Compute at the edge: hyperscale cloud providers are courting both operators and their enterprise customers

The demand for edge computing is high among enterprises

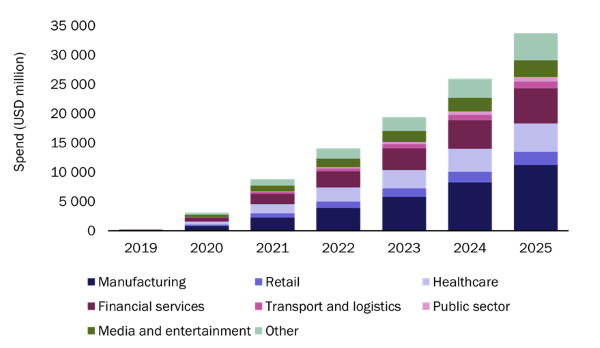

Analysys Mason's recent survey of large enterprises in four developed countries and six vertical markets confirmed that the enterprise demand for edge computing is strong. The six vertical industries included in our survey were manufacturing, transport and logistics, healthcare, finance, retail and the public sector. Enterprises indicated that they plan to use edge computing for new digital use cases where the proximity to data sources is important, and where the cost of shipping massive datasets from their premises back to a central cloud is prohibitive. Large companies across all the sectors expressed a preference for ‘public edge computing’, delivered by a third-party owner and operator of multi-tenant edge cloud infrastructure over edge clouds that a third-party or the enterprise itself manages on-premises. Analysys Mason expected that the public edge cloud computing services market would grow to USD33.7 billion in 2025, at a CAGR of 62% from 2020, prior to the COVID-19 outbreak (Figure 1).

Figure 1: Enterprise spend on public edge cloud, by sector, worldwide, 2019–2025

Source: Analysys Mason, 2020

The public edge computing opportunity is attractive to operators because it coincides with their ambitions to generate substantial revenue from enterprises’ use of their 5G networks. New digital use cases including autonomous vehicles and factory automation will require a combination of edge computing and 5G capabilities including ultra-low latency and network slicing. Operators own metro data centres, central offices and cell sites in areas with high population densities and/or near industrial facilities, which would be prime locations for edge computing infrastructure (depending on the mix of requirements). By building capacity beyond their own 5G networking needs in these locations, operators hope to capture a share of the emerging public edge computing market; this is the premise of the ETSI Multi Access Edge Computing (MEC) initiative.

Public cloud providers have also recognised the growing enthusiasm for edge computing in enterprise verticals, particularly in those that they are keen to target, such as manufacturing and healthcare. These players also possess key edge computing ingredients, including versions of their cloud technology stacks that can be delivered on enterprise premises and platform services that are of high relevance to new edge applications and around which they have built developer ecosystems. Such platform services include IoT device management, AI/analytics, digital twins (virtual replicas of physical systems, such as wind turbines or seaports), blockchain and gaming.

Operators and public cloud providers are collaborating to address the edge cloud market opportunity

Many public cloud providers have collaborated with operators in the past 9 months as they pool their respective strengths to address the public edge computing market. AWS, Google, IBM and Microsoft Azure have all announced edge computing partnerships with multiple Tier-1 operators, through which they will place their cloud stacks in operators’ premises, starting with metro data centres. In these locations, public cloud providers’ stacks are typically co-located with operators’ network edge clouds running virtualised network functions, such as components of the mobile packet core and eventually the 5G core, thereby supporting converged fixed and mobile access.

Operators are pursuing a dual strategy regarding public edge computing. They are working with public cloud providers to get to market quickly, but they are also setting up industry alliances with fellow operators to create interoperability between their own edge clouds. These alliances are fragmented at present: for example, Verizon, América Móvil, KT, Rogers, Telstra and Vodafone formed the 5G Future Forum at the beginning of the year, while a different mix of operators from Europe and Asia–Pacific announced the GSMA Operator Platform Project in February 2020. Nonetheless, these alliances signal operators’ intentions to own as much of the edge value chain as possible, from edge locations and connectivity to the platform services that will underpin a 5G-enabled edge computing developer ecosystem.

Public cloud providers will continue to seek edge location partners beyond operators and appear to have plans to colonise the private, on-premises edge, including the ‘far edge’ of 55 billion connected devices that IBM is predicting for 2022. Public cloud providers could take advantage of 5G spectrum licensing changes (regulators in various countries are opening up mid-band spectrum for private/shared usage) to offer private networks-as-a-service running on their clouds. Microsoft’s March 2020 deal to acquire 4G/5G mobile core vendor, Affirmed Networks, is a step in this direction. Microsoft underlined the link between Affirmed and its Azure Edge Zone strategy, which could see Affirmed running in Microsoft’s 200 edge zones as well as in on-premises Azure private edge zones.

The long-term balance of power in the edge cloud market is uncertain

Edge computing represents a nascent but attractive new market opportunity. Edge clouds will enable completely new use cases across industry sectors; they will also address the demands of a post-COVID-19 landscape, in which the delivery of experience is likely to be more-digital. The promise of this market is drawing operators and public cloud providers together for now, but the balance of power between these players is uncertain in the longer term. Analysys Mason is tracking the evolution of the edge computing market in its research publications and through custom research studies. A report on operator opportunities and threats in the public edge computing market will be published shortly.

For further details, please contact Caroline Chappell or David Abecassis.

Download

Article (PDF)Authors

Gorkem Yigit

Research Director