The liberalisation of the telecoms market in Ethiopia presents a new opportunity to operators worldwide

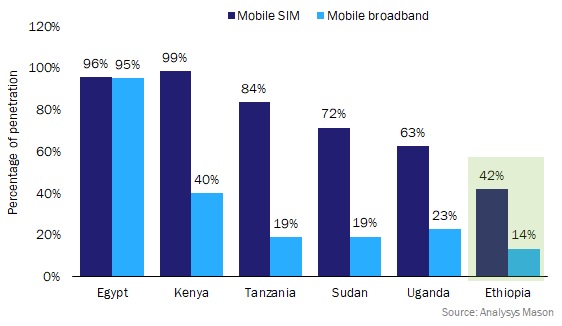

Ethiopia is one of the few telecoms markets worldwide that still operates under a monopoly. Government-owned Ethio Telecom (Ethiotel) controls Ethiopia’s mobile market, as well as the fixed telephony and fixed broadband markets, and the international gateway. This monopoly has resulted in an underdeveloped telecoms market: as of the end of 2018, only 42% of Ethiopians have a mobile phone, and only 14% have mobile broadband, which is low compared with other countries of a comparable size within the region, including Egypt, Sudan, Tanzania, Kenya and Uganda (see Figure 1). However, the government in Ethiopia has recently captured the wider attention of the global telecoms industry through its many initiatives to expedite the liberalisation of the telecoms market and to modernise the local telecoms infrastructure. This article discusses these initiatives in more detail.

Figure 1: Comparison of mobile SIM and mobile broadbroad penetration in Ethiopia and in neighbouring countries, 2018

Ethiopia has low mobile SIM penetration, poor mobile broadband take-up and low levels of international connectivity

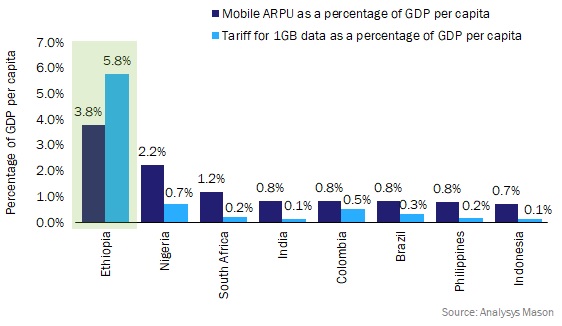

Mobile SIM penetration of the population and mobile broadband take-up in Ethiopia are both low compared with other developing countries worldwide, and these trends are driven primarily by high mobile tariffs and the country’s poor network coverage (see Figure 2). While 2G networks are widely available in Ethiopia (99% population coverage), 4G coverage is restricted to the Ethiopian capital of Addis Ababa.

Figure 2: Mobile ARPU and annualised tariff for 1GB of data as a percentage of GDP per capita, 2018

Ethiopia also has a notably low level of international connectivity, with international capacity to this landlocked country being provided exclusively by terrestrial cables. This has resulted in an average of only 0.6kbit/s of international bandwidth per capita, whereas Ethiopia’s neighbour, Sudan, has nearly four times as much (2.5kbit/s per capita), and Kenya’s and Egypt’s international bandwidth per capita is significantly higher at 17kbit/s and 14kbit/s, respectively.

Ethiopia’s telecoms market is opening up to outside investment, with interest from regional and global telecoms groups

However, Prime Minister Abiy Ahmed declared in June 2019 that Ethiopia will privatise and liberalise its economy to spur competition in several critical sectors, including telecommunications. The World Bank is also supporting the government in Ethiopia with implementing these institutional reforms. The Ministry of Finance has recently clarified that the government will adopt the following strategies to liberalise the telecoms market and open it up to foreign investment.

- An independent regulatory authority will be set up to oversee the development of the telecoms sector in Ethiopia.

- Two new licences will be issued, for which foreign operators can bid.

- A significant (minority) stake of Ethiotel will be divested and made available for foreign investors to acquire.

Many regional and global telecoms group across the value chain (including operators such as Etisalat, MTN, Orange, Viettel and Vodafone) have already expressed an interest in bidding for these licences. This liberalisation of the telecoms market is expected to introduce competition to the market and help address the key challenges around high tariffs and low mobile SIM and broadband penetration.

The liberalisation of Myanmar’s underdeveloped telecoms sector could serve as a useful predictor of how successful similar changes will be in Ethiopia. When the government in Myanmar liberalised the telecoms sector in 2013, mobile SIM penetration accelerated from 10% to 99% and mobile broadband penetration increased from 3% to 67% within only 4 years. Liberalisation paved the way in Myanmar for reduced prices and increased mobile SIM penetration and higher international bandwidth.

- Prior to liberalisation, the only operator in the country offered SIM cards for as high as USD300. The entry of two new players reduced the price of a SIM card to just USD1.50.

- Mobile broadband penetration also quickly rose from 3% in 2013 before liberalisation to 67% in 2017 after liberalisation.

- International connectivity increased significantly in Myanmar, from only one international gateway and a single international submarine cable prior to liberalisation, to six international gateways and three submarine cables after liberalisation.

Most of the major operator groups are likely to consider the investment opportunity in Ethiopia – either to acquire a stake in Ethio Telecom or to deploy greenfield operations. When assessing this opportunity, operators will need to carefully consider how the legal/regulatory environment is likely to change, as well as understand the demand characteristics and the other challenges of this market.

Analysys Mason has built a solid track record of successfully supporting market entrants and can assist in assessing the Ethiopian opportunity and identifying the key success factors for entering this untapped market.

Downloads

Article (PDF)Authors

Johann Adjovi

Partner, expert in strategyLatest Publications

Podcast

Wireless networks evolution and digital sustainability: what is Arcep’s approach?

Predictions

Regulatory policy will demand a pivot from higher speeds to network coverage and resilience

Report

The economic impact of Meta’s edge infrastructure across 9 countries in the MENAT region