MNO capex optimisation using big data analytics delivers measurable actions and benefits

There is increasing evidence that network customer experience is a key driver for churn

The adoption of 4G devices and services is accelerating across the Asia–Pacific region. Developed markets such as Japan, South Korea and Taiwan have already reached approximately 80% 4G coverage, and the 4G share of connections in middle-income countries such as Thailand and Malaysia is around 50%. In emerging markets such as Indonesia, the 4G share of connections is approximately 30%, and this figure is potentially significantly higher in urban areas where 4G is deployed.

The adoption of 4G is driving an increase in the growth of data consumption, and the data used per connection has doubled in several markets over the last 12 months. Increasing data growth is increasing network congestion and is therefore resulting in a worse network customer experience. Customers are also now able to access publicly available comparisons of network speed across operators (for example, using tools such as YouTube VideoCheckUp and Open Signal).

Primary research shows that network experience (described as consistent data speeds and wide network coverage) is a significant driver for both churn and the choice of a users’ next plan (source: Analysys Mason Research’s Connected Consumer Survey). Network customer experience is therefore now a key differentiator for MNOs that wish to grow their 4G market share and revenue.

Capex optimisation requires a strong focus on RoI as revenue stagnates

The competitive dynamics in selling data services and the declining voice/SMS traffic have resulted in stagnating or declining service revenue across most markets, despite the rapid growth in data. MNOs are therefore unable to increase capital expenditure (capex) as a proportion of revenue, and in some cases, are required to reduce capital expenditure. There is, therefore, an increasing need to focus on the deployment of incremental network capacity to support users that are likely to provide the best financial returns.

Capex optimisation needs to focus on profitable yields – looking at high-value customers with the best absolute margin, and latent demand where increased capacity can directly drive revenue growth and improve customer experience to reduce the risk of churn.

Big data combined with a robust analytical framework provides objective capex optimisation with meaningful results

Analysys Mason has developed a robust framework to prioritise sites for upgrades requiring capital expenditure. The framework consists of the following.

- A financial metric of site revenue. Site revenue is calculated using bottom-up data of traffic, yield and latent demand at each site, based on the users connecting and consuming services at the site.

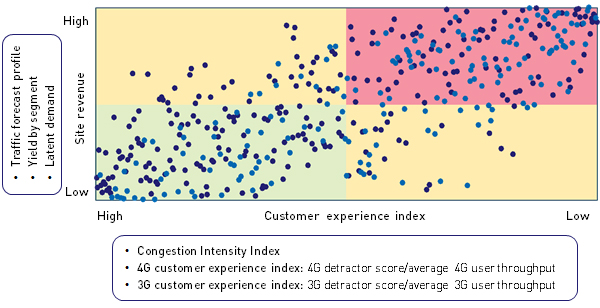

- A strategic metric of customer experience (see Figure 1). Customer experience is a composite metric made up of Analysys Mason’s network Congestion Intensity Index, a 4G customer experience index and a 3G customer experience index.

Figure 1: Capex optimisation framework: site prioritisation by customer experience index and site revenue [Source: Analysys Mason, 2018]

These metrics are both calculated using a big data approach jointly developed with DataSpark. Figure 1 illustrates the categorisation of sites from two different regions using these two metrics and enables MNOs to identify sites with high site revenue and low customer experience (with the red background) as those with potential for capex upgrade. The methodology has further analytics based on business objectives, specifically around prioritising sites with:

- a higher potential for growth in revenue and RoI

- greater customer experience problems in order to reduce the churn risk

- a significant amount of revenue generated by high-value subscribers.

The big data approach jointly developed by Analysys Mason and DataSpark has been used to demonstrate an 11% improvement in RoI compared to an approach that was using only traffic congestion as a basis for site prioritisation. The output of this project not only highlights potential sites for upgrade, but also provides a clear plan for upgrade taking into account the existing spectrum deployed, the additional spectrum available, the cost of deployment and the ability of devices used in the vicinity of that site to make use of the deployed spectrum.

Analysys Mason and DataSpark are jointly working with MNOs in the Asia–Pacific region to support the development of analytics capabilities to drive objective decision making. Capex optimisation is one use case of the analytics platform. Additional internal use cases (such as fixed wireless access deployment, FTTH roll-out and 5G deployment) are the subject of ongoing discussions. The analytics platform also provides MNOs with the basis for external monetisation opportunities. Should you be interested in finding out more about how analytics could support objective decision making in your organisation, please contact Amrish Kacker, Partner, at amrish.kacker@analysysmason.com.

Press Release: Singtel’s DataSpark and Analysys Mason to develop telco network planning app

Downloads

Article (PDF)Latest Publications

Predictions

GPUaaS revenue will quadruple in the next 5 years, powering new data-centre investment opportunities

Predictions

Businesses will discover that AI can become kryptonite if they do not grasp how to wield this superpower

Predictions

Regulatory policy will demand a pivot from higher speeds to network coverage and resilience