Enabling the full benefits of 5G will need new thinking from regulators and operators

Operators' announcements of 5G launches have stepped up in recent weeks and hundreds more will commence service during 2020. This represents the opening of a major new front for service competition, targeting an increase in per-end-user revenue, winning new customers, reducing churn and launching new services. Mobile and fixed operators can take a variety of roles in this intensified market. Governance of the sector will need to adapt swiftly and carefully to ensure fair competition and good consumer outcomes from the outset, as the industry pivots towards the opportunities enabled by 5G.

5G will boost competitiveness across a range of communications markets and their adjacent industries

Competition will increasingly focus on 5G launches

Most mobile operators have confirmed that they intend to invest in their networks to offer 5G, albeit over different timeframes. It will be important for operators to launch 5G services in a timely way to remain competitive in the mobile market, before the greater capabilities of 5G allow their rivals to outcompete them. Speed and latency will be used to market 5G, because both will become more important – for example, for supporting Google Stadia and similar services over mobile connections.

Competitive dynamics continue to move towards converged offers

5G is expected to increase fixed–mobile convergence, giving greater advantages to integrated operators. Convergence of connectivity, communications and content will continue, and content will become a key source of differentiation. National operators are not in the strongest position to acquire broadcasting rights for premium sporting and first-run entertainment content, but providing seamless access over fixed and mobile to such premium content (that is, through partnerships) will be important to prevent churn.

Opportunities in IoT and smart cities involve competition, or partnership, with adjacent industries and services

Associated 5G developments in the fields of IoT and smart cities also represent an opportunity for a wide variety of interested firms to package advanced smart utility and connected-device solutions to consumers and businesses alike. However, this will require the underlying physical and digital infrastructure to be more extensively developed (for example, densification of mobile and fibre coverage, computing power at the edge of the network). This densification is in progress, but can only be completed across entire nations in the medium to long term; operators have the opportunity to plan to be the market leader, to join forces, or be a 'fast follower, catching up from behind.

Non-telco players could own 5G spectrum in the longer term

Most mobile access services can be provided over MNO (and MVNO) connectivity, and it is not yet known whether it will be common practice for other industry players to own spectrum for 5G. However, when the wider industry and adjacent players have a better understanding of how 5G technology will develop, there could be value in non-telcos acquiring 5G spectrum. This could be to provide private campus/facility area networks, augmenting or acting as a replacement to Wi-Fi, or for specialised wide-area connectivity such as for emergency, utility or vehicular communication services.

5G will introduce or expand a variety of competition concerns

The transition to 5G-led services introduces a significant number of fundamental and technical changes to the industry, in four broad categories. Competition concerns will accompany these changes.

Industry structure: the large fixed costs of 5G deployment, particularly with higher-frequency spectrum and massive MIMO antenna systems, will lead to greater scale effects. At the same time, mobile broadband traffic carriage will become increasingly commoditised, alongside the growth of associated 5G fixed-wireless traffic.

- Concerns: market concentration; entry, expansion and dominance.

Operator interdependencies: RAN sharing has been spreading across the mobile sector for a number of years. RAN sharing in 5G is complicated by factors surrounding non-standalone deployment and vendor interoperability. However, strong pressures on costs will push operators towards sharing. RAN as a service, wholesale RAN and neutral host architecture will also become more widespread, particularly where spectrum allocations are fragmented.

- Concerns: as per existing network sharing: correlation of infrastructure and services, restrictions to competition.

Network differentials: virtualised core networks and network-slicing technologies will be common in 5G. Analysys Mason has explored these developments in depth in other articles.

- Concerns: quality and service neutrality, non-discrimination.

New diversified and emerging services: the new ultra-reliable, low-latency and massive machine communications opportunities made possible by 5G technologies are not the initial focus of 5G offerings but they will enable operators to plan a much wider range of consumer and industrial communications applications. This places the connectivity component at the heart of many other, generally larger value chains. Adjacent industries will need, and want, to control the essential embedded communications.

- Concerns: quality differentials, network effects, barriers to entry/switching, access to product-user data, adjacent sector rules.

Existing, new and increasingly complex rules, remedies and policies may be applied to these 5G-driven competition issues

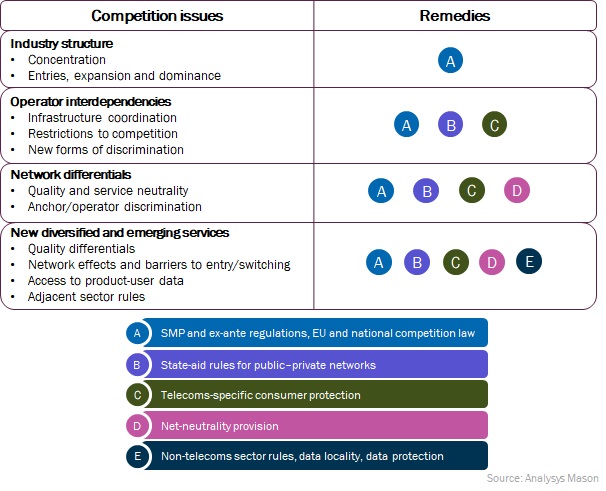

The figure below summarises the complexity of existing and new remedies and policies, which could be developed to address to the competition concerns highlighted in the section above.

Figure 1: Competition issues and remedies

The key issue for industry players is understanding the challenges and risks, while proactively avoiding the potential damage, as well as managing the regulators and competition authorities' interests. Suitable governmental and regulatory policy stances can help to guide the industry stakeholders and avert service development delays and economic drag that could reduce the benefits of 5G. Such action is needed already in 2020.

For more information about the competition effects that 5G will have on the telecoms industry and your business, contact Ian Streule.

Downloads

Article (PDF)Authors

Ian Streule

PartnerArticle

Policy makers must explore all possible levers to achieve gigabit connectivity ambitions

Report

AI for connectivity: how policy makers can help digitalisation

Report

LEO satellite broadband: a cost-effective option for rural areas of Europe