In-house energy service companies: the best of all possible worlds for Towerco organic growth

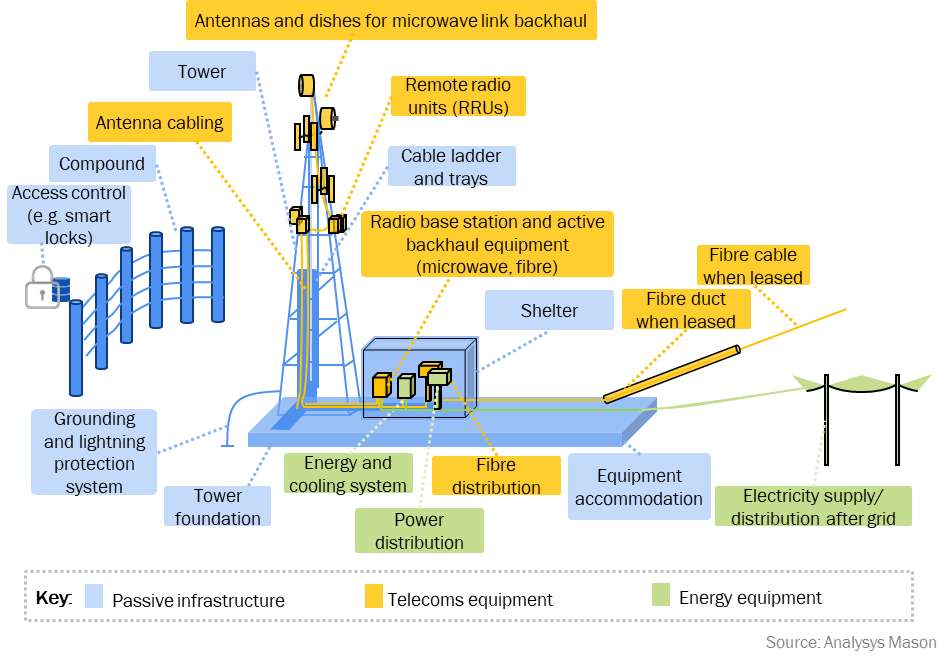

The physical components found within a mobile site can be conveniently categorised into three main groups: active, passive and energy-related.

Figure 1: Mobile site components

The active part of the network is typically owned directly by mobile network operators (MNOs).1 Conversely, the ownership and responsibility for passive infrastructure and energy-related equipment (both of which can more readily be shared between co-locating MNOs) has progressively shifted towards third-party tower companies (Towercos). In emerging markets, where power management is complicated by the absence of widespread and dependable electricity grids, most of the tower sale and lease-back (SLB) arrangements have encompassed both passive and energy components.

Putting aside financial and deleveraging considerations, MNOs are progressively demonstrating a greater inclination towards outsourcing power management (and associated equipment). This preference could be attributed to the intricate nature of power supply and management, which is more remote to existing MNO skillsets than passive asset management, and necessitates different monitoring systems and dedicated resources especially when power is self-generated, is shared between multiple consumers (that is, different co-located MNOs) or is the target of cost and usage reductions.

In recent years, specialised energy service companies (ESCOs) have been established and expanded in emerging markets, particularly in Africa. These entities dedicate themselves solely to supplying power, and overseeing power equipment and the associated operations and maintenance (O&M) duties, without getting involved in passive infrastructure. Notable ESCOs include Aktivco, Applied Solar Technologies, Biswal, Distributed Power Africa, Energy Vision, ESCOTEL, GreenWish Partners, IPT Powertech and Voltalia.

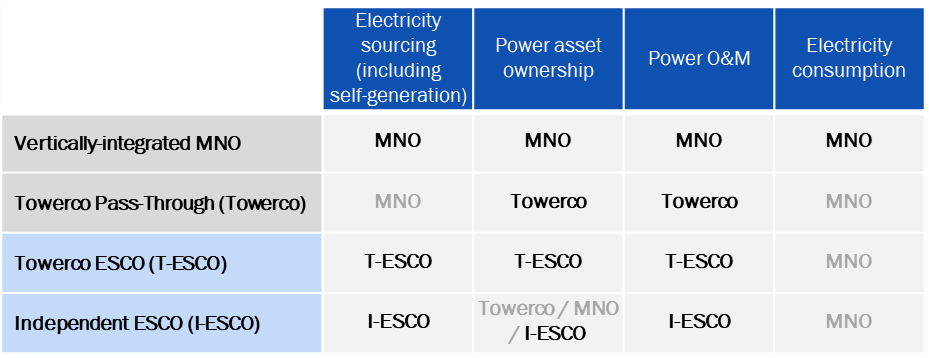

As the use of ESCOs gains traction, there can be an interplay between Towercos and ESCOs. Central to these discussions is the optimal approach to delivering power as a service (PaaS): either through a unified Towerco–ESCO entity (T-ESCO) or as an independent energy service company (I-ESCO) (Figure 2).

Figure 2: Power business models at telecoms tower sites2

Towercos perceive power management as an integral facet of their growth strategy and core operations

Towercos should include PaaS in their operational scope for three reasons.

- Experience and familiarity. Much of the complexity associated with running a Towerco in emerging markets originates from the management of power equipment. This includes refuelling, uptime monitoring, maintenance, security and end-of-life equipment replacement. Given the historical context of SLB deals, Towercos have amassed significant expertise in this space. This service is incremental to the passive infrastructure sharing and Towercos see it as increasing the value they provide to their MNO clients.

- Organic growth avenue. PaaS is seen as an important route to organic growth for Towercos. Notably, energy is a significant cost for MNOs; it accounts for approximately 15% of network opex. As these networks expand, increasing coverage and undergoing technological upgrades, energy demand will grow. This is especially challenging in countries where power infrastructure is limited and energy is scarce. Towercos can seize the opportunity to leverage mobile network operator investments as well as make their own investments to meet the escalating demand. Several MNOs and Towercos have already committed substantial capital to upgrade their power infrastructure.

- Operational and commercial synergies. The integration of PaaS offers a confluence of operational and commercial synergies. Operationally, it enables the integration of network operations centre (NOC) monitoring, site visits, supplier management and asset oversight. From a commercial standpoint, Towercos can present themselves as comprehensive solution providers, catering to various aspects of MNOs’ needs.

These arguments form a compelling case for African Towercos seeking to develop their own PaaS offerings.

Nonetheless, financial markets may incentivise the segregation of PaaS from tower co-location services

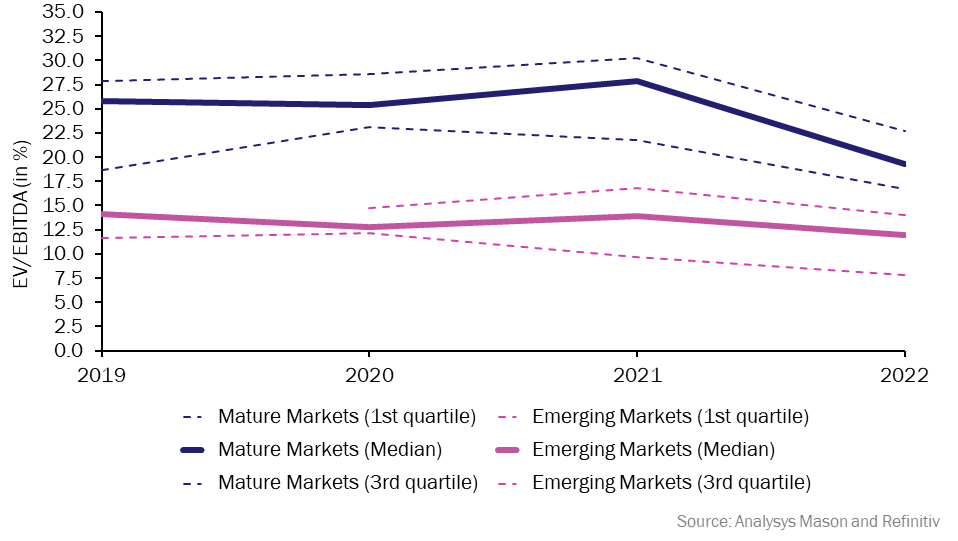

Institutional investors and Towerco executives may have different views. Towercos in emerging markets have consistently been undervalued by public markets relative to their counterparts in developed regions (Figure 3).

Figure 3: Towercos EV/EBITDA

Note: Mature market Towercos: American Tower, Crown Castle, Cellnex Telecom, Inwit, Rai Way, SBA Communications Corp, Vantage Towers. Emerging market Towercos: GTL Infrastructure, Helios Towers, IHS Holding, Indus Towers, PT Dayamitra Telekomunikasi, Tower Bersama Infrastructure.

Discussions with investors have identified several factors beyond country risk premium that may be contributing to the lower trading multiples of emerging market Towercos. Exposure to power emerges as a key factor. PaaS is not universally perceived as an infrastructure-grade investment due to the susceptibility to energy cost fluctuations, shorter contract durations, heightened operational risks, abbreviated equipment lifespan, and elevated refresh capital expenditure and operating costs.

In essence, infrastructure investors associate greater risk with PaaS when contrasted with tower colocation. As a result, they may not be willing to attribute the same valuation multiples to this part of the business. Consequently, some investors gravitate toward Towercos that emphasise PaaS to a lesser extent.

Could the establishment of captive ESCOs offer a solution?

Towercos that offer power-related services to MNOs (that is, T-ESCOs) should contemplate segregating their PaaS operations into distinct entities while retaining operational and financial control, effectively creating captive ESCOs. This strategic move entails straightforward financial benefits. T-ESCOs can clearly explain the relative revenue and margin contributions of both services (colocation and energy), aiming for enhanced valuation. Additionally, this approach may attract minority investors experienced in energy-related ventures. The captive nature of the newly formed ESCO would still enable T-ESCOs to capitalise on the strategic and operational advantages of offering both services seamlessly. Transparency regarding pricing allocation between the two business units could yield long-term benefits, including better risk management, enhanced operational accountability and improved relationship with MNOs. Moreover, potential strategic benefits abound, such as expanding PaaS offerings beyond the existing portfolio of owned sites (including MNO-owned sites and smaller Towercos lacking this capability), fostering experimentation and innovation, and ultimately out-competing I-ESCOs.

However, the complexity in successfully delivering this captive ESCO should not be underestimated, as T-ESCOs must ensure that the two distinct entities have the appropriate incentives to drive both cost (for example, maintenance and supplier management) and revenue synergies (for example, commercial negotiations). In some cases, re-negotiation of master service agreements with tenants might be necessary, as these agreements may not currently consistently differentiate commercial terms for energy and site colocation.

Conclusion

Towercos should consider the separation of their ESCO business into dedicated special-purpose vehicles to maximise value creation and visibility on returns on investments of the whole company for their shareholders. This is especially true for Towercos operating in emerging markets, but there are merits in considering this option in developed markets as well. Management should not underestimate the cultural and implementation complexity of such strategy and must clearly identify the rules of engagement between the ESCO and the Towerco entities through a master service agreement that ensure a full alignment of interested between the business units.

Analysys Mason is the partner of choice of Towercos and investors targeting the sector. We offer actionable (and analytical) advice supporting key commercial, technical and operational decisions. The combination of our in-house strategy, operational and technical expertise with our unrivalled knowledge of the Towerco market (150 projects in the last 4 years) make us an ideal partner for Towercos developing their future growth strategies. For more details, contact Alessandro Ravagnolo and Alex Pericleous.

1 For more information, see Analysys Mason’s Polkomtel Infrastruktura’s deal with Cellnex marks the emergence of the mobile NetCo model and Neutral host models could create opportunities for investors in rural areas.

2 For more information, see the GSMA’s “Green Power for Mobile”, 2014.

Article (PDF)

DownloadAuthors

Alessandro Ravagnolo

Partner, expert in transaction servicesRelated items

Article

High stakes for data-centre investors and operators: GPUaaS specialists offer growth with risk

Article

CFO interview: Netomnia’s Wil Wadsworth on raising finance in a challenging debt environment

Project experience

Providing end-to-end, essential support to a regional digital services company’s first Project Gigabit win