Data-centre owners must enhance their ESG credentials to compete for customers and capital

30 January 2024 | Strategy

Miltos Andriopoulos | Sabre Konidaris | Clarissa Wang

Article | PDF (3 pages)

Growth in data-heavy and compute-heavy applications, such as streaming and AI, is driving demand for data centres. In addition, small and medium-sized enterprises (SMEs) are demonstrating a growing preference for cloud services, which is creating opportunities for new data-centre projects.

Despite the benefits associated with data centres (such as improved productivity), the industry’s rapid growth poses environmental challenges. Running data-centre IT equipment and supporting infrastructure requires considerable power (data centres account for approximately 1–1.5% of global electricity consumption) and water (a data centre consumes approximately 24.9 million litres per year).

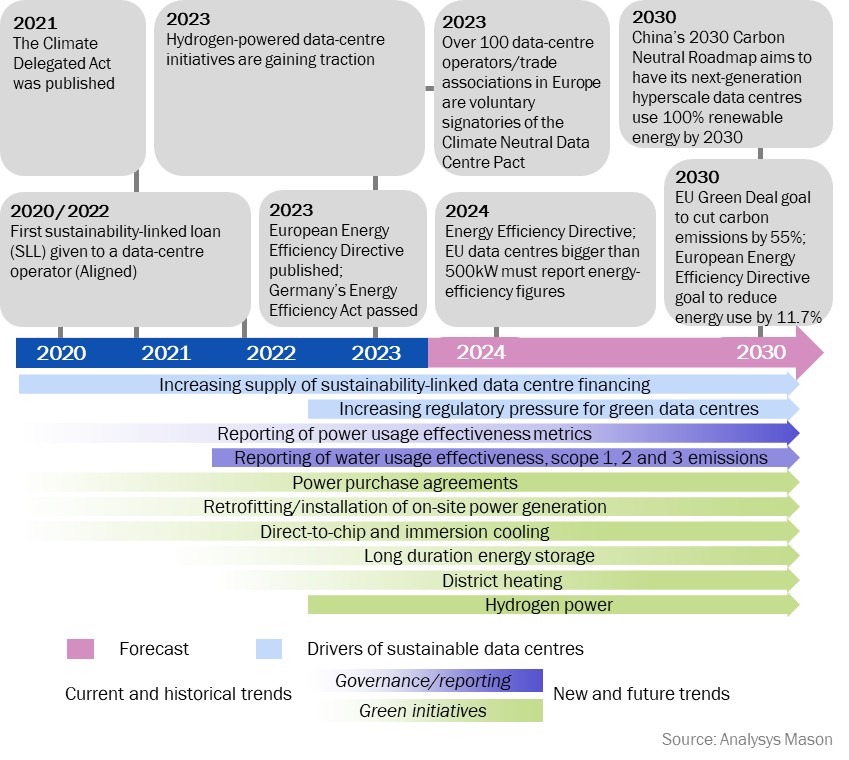

A timeline of key stakeholder initiatives is presented below.

Figure 1: Timeline of data-centre sustainability trends and initiatives

Various stakeholders are promoting the idea of more-sustainable data centres. This article addresses the key environmental, social and governance (ESG) factors that data-centre operators need to consider if they are to be competitive, including the need for transparent reporting given the evolving priorities of financiers.

Transparent ESG reporting has become crucial to the business case

Increasing regulatory pressure, such as the EU’s energy efficiency directive, will require operators to report energy efficiency figures and other sustainability metrics. Underperformance could put data-centre operators at risk in terms of their reputation with customers and their attractiveness to sustainable financiers, and could even result in penalties from regulators.

For brownfield assets, thorough ESG reporting should enable data-centre owners to more precisely assess the need for facility and equipment upgrades to meet regulator and financier requirements. Many established data-centre operators must improve their servers, cooling and electrical equipment to remain compliant. As a result, data-centre operators are increasingly installing hardware to boost equipment efficiency1 (among other initiatives) and are communicating such successes in their sustainability reporting.

Sustainability is becoming a core priority for data-centre operators due to customer preferences. Hyperscalers, such as Google and Microsoft, publicly report the power usage effectiveness (PUE) and water usage effectiveness (WUE) metrics of their data centres. Co-location data-centre customers (such as leading telecoms operators) are increasingly concerned that their supply chains contribute a significant share of their carbon footprints and are striving to decarbonise them. As a result, co-location data-centre operators such as Digital Realty have also started reporting on metrics including carbon emissions, electricity consumption and renewable energy composition in their annual sustainability reports.

Financiers are business-critical and increasingly focused on sustainability

Building and operating data centres is highly capital-intensive and often requires external financing. Despite challenging conditions for M&A markets recently, a record-breaking 99 data-centre deals were completed worldwide in 2023 (up from 88 in 2022).

As governments and other bodies (such as the EU) continue to implement measures to tackle data-centre sustainability (such as the Assessment Framework for Data Centres2 under the EU’s Corporate Sustainability Reporting Directive and other regulation3 including initiatives discussed in a previous Analysys Mason article), financiers are increasingly attuned to the sustainability of data-centre build and operations. Being attractive to sustainable investors, especially in a constrained debt market, is a win-win for operators who can simultaneously reduce energy consumption costs through greener build and operational practices.

Over the past decade, operators like Digital Realty and Equinix have issued green bonds, and there has been a surge in funds available from ESG-conscious investors (for example, infrastructure funds and development funds) and lenders. Furthermore, AirTrunk secured the largest sustainability-linked loan (SLL) for a data centre in history (AUD4.6 billion) in August 2023. This SLL is the first to include carbon usage effectiveness (CUE) as a KPI. Notably, a 2022 industry survey shows that 75% of debt providers and equity investors say they would willingly pay a premium to invest in a data centre with excellent ESG credentials.

To appeal to financiers, Analysys Mason suggests that existing and prospective data-centre owners strive to understand the ESG profile of the assets and actively engage in the evolving regulatory landscape, as doing so will assist in developing a contemporary sustainability strategy.

Analysys Mason offers strategic support to data-centre operators and investors on key commercial, technical and operational decisions. Our in-house expertise and capabilities make us an ideal partner for data-centre operators that are seeking ESG advisory services to achieve competitive advantage. For more details, please contact Miltos Andriopoulos, Sabre Konidaris and Clarissa Wang.

Article (PDF)

DownloadAuthors

Related items

Article

Geopolitics and sovereignty are (once again) a driving force for the space industry

Article

The QoD network API is increasingly being rolled out by CSPs, but monetisation remains limited

Article

A move away from inflation-linked broadband pricing in the UK may actually accelerate ARPU growth