Active sharing: a way of delivering 5G ROI, or a technological and operational hazard?

The challenge of achieving a return on investments in 5G technology and services

In developing markets, low ARPU leads to challenges for operators that want to realise a reasonable return on investment (ROI) in 5G. Even in developed markets with more-favourable customer economics and relatively earlier adoption of newer technologies, the case for 5G remains challenging.

The 5G business case is difficult to justify in many countries for several reasons. On the cost side, 5G spectrum can be expensive. Furthermore, 5G involves high network equipment capex and opex. On the revenue side, ARPU uplift is limited and add-on revenue use cases will be rare in the near-to-medium term. As a result, the 5G business case is anchored to defending market share until demand increases network capacity requirements to the point that 5G becomes the only cost-effective network solution.

Active sharing can lead to significant savings for MNOs, if done right

Active sharing can nearly halve the number of physical sites required for sharing operators to deploy an equivalent number of PoPs. In a 5G-only sharing scenario, our estimates suggest that the aggregate savings potential from launching 5G via active sharing, range between 18% and 35% (compared with a no-sharing scenario). Further, if the full technology stack is shared (that is, all technologies, not just 5G, are actively shared), then the savings could be more than 40% compared with a non-sharing scenario (although these savings depend on the state of the existing legacy networks).

Active sharing can be done in a variety of ways

Key dimensions for active sharing include geography, depth of sharing and 5G technology.

Operators can share full national networks, or limit sharing to particular geographies

Sharing the network across an entire nation enables operators to achieve maximum savings by minimising duplication on network and operation and maintenance (O&M) services. On the other hand, limiting the network sharing to non-dense-urban areas can help operators to maintain their ability to differentiate on coverage and quality of service in the more-lucrative dense-urban areas, while still benefiting from reduced cost in less-lucrative non-dense-urban areas (where the business case for 5G is the most debatable). In addition, traffic density is typically higher in dense-urban areas, where spectrum and equipment can be more-efficiently utilised, and the savings from sharing are therefore reduced; at most, instead of two sites shared 50:50, there could be one site for each operator providing the same total capacity.

Possible network-sharing arrangements depend on the preferred depth of sharing

Possible modes of network sharing include the following.

- Multi-operator RAN (MORAN) entails sharing the RAN equipment and the passive infrastructure; spectrum is not shared or pooled. Of all the active sharing modes, MORAN gives operators the best opportunity to differentiate on QoS.

- Multi-operator core network (MOCN) goes a step further; operators run their network on a common RAN and a shared pool of spectrum. Spectrum pooling can be efficient and have benefits for operators but the implementation of a MOCN arrangement depends on the regulations around spectrum sharing.

- Gateway core network (GWCN) involves operators sharing the core network. However, the incremental savings from sharing core networks are limited and, as a result, GWCN is generally not preferred by operators.

Choosing between these three options does not typically have a large impact on savings, but is rather a decision based on preferred level of integration between operators as well as the regulators acceptance of deeper integration.

The mode of 5G deployment –non-standalone (NSA) or standalone (SA) – is a key design decision for a shared network

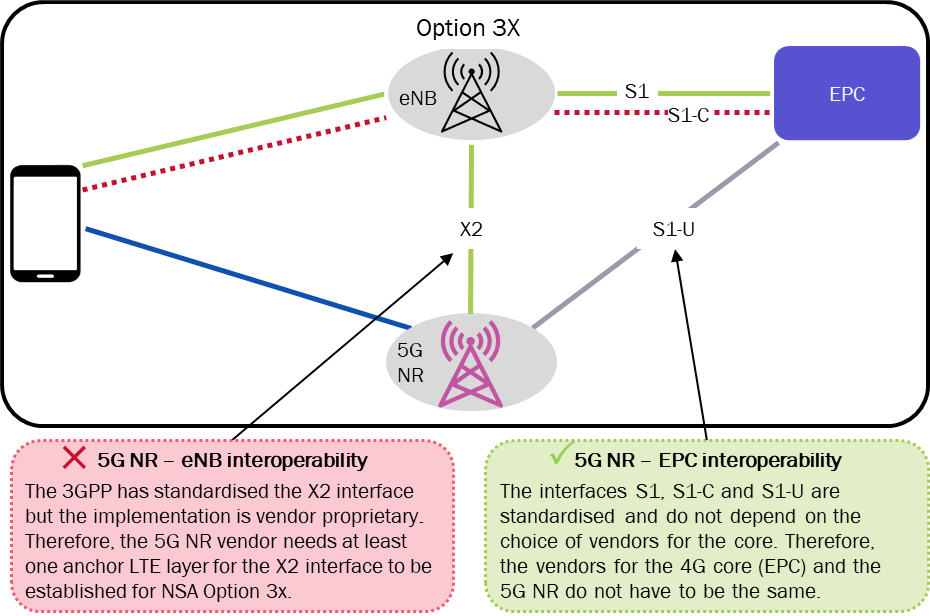

5G NSA involves the use of a shared core (4G ePC or 5GC) to connect both the 4G (LTE) and 5G (NR) radio networks and for the LTE and NR radio networks to connect with each other; 5G SA features an NR network that is independent of a 4G network and in all likelihood relies on a 5GC. Operators inmost countries are using the more incremental 5G NSA approach, given that it can support more extensive coverage, the most common 5G use cases such as eMBB and FWA, and can be deployed more rapidly than 5G SA.

However, in the context of active sharing, 5G NSA poses a major challenge. Launching 5G NSA with active sharing requires operators to use the same vendor in their 4G and 5G cores, which is a major constraint in most countries (Figure 1). However, operators in Norway, South Korea and Sweden have launched 5G NSA via active sharing arrangements.

Figure 1: Vendor interoperability constraints in 5G NSA

Source: 3GPP, Parallel Wireless and Analysys Mason © 2019 - 3GPP™ deliverables and material are the property of ARIB, ATIS, CCSA, ETSI, TSDSI, TTA and TTC who jointly own the copyright in them. They may be subject to further modifications and are therefore provided to you “as is” for information purposes only. Further use is strictly prohibited.

In cases where the 4G vendor mismatch between operators is limited to a small number of sites, there are some possible workarounds such as deploying an anchor LTE layer and using open X2 interfaces, which can enable the operators to launch 5G NSA with active sharing with minimal investment.

However, if the scale of vendor mismatch on the operators’ 4G networks is high, then the operators are better off opting to launch 5G SA with active sharing. The X2 interface is not needed in 5G SA, removing the need for vendor interoperability. As of 2021, 93 operators in 52 countries have begun investing in building 5G SA networks and 22 operators in 17 countries, including China and Singapore, have launched 5G SA networks.1

Active sharing depends on trust and transparency between operators to address operational challenges

A reduction in the required number of sites per operator and sharing opex increases the viability of the 5G business case. The reduced upfront investment and improved business case can lead to quicker and more extensive 5G network deployments While there are some complexities associated with active sharing, there are feasible work arounds with slightly reduced, but still very positive potential savings, as evident from the solutions around the vendor interoperability issue with 5G NSA.

Despite the benefits, it is crucial to note that active sharing involves major operational co-ordination between the participating operators. As a result, apart from the decisions on the various dimensions of launching 5G via active sharing, the level of trust and transparency between the operators will play a pivotal role in deciding the success of such an agreement.

Analysys Mason has assisted operators in many countries to assess active sharing in the context of 5G deployment and we are well-equipped to support operators in overcoming any barriers and realising the full potential of the 5G business case.

1 Source: GSACOM.

Article (PDF)

DownloadAuthors

Rohan Dhamija

Managing Partner | Director Head - Middle East and India (South Asia)

Vishesh Sinha

Consultant