Investing in fibre: sometimes it is better to sell shovels to the prospectors than to dig for gold yourself

Fibre is one of those words that immediately generates excitement and captures the attention of policy makers, financial investors and, more generally, telecoms industry specialists. Fibre assets are very capex intensive businesses and are large investment tickets, trading at EBITDA multiples of 10 and above. Conversely, other businesses in the fibre roll-out supply chain provide opportunities for investors to take advantage of the growth in fibre spending without needing to make large upfront capital investments.

The demand for fibre roll-outs continues to be strong in Europe

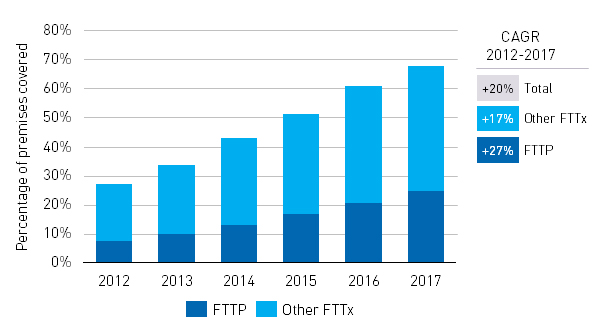

Data from Analysys Mason Research (see Figure 1) shows a continuous growth in fibre network coverage in Europe over the last 5 years. This trend is expected to continue, supported by roll-outs from incumbent operators, cable operators moving to fibre-oriented architectures such as fibre-to-the-last-amplifier (FTTLA) or radio frequency over glass (RFoG), and new challengers (for example, CityFibre in the UK, OpenFiber in Italy, Deutsche Glasfaser in Germany). This continuous roll-out is due to a combination of demand, competitive pressure and favourable policies from various policy makers that have provided subsidies.

Figure 1: Evolution of FTTx coverage in Europe1 2 [Source: Analysys Mason Research, 2017]

Investors are fighting to secure fibre assets across Europe

Financial investors have been very active in supporting fibre deployment and continue to compete for fibre assets across Europe. The most active investors are infrastructure and pension funds as they favour long-term investments with low volatility, recurring revenue and robust cashflows. This may also explain the emergence of fibre companies operating according to a wholesale open access model, which is perceived as more secure as it can take retail competition out of the equation.

Investment opportunities can be found within the extended fibre roll-out supply chain

While infrastructure and pension funds are competing to secure fibre assets, there is a parallel opportunity within the extended fibre roll-out supply chain. Operators rely on a plethora of suppliers and partners, who also experience growing demand from both traditional customers (for example, fixed incumbents) and new entrants.

There are many sub-sectors within the fibre roll-out supply chain, but they can be broadly grouped as:

- telecoms equipment manufacturers (active and passive elements)

- specialist telecoms service companies (network design, planning, installation and maintenance, and civil works).

The demand is strong, and the offer is fragmented

What makes companies in the fibre supply value chain attractive is straightforward: strong demand for fibre and fragmented competition.

The demand for fibre is directly correlated with the expansion of fibre networks. This demand is strong and is expected to remain strong in the short to medium term.

The level of maturity across the different areas of the fibre roll-out supply chain varies. Large international vendors are typically already leading in the manufacture and sales of active equipment. Historically, broadband upgrades were predominantly made through investments in active equipment in the upper levels of the network. As a consequence, this area of the industry has already reached high maturity levels.

Investments in FTTx (especially FTTP) networks require capex to be shifted from active to passive infrastructure (including civil works) to bring fibre closer to the end user. This is expected to benefit manufacturers of passive equipment and telecoms service companies whose competitive landscapes are typically fragmented with a multitude of national or even regional manufacturers and service companies. There is therefore room for consolidation and the creation of multi-market leaders.

To address the opportunity of investing in companies within the fibre supply value chain, investors must answer a number of due diligence questions

Investing in a sector where demand is strong sounds straightforward. However, there are some key uncertainties that must be addressed.

- How strong and sustainable is the demand for fibre in the long term? Investors must think carefully about their future sales, and consider what the right timing will be, as well as what the exit story should be. It is important to answer questions such as: what coverage will fibre networks attain? How quickly will this coverage be achieved? What is going to be the dominant fibre architecture? What will the optical deployment methods be? Will non-FTTH networks (such as 5G, G.Fast and DOCSIS3.1) be valid alternatives?

- How volatile is the demand for fibre? The revenue of companies in the fibre roll-out supply chain depends on the capex of the operators. Capex is volatile by nature and is subject to being diverted to new areas. Revenue is transaction-based, and a relatively low share of the total is either recurring or based on long-term contracts. A long-term view is therefore required.

- How replicable and commoditised are the products or services? The investor needs to understand what makes a company’s offering unique and assess if this competitive differentiator can be preserved in the future.

- How strong is the company’s relationship with the customers and the rest of the value chain? The presence of strong customer–supplier relationships can impact the value of a company. The investor needs to understand how the company (and the management) is perceived by the different stakeholders, where it fits within the procurement strategies of its customers and how high the switching costs are.

The answers to all of these questions should not only inform the modelling of the cashflow, but also that of the terminal value that could make a significant difference in terms of the final valuation.

Analysys Mason is the commercial and technical advisor of choice of several major financial investors and industry players thanks to its exclusive focus on TMT and the experience gained in over 300 transaction support assignments over the last 5 years. We have carried out approximately 75 fibre-related due diligences since 2014, and work for players operating within the fibre roll-out supply chain.

If you would like to know more, please reach out to the author, Alessandro Ravagnolo (alessandro.ravagnolo@analysysmason.com).

1 For more information, please see Analysys Mason’s FTTx coverage and capex: worldwide trends and forecasts 2017–2022.

2 Fibre-to-the-premises (FTTP) is a full-fibre architecture and is an alternative to hybrid fibre–copper FTTX solutions (such as FTTC and FTTB).

Downloads

Article (PDF)Authors

Alessandro Ravagnolo

Partner, expert in transaction servicesLatest Publications

Predictions

GPUaaS revenue will quadruple in the next 5 years, powering new data-centre investment opportunities

Predictions

AI adoption is surging, but <25% of portfolio companies’ AI tools will fully succeed in 2026

Predictions

France is likely to be the next major European market to go from four to three mobile operators in 2026