We conducted a red-flag business plan review which allowed the client to identify all the areas which may be of concern to an independent consultant and thus prepare its response and supporting evidence to the independent consultant.