Recent Asia–Pacific mergers offer a masterclass in post-merger value creation

Mergers and acquisitions in the mobile sector are complex processes, and the various threads of equipment vendors, brands, rationalisation of sites, stores and back-office functions can easily become tangled. Progress is then impeded, and the hoped-for value of the merger remains frustratingly out of reach.

Conversely, there have been a string of examples among mobile operators in the Asia–Pacific region that demonstrate how an ambitious and committed approach to mergers is able to drive significant value. Careful advance planning is important, but once the merger process is in train it is critical to maintain momentum with ruthless focus on strategic commercial objectives.

Recent mergers show early indications of success

There have been five notable mergers in Asia–Pacific mobile markets since 2021, all of which can be considered successful in light of their positive impact on top and bottom lines, as well as improvements in customer experience:

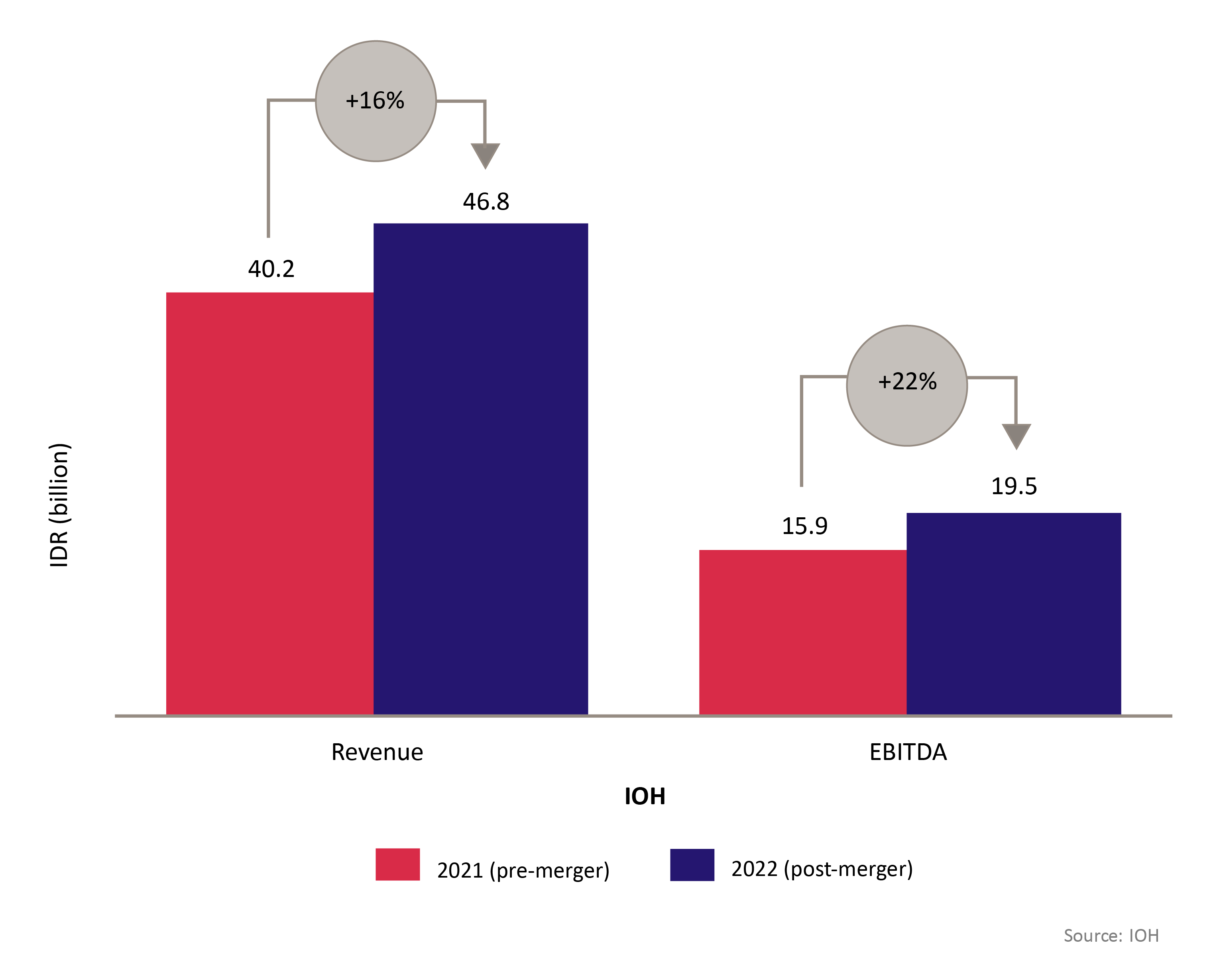

- Indosat Ooredoo and Hutchison 3 (IOH): merger completed in January 2022. By the end of 2022, IOH’s total revenue increased 16%, from IDR40.1 billion (USD2.5 billion) of combined revenue pre-merger to IDR46.8 billion (USD3.0 billion) in the year following the merger, and normalised EBITDA was 22% higher year-on-year at IDR19.5 billion (USD1.26 billion).

- Celcom and Digi: merger completed on 30 November 2022. Initial growth has been modest, but the risk of merger ‘dis-synergies’ has been neutralised, and the merged entity saw improvements of 1% in revenue and 3% in EBITDA during 2023.

- True-dtac: merger completed in March 2023. The new entity now expects to return to profit in 2024, one year sooner than previously expected.

- FarEasTone and Asia Pacific Telecom (APT): merger completed in December 2023. The merger is too recent to be able to see definitive results, but initial indications are positive. Synergies from the merger are fuelling continued customer upgrades to 5G, and stable growth in the merged business.

- Taiwan Mobile and T-Star: merger completed in December 2023. The merger is too recent to be able to see definitive results, but network consolidation has been progressing smoothly, with more than 150 administrative zones already completing the integration of multi-operator core networks (MOCN), and integration work had started in another 346 zones as of February 2024.

Figure 1: Impact of merger on IOH’s financial performance

Lessons can be learnt from recent mergers

Each merger has unique characteristics and circumstances, but it is possible to draw universal insights from recent successes in Asia:

- Partnerships can accelerate network synergies: IOH managed to achieve network integration in 12 months, much faster than the 21- to 24-month timeline anticipated initially. This was due to close partnership with network vendors Huawei and Ericsson, as well as passive infrastructure providers (towercos and fibrecos). IOH users on both networks have experienced improvements in key metrics since the merger, shown by an increase in average download speeds and time spent connected to a connection via 4G or better. This was the catalyst for strong growth in subscriber numbers, data usage and revenue following the merger.

- Preparation is half the battle: gaining formal regulatory approval for their merger was time-consuming, but FarEastTone and APT made good use of time with extensive planning, especially in the area of IT. Around the same time, Taiwan Mobile and T-Star underwent similar preparation exercises while waiting for formal approvals for their merger: “After 23 months of meticulous communication and negotiation encompassing preparatory work for IT systems, network technology, employee placement, user rights, and software and hardware integration, Taiwan Mobile Co., Ltd officially consummated its merger with Taiwan Star Telecom Corporation Limited (T Star) on December 1, 2023.”

- Managing the customer experience is vital: a ‘one size fits all’ approach does not exist, but all mergers need clarity in communication with customers, including a strong focus on maintaining (and ideally improving) the customer experience. Axiata and Telenor kept both the Celcom and Digi brands as they believed in the individual brands’ value, but they integrated back-end IT systems to allow customers from either brand to be able to use any of its branded stores.

- Greater scale and synergies can be exploited to drive down procurement costs: the True-dtac merger not only allowed True Corporation to benefit from volume discounts, but also from Telenor’s global procurement, which yielded higher discounts from vendors.

- Increased scale can open the door to new areas: since its consolidation, CelcomDigi’s fibre and wireless broadband business has shown positive growth, increasing its subscriber base by 30 000 to reach 131 000 subscribers in 4Q 2023, while True Corp expects “more value-driven convergence or products and services thanks to access to a wider ecosystem of partners.”

These examples serve as useful models to demonstrate the importance of creating and sustaining momentum through the early stages of a merger process, and to identify the specific areas that can ensure the first 100 days after the transaction can be instrumental in generating immediate and lasting value.

About us

Analysys Mason is uniquely positioned to help operators capitalise on the opportunities offered by the merger process. Our combination of TMT specialisation and global presence gives us valuable insight into developments across the mobile industry. As a respected adviser on major mergers across the telecoms sector for decades, we have extensive experience of planning and delivering value creation for operators across the globe, particularly in network consolidation, including reviewing process for decommissioning of duplicated sites as well as inventory management. For more information, please contact Jia Yee Lim (Principal).

Article (PDF)

DownloadAuthor

Lim Jia Yee

Principal, expert in transaction support and regulationRelated items

Analysys Mason’s predictions for M&A activity in the telecoms market in 2024

Article

Technical due diligence: the growing imperative before investing in new-age businesses

Article

Asia–Pacific telecoms market update 1Q 2024: 5G is spreading rapidly in India