Further investment in 5G infrastructure could lead to over EUR160 billion of benefits in Europe

Consumers are already using 5G mobile broadband (MBB) services in some countries, and these initial 5G services will be expanded as mobile network operators (MNOs) continue to invest in 5G coverage. Further evolution to standalone, virtualised architecture will enable additional 5G use cases to be delivered, including multiple low-latency, ultra-reliable applications.

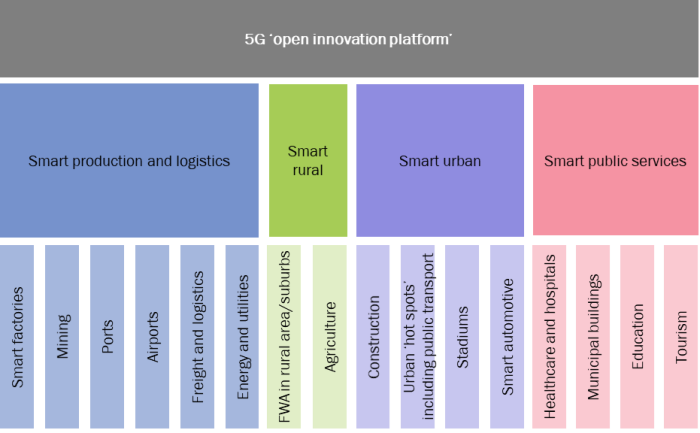

Analysys Mason set out a 5G ‘open innovation platform’ in a recent study in conjunction with Ericsson and Qualcomm (Figure 1). This platform is formed of a wide range of innovative use cases that full 5G networks may be able to support. Our study focused on modelling the costs and benefits of deploying 5G technologies to deliver these use cases.

Figure 1: 5G open innovation platform

Source: Analysys Mason, 2021

The use cases (bottom row in Figure 1) were grouped into clusters (middle row). This grouping helped to align our conclusions with different 5G policy themes and also aids interpretation.

Our aim was to develop new analysis of potential net benefits

When developing our analysis, we considered that many of the benefits of new 5G use cases are yet to be realised on a large scale. Hence, where possible, we referred to existing studies discussing said benefits in order to align our modelling with the published literature as much as possible. We also developed input assumptions for 5G deployment and benefits based on published industry experience from 5G trials that have already taken place in Europe. 1 We developed a detailed and robust analysis of the costs of rolling out additional infrastructure to deliver the 5G capabilities needed for the selected clusters/use cases in order to provide quantitative estimates of the net benefits (that is, the benefits delivered by the use cases, relative to additional deployment costs).

The economic benefits and additional infrastructure deployment costs of full 5G are calculated with reference to the 5G coverage that is expected in various European countries in 2025. Costs and benefits are incremental to those of current deployments (that is, the costs and benefits generated from the initial 5G deployment for consumer use are not included in our estimates). We assume that 5G will be deployed on 100% of existing mobile sites by 2025; 5G mid-band spectrum will be used on some sites, while others will use existing low and lower mid-band spectrum (for example, 700MHz–2.6GHz). We add further capacity and coverage to the base case using mid-band and/or high-band (26GHz) spectrum, which is use-case dependent.

Our analysis suggests that the benefit/cost ratio from investing in full 5G in Europe is over four

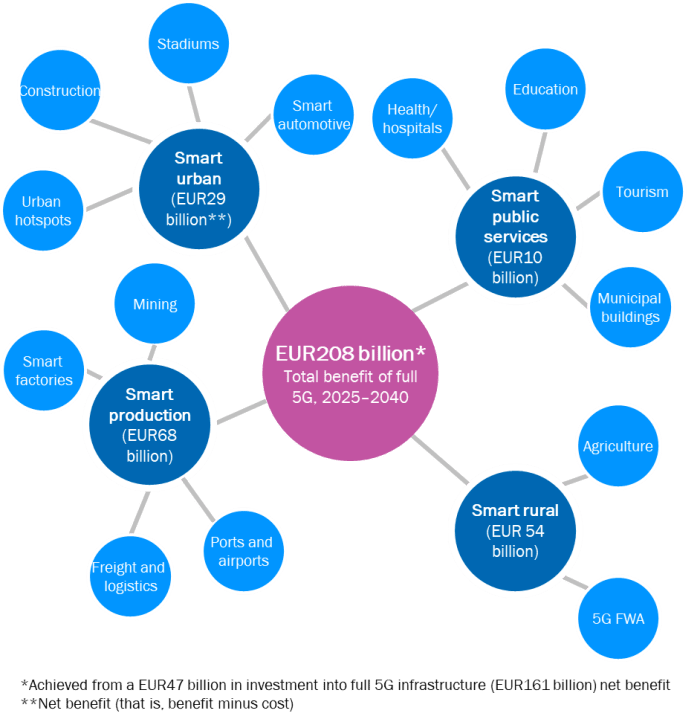

We estimate that the open innovation platform of full 5G networks in Europe will be able to deliver EUR208 billion of benefits at a cost of approximately EUR36 billion between 2025 and 2040 (representing a benefit/cost ratio of around four). The split of these benefits by cluster is shown in Figure 2. This suggests that European industrial policy should focus on accelerating the use of 5G infrastructure in the smart production and logistics cluster as a priority. It also suggests that it would be beneficial for European regulators to enable rural 5G coverage, and to support further innovation in 5G deployment in cities.

Figure 2: Full 5G benefits in Europe

Source: Analysys Mason, 2021

We also identify that there will be a range of benefits from using 5G infrastructure in factories, agriculture, construction and other sectors. Potential environmental benefits from these deployments include the better use of time and materials (potentially leading to lower energy consumption), improved equipment lifetimes through real-time monitoring, increased efficiency and a reduced need for journeys (and lower journey times). Social benefits include improved sustainability for local and rural industries through better connectivity, better security and digitally skilled workforces.

It is essential that the accelerated roll-out of 5G continues in the coming years (up to 2025) in order to achieve these benefits. Operators should work towards 5G roll-out targets that are consistent with Europe’s 5G Action Plan (5GAP). There should also be a focus on reducing any barriers to deployment. For example, the recent European Commission recommendation to use a common toolbox to reduce the cost of high-capacity network deployments should be followed.2 Our study identifies the targeted action by policy makers and operators to expand the geographic coverage of mobile networks as a priority so as to deliver 5G services in rural areas. Allocating the remaining spectrum in all of the identified 5G pioneer bands (700MHz, 3.6–3.8GHz and 26GHz) will be important to accelerate 5G deployments.

Analysys Mason Consulting can help to develop deployment strategies for 5G and 5G spectrum roadmaps. We can also carry out cost/benefit/revenue analysis. For further advice please contact Janette Stewart.

1 For example, Qualcomm (2019), Qualcomm Technologies and Siemens set up the first 5G private standalone network in an industrial environment using the 3.7-3.8GHz band. Available at: https://www.qualcomm.com/news/releases/2019/11/26/qualcomm-technologies-and-siemens-set-first-5g-private-standalone-network; Qualcomm (2019), Qualcomm Technologies & Bosch Rexroth Showcase Time-Synchronized Industrial Devices Over Live 5G Network. Available at: https://www.qualcomm.com/news/releases/2019/11/25/qualcomm-technologies-bosch-rexroth-showcase-time-synchronized-industrial and Ericsson (2020), The 5G Port of the Future. Available at: https://www.ericsson.com/en/blog/2020/7/the-5g-port-of-the-future.

2 European Commission (2020), Commission Recommendation on a common Union toolbox for reducing the cost of deploying very high capacity networks and ensuring timely and investment-friendly access to 5G radio spectrum.

Article (PDF)

DownloadAuthor

Janette Stewart

Partner, expert in spectrum management, policy and valuationRelated items

See moreArticle

Policy makers must explore all possible levers to achieve gigabit connectivity ambitions

Report

AI for connectivity: how policy makers can help digitalisation

Report

LEO satellite broadband: a cost-effective option for rural areas of Europe