Operators must rapidly revise their pay-TV strategies as cord-cutting accelerates

The arrival of over-the-top (OTT) video services such as Netflix and Hulu first raised the possibility of ‘cord-cutting’, as the availability of more affordable OTT video content posed a potential threat to large traditional pay-TV bundles. The extent of cord-cutting initially appeared to be limited, but there is now evidence that it represents a sustained trend in some developed markets, leading to a continuing decline in the number of pay-TV subscriptions.

Traditional pay-TV subscribers are increasingly moving to OTT alternatives

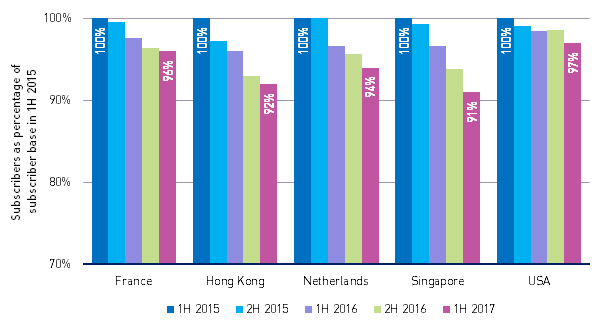

There has been a steady decline in pay-TV subscribers in most mature markets over the past 2 years, as shown in Figure 1. The two Asian markets (Hong Kong and Singapore) have seen a particularly significant drop in pay-TV subscriptions since the beginning of 2015 – up to 4% in the first year and 9% by the second.

Figure 1: Pay-TV subscribers as a percentage of the number of subscriber in 1H 2015, selected mature markets, 1H 2015–1H 2017 [Source: Operators' financial reports]

This decline in pay-TV subscribers is not only expected to continue, but also to accelerate. There are several factors driving this trend.

- The adoption of live TV and the expansion of high-quality video content available over OTT.

- OTT services initially focused on video and principally replaced revenue from physical video. However, they are now increasingly offering live TV services, which are more direct substitutes for pay-TV services.

- Live sports are often considered to be the last bastion of traditional pay-TV subscriptions, but even these are now increasingly available through OTT providers. For example, NFL and ATP World Tour are available on Amazon Prime Video, UEFA Champions League and MLB on Facebook and ESPN is to launch an OTT service in 2018.

- Disney has launched its own OTT TV and video service, bringing its vast catalogue directly to consumers and thus competing directly with pay-TV services.

- Netflix is planning to spend USD6 billion on original content in 2017 – this figure is expected to increase as it expands its content portfolio to drive membership growth.

- Increasing levels of piracy and use of unofficial streaming mediums.

- Season 7 of HBO’s Game of Thrones saw each episode pirated an average of around 140 million times compared to around 32 million legally-viewed streams per episode.1

- Relatively cheap ‘grey market’ Android set-top boxes are increasingly popular. These allow users to access a broad range of content without incurring an expensive monthly subscription fee

Attractive content is therefore increasingly available over alternative platforms at more affordable prices than those of traditional pay TV. This is likely to lead to further cord-cutting across pay-TV markets and a subsequent decline in traditional pay-TV revenue.

Traditional broadcasting cost structures provide pay-TV operators with limited flexibility to maintain their profitability

Declines in both pay-TV subscriber numbers and revenue require a corresponding decrease in operating costs if pay-TV operators are to maintain their current profit levels. Content is generally the largest operating cost item for pay-TV operators. However, existing content contracts (at least for premium content) typically involve fixed lump-sum payments or high minimum guarantees, both of which will reduce pay-TV operators’ profitability when subscribers and revenue decline. We understand from our interviews with pay-TV operators that negotiating for discounts on premium content contracts has proved to be extremely challenging. Content providers have growing demand from new large digital distributors, which are ready to pay significant amounts for these rights – in some cases several times what traditional operators pay. The providers therefore see no need to offer discounts. For example, Comcast has repeatedly stated in its financial reports that it “[expects] that [its] programming expenses will continue to increase, which may negatively impact [its] operating margin”, suggesting that even large operators are finding it difficult to maintain or reduce content costs.

The cost of broadcasting infrastructure is another component (beyond the cost of content) that often does not scale with revenue and subscribers. Investments in satellite transponder capacity for DTH operators and in terrestrial multiplex capacity instead scale with the number and quality of channels. Pay-TV operators will have to invest more in broadcasting infrastructure to support the transmission of 4K channels, as 4K TV penetration and the availability of content for these channels increases. This investment will be increasingly difficult to justify in an environment where revenue is stagnating or declining. Fixed network broadcast infrastructure for cable and IPTV operators scales more directly with subscriber numbers (or rather, premises passed), but also does not provide flexibility in terms of cost savings to adjust for lost revenue.

Operators must refocus their traditional pay-TV strategies to pivot to OTT and revamp business models, both in terms of revenue and cost

The expected reduction in pay-TV subscriber numbers, coupled with the corresponding difficulty in reducing associated costs, presents a challenging outlook for operators’ traditional pay-TV businesses. Profits are likely to face significant downward pressure. Operators must consider innovative revenue and cost initiatives to sustain their traditional pay-TV businesses in a declining market, as well as considering moving into OTT TV and video services. Possible initiatives operators could adopt include:

- providing excellent customer service by offering the superior user interface and experience (integrating live TV, video on-demand, catch up services, cloud DVR and video archive services) that consumers increasingly expect

- breaking up traditional high-cost, large TV bundles and moving towards smaller ‘a la carte’ or ‘bite-sized’ offerings to compete with the equivalent ‘skinny’ or ‘pay-lite’ OTT pay-TV bundles that appeal better to some customer segments

- increasingly adopting OTT TV and video distribution and re-examining options such as OTT content delivery to reduce broadcasting infrastructure costs, which are partly borne by consumers (for example, broadband) and content providers (for example, content delivery networks)

- partnering with new content providers or other OTT providers in revenue-sharing models where possible to avoid large lump-sums or high minimum guarantees

- seeking greater scale in content negotiations by setting up joint ventures with pay-TV operators in other regions (or even competing pay-TV operators) to acquire content from providers – the resulting stronger negotiating position may also yield lower lump sums and minimum guarantees.

In summary, innovation and partnerships will be key for operators to successfully compete in the new OTT TV and video market by offering attractive content, flexible pricing and the integrated experience consumers now expect. Pay-TV operators must adapt quickly as they are competing against innovative and fast-moving players, such as Amazon, Netflix, Viu and YouTube TV.

Analysys Mason has extensive experience in working with pay-TV operators on a broad range of issues, including business planning, platform strategy, content optimisation and regulatory support. We have previously published discussions on live TV OTT2 and the impact of IP on broadcasting.3 For further information, please contact Dion Teo.

1 Source: http://www.bbc.co.uk/newsbeat/article/41197556/game-of-thrones-s7-illegally-downloaded-billion-times-says-piracy-tracking-firm

2 For further details, see Analysys Mason’s Article Live TV OTT offers are accelerating the transformation of TV and video markets: implications for stakeholders

3 For further details, see Lluís Borrell’s presentation from the IBC2017 conference Is IP really having an impact on broadcasting?

Downloads

Article (PDF)Authors

Dion Teo

Partner, expert in strategyLatest Publications

Predictions

GPUaaS revenue will quadruple in the next 5 years, powering new data-centre investment opportunities

Predictions

Regulatory policy will demand a pivot from higher speeds to network coverage and resilience

Predictions

AI adoption is surging, but <25% of portfolio companies’ AI tools will fully succeed in 2026