Annual FTTH activation rate in France has tripled, which will stimulate investment to finish the planned roll-out

The annual activation rate of FTTH lines in France continues to increase consistently, as the number of new FTTH roll-outs exceeded 2 million lines for the first time in 2016.1 This trend will be critical to securing financing for FTTH roll-outs, especially in the less densely-populated areas of the country.

The French national broadband plan consists of rolling out over 30 million ultrafast broadband lines (mainly using FTTH) by 2022, which represents over EUR20 billion of investment. Operators are deploying their networks on a commercial basis (or have expressed interest in doing so) in areas that cover around 57% of the population, representing EUR6–7 billion of investment. Local authorities are deploying public initiative networks in the rest of the country, including the less-densely populated areas. These offer wholesale access to commercial operators and wholesale prices are held in line with those in more densely-populated areas by public subsidies (which represent around half of the remaining EUR13–14 billion to be invested).

Return on investment in these public initiative networks will mainly come from the co-investment or line rental paid by retail operators, which use these networks to sell retail FTTH services. The main driver for return on investment is therefore take-up of rolled-out lines, as wholesale prices are set in line with more densely-populated areas. The key question for financing these public initiative networks is thus how quickly customers will switch to fibre (even if there is little doubt that they will eventually do so), given that existing copper and cable lines often offer relatively good speeds.

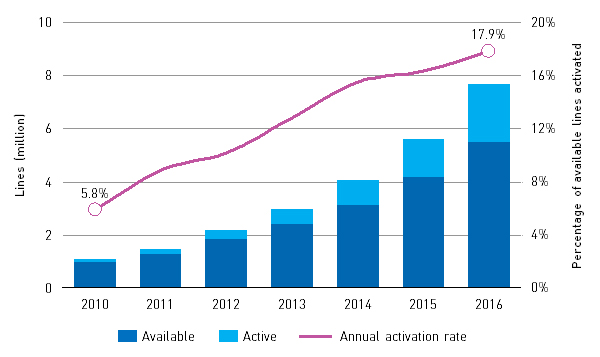

Analysing market development may provide an answer to this key question. Less than 6% of available FTTH lines (rolled-out lines on which no service was delivered at the beginning of the year) became active during 2010, taking into account deactivations (Figure 1). However, this rate of activation has consistently increased over the past 6 years, reaching almost 18% in 2016. In other words, the percentage of French customers that will switch to fibre within a year when it is available has tripled over the past 6 years.

Two factors can explain this trend. On the demand-side, mainstream online services increasingly depend on the technological characteristics of FTTH (such as its downstream and upstream speeds and low latency) as penetration reaches a critical mass, which encourages customers to switch. On the supply-side, all major operators will have to actively promote FTTH to defend their long-term market share as it becomes mainstream. These two factors will reinforce each other and create a virtuous circle, but the speed at which this happens is critical to any investment decision.

Figure 1: Available and active FTTH lines and percentage of available lines activated each year, France, 2010–2016 [Source: ARCEP and Analysys Mason, 2017]

It is essential to quantify the rate at which customers switch to FTTH in order to optimise financing of the massive investments required to finish the planned roll-out over the next few years. Please contact Omar Bouhali (Principal) to discuss this further.

1 Annual FTTH activation rate in France has tripled, which will stimulate investment to finish the planned roll-out

Downloads

Article (PDF)Authors

Omar Bouhali

PartnerLatest Publications

Predictions

GPUaaS revenue will quadruple in the next 5 years, powering new data-centre investment opportunities

Predictions

Regulatory policy will demand a pivot from higher speeds to network coverage and resilience

Predictions

AI adoption is surging, but <25% of portfolio companies’ AI tools will fully succeed in 2026