Mobile network operators have an opportunity in the private LTE/5G networks market

Enterprises in the industrial sector are undergoing digital transformations to improve the customer experience and the agility with which they can do business. Private networks that use LTE and/or 5G have the potential to provide reliable, high-performance, secure wireless communications, thereby fulfilling enterprises’ business-critical and mission-critical needs.

Private LTE/5G networks can provide significant benefits to industrial users

A private network uses localised network infrastructure (such as small cell access points) to provide coverage and connectivity for private use. It functions similarly to a scaled-down version of a public cellular network and can be based on licensed, unlicensed or shared spectrum. Some international spectrum authorities have set aside spectrum for localised services to further enable private networks, while others have promoted spectrum leasing and have made other non-mobile bands available for sharing. For example, the regulator in Germany has allocated 100MHz of spectrum in the 3.5GHz band for localised services,1 while the regulator in the UK has promoted spectrum sharing by making spectrum in the 3.8–4.2GHz band, part of the 1800MHz band and part of the 2300MHz band available on a shared basis for localised use.

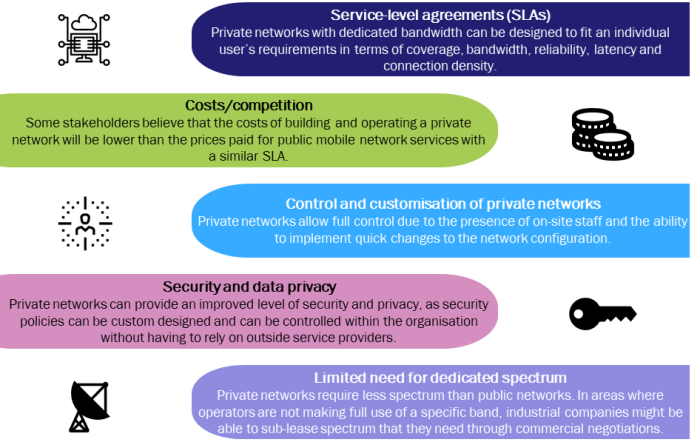

Private networks (sometimes referred to as campus networks) can potentially deliver several advantages to industrial users in terms of efficiency and security, depending on the requirements of those users and the network architecture employed. Figure 1 below outlines the potential benefits of private networks.

Figure 1: Potential benefits of private networks

Source: Analysys Mason, 2020

Large enterprises in the countries that are leading ICT development have shown interest in private networks

Companies such as Bosch, Daimler and Siemens argue that the high performance, low latency, reliability and security of private networks enables a whole host of new use cases to be addressed, which in turn allows industries to tap into business- and mission-critical applications that might not have been feasible otherwise. Some of these applications are common to industries in a number of countries. Figure 2 shows a non-exhaustive list of such applications.

Figure 2: Examples of business- and mission-critical applications that are enabled by private networks

Source: Analysys Mason, 2020

Several globally renowned enterprises have started to use private networks, particularly those in the USA, Germany, Finland and Japan. Some vendors and enterprises are working with operators to deliver private LTE/5G networks to the industrial sector, while others are working independently (Figure 3).

Figure 3: Examples of enterprises that are working with and without operators to develop private networks

| Enterprise | Country | Operator involvement | Details |

|---|---|---|---|

| Lufthansa | Finland | None | Lufthansa deployed a private 5G network with Nokia to enable the remote inspection of engine parts for its civil aviation customers, and is managing the network internally. |

| Fujitsu | Japan | None | Fujitsu, a Japanese ICT specialist, launched a private 5G network in the 28.2–28.3GHz frequency range to strengthen security over a 28 000 square metre area. |

| Komatsu America | USA | None | In collaboration with Nokia, Komatsu America announced that the Autonomous Haulage System (AHS) in the USA will operate on a private LTE network in order to deliver significant benefits including reduced worker exposure to harm and improved safety. |

| BMW | Germany | Deutsche Telekom | Deutsche Telekom built a private 5G campus network with Ericsson at BMW's Leipzig plant to control and monitor various applications in production. |

| e.GO Mobile | Germany | Vodafone | In partnership with Vodafone and Ericsson, German electric microcar company e.GO Mobile enabled 5G car manufacturing to deliver secure and real-time data networking across the production chain. |

Source: Analysys Mason, 2020

Early market observations indicate that there is an appetite for private networks

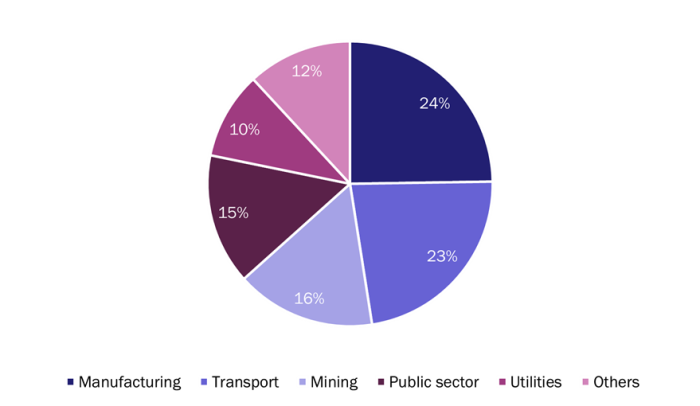

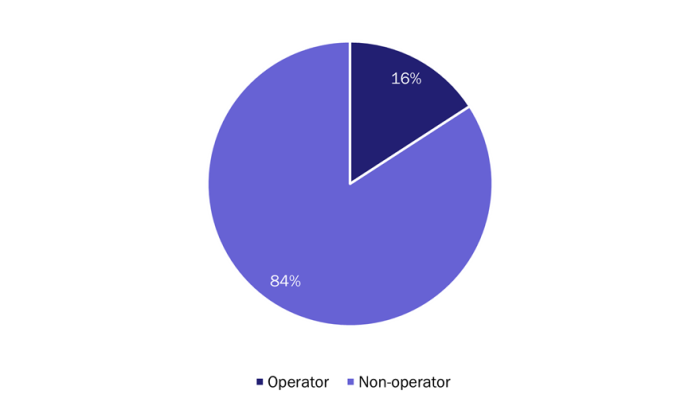

There have already been over a hundred announcements of private LTE/5G network launches. Initial market observations suggest that there is an appetite for private networks among enterprises, particularly those in industries such as manufacturing, transport, mining, the public sector and utilities. Indeed, these industries account for close to 90% of all publicly announced private networks worldwide (Figure 4). Additionally, 16% of the networks that have already been announced will be led by operators (Figure 5).

Figure 4: Publicly announced private LTE/5G networks, split by sector

Source: Analysys Mason, 2020

Source: Analysys Mason, 2020

Figure 5: Publicly announced private LTE/5G networks, split by the entity leading the deployment

Source: Analysys Mason, 2020

Operators must use their dedicated commercial teams and industry knowledge to offer competitive private network solutions

Industrial users and large enterprises are interested in investing in their own private networks in order to have control over their own infrastructure. Coupled with vendors’ ability to help them to set up their own private LTE/5G networks, this could potentially remove operators from the equation altogether. Enterprises may still consider partnering with mobile network operators to build their private networks, but they may similarly consider infrastructure vendors, small cell vendors or specialist system integrators. Operators must therefore be able to provide industrial users with a competitive and attractive proposal.

The four leading attributes that give operators a competitive advantage and enable them to tap into this market are as follows.

- The ability to use licensed spectrum. Operator-licensed spectrum is available and unlikely to suffer from interference. This is currently operators’ biggest advantage because unlicensed/enterprise-licensed spectrum options have not yet become available for private networks in most countries.

- Route to market. Operators already have relationships with many potential private network customers.

- Deep knowledge of mobile network design and operations. Operators have expertise in the mobile workforce and in the delivery of evolving network architecture and its operation.

- The ability to integrate with wide-area public cellular services. This is particularly important for customers that are seeking wide-area mobility services.

To make the best use of these advantages, operators will need to develop private network solutions that satisfy enterprise demands for a range of network characteristics (such as security, SLAs and flexibility), while also balancing the costs and benefits from the enterprise’s point of view. If the ownership and operation of private networks is outsourced to operators, enterprises can focus entirely on their core competencies.

To be in a position to capture this opportunity, operators need to initiate and execute research, and complete technical, architectural and product development. It is critical that operators effectively leverage assets and know-how in order to tap into this market; to do so, they may need to implement dedicated commercial teams with significant industry knowledge of the latest technologies and use cases, both from a technical and a financial point of view. This will ultimately allow operators to develop attractive enterprise private network solutions, thereby ensuring them a place within the ecosystem.

Analysys Mason works closely with stakeholders across the private network value chain, including regulators, vendors, system integrators and operators. Recent consulting projects conducted include providing commercial support in the enterprise private network segment (identifying sectors, needs and clients) for enterprises across Europe and the Middle East, and providing commercial support for pricing and negotiations between operators and enterprises (including an engagement with a leading mobile operator to support commercial negotiations with an infrastructure player). Extensive research on private network-related topics is also available through Analysys Mason Research. For more information about our services, please contact Rohan Dhamija or Jacopo Pichelli.

1 80MHz of the 100MHz allocated for localised services is shared with fixed-wireless access (FWA) connectivity providers.

Article (PDF)

Download