Supported the merger of the tower portfolios of the two leading mobile network operators in Greece

Project experience | Transaction support

The problem

- In 2014, the two leading mobile network operators (MNOs) in Greece (Vodafone and WIND) entered into a network-sharing agreement to jointly manage their mobile networks and implement radio access network (RAN) sharing across select areas. As a result of increasing co-operation, the MNOs were looking to merge their tower infrastructure assets in Greece into a jointly owned entity (Vantage Towers Greece) which would be majority-owned by Vantage Towers, and then lease back the sites to Vodafone and WIND

- Analysys Mason was engaged as an independent adviser to assess the commercial outlook and technical characteristics of each party’s assets and inform relative valuations of the merger exercise

The solution

- We deployed a highly skilled senior team with deep knowledge of the tower industry and the local market, as well as local language skills

- We developed a forecast for future tenancies on a site-by-site basis for the two tower portfolios; determined suitable anchor pricing using total-cost-of-ownership modelling and modelled upside scenarios including the impact of tourism and commercialisation of small cells

- We performed a technical assessment on a sample of each party’s assets (e.g. maintenance status, technical capacity for hosting new tenants) through site visits

- Due to the handling of commercially sensitive information, we worked under a ‘clean-team’ environment to prevent the potential leak of forward-looking plans and other confidential information between the two MNOs

- As a result, three reports were produced: one for clean-team members only and two separate non-clean team reports (one for each party) which had commercially sensitive information on the other MNO redacted

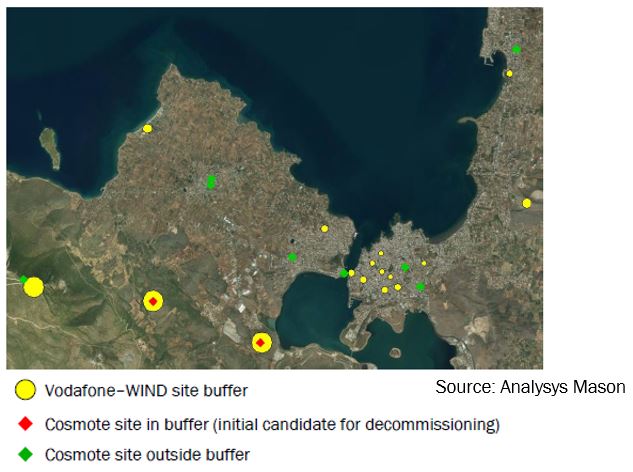

Figure: Illustration of decommissioning potential in Euripus Strait

The result

- Our inputs were used to construct the consolidated business plan of the two portfolios and inform the valuations

- Thanks to our analysis and continuous support, our clients successfully closed the merger in time and were able to present the deal as a successful case study of inorganic growth in preparation for Vantage Towers Europe’s initial public offering

We were engaged as an independent adviser to assess the commercial outlook and technical characteristics of each party’s assets and inform relative valuations of the merger exercise