We examined competitive, technology and regulatory threats to the viability of a wholesale fixed incumbent, and conducted an outside-in modelling exercise

Project experience | Strategy

The problem

- A financial institution was considering an investment in the wholesale arm of a large Western European fixed incumbent operator. Analysys Mason was engaged by the potential investor to examine the competitive, technology and regulatory threats to the future viability of the operator’s business

The solution

- Using a combination of internal expertise and secondary research, we tested a list of hypotheses to determine the attractiveness of a potential investment, including:

- the future defensibility of the operator’s copper and fibre assets

- the threat from alternative technologies such as cable, satellite and 5G fixed-wireless access (FWA)

- the competitive threat from other FTTP infrastructure providers

- the expected evolution of active and passive infrastructure regulation

- the operator’s potential scope for cost reductions

- a case study exercise examining prior fibre roll-outs in international markets and their implications for the incumbent

- Analysys Mason also undertook an extensive outside-in modelling exercise, forecasting the operator’s volumes, prices and financials over a 30-year time horizon to provide a view on the potential return on investment

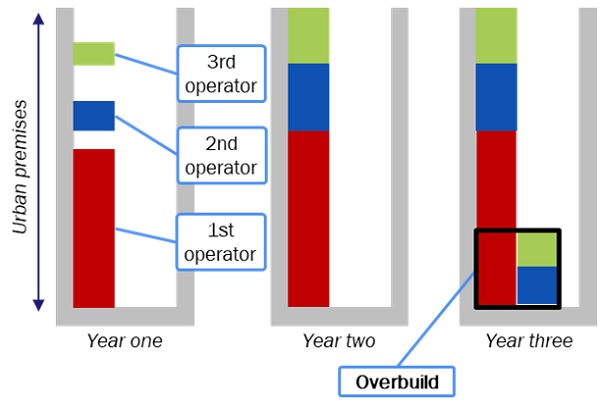

Figure: Illustration of overbuild modelling approach, based on announced operator roll-out plans

The result

- The resulting report was presented and discussed with the potential investor in a series of face-to-face workshops, and helped to inform our client’s discussions with the potential target

- The outputs of our modelling were used as commercial and technical inputs to a valuation model run by the investor’s financial advisers