Mobile payments in emerging markets – beyond m-pesa

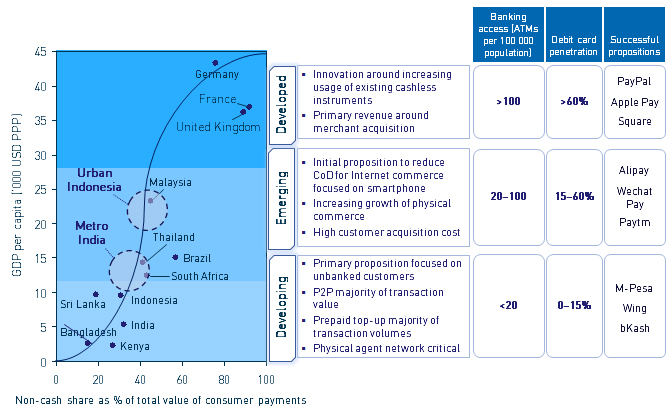

Banking characteristics (e.g. debit card penetration, ATM availability) across developing, emerging and developed markets vary significantly, resulting in different mobile payment business models in these markets (see Figure 1 below).

Figure 1: Characteristics of mobile money and payments in developing, emerging and developed markets [Source: MasterCard Advisors, Euromonitor, Analysys Mason project]

The success of m-pesa in African markets has been replicated in several other developing markets (e.g. Wing Money in Cambodia and bKash in Bangladesh). These mobile payment propositions primarily focus on providing payment and banking solutions for unbanked customers.

- In developing markets, the propositions initially provided domestic P2P money transfer facilities

- they have expanded to also cover prepaid mobile and bill payments and, to a limited extent, physical merchant payments

- The technology solution has worked with basic phones using Unstructured Supplementary Service Data (USSD) as a communication mechanism

- The ability to move money via physical transactions has been critical to the propositions’ success

- this has required supportive regulation and a wide network of agents.

Mobile payments in emerging markets present the most disruptive evolution of payments and create a significant competitor for the incumbent financial systems. MNOs in emerging markets have tried to adapt developing and developed market approaches, but they need to refocus their efforts, taking into account the potential to play a role in the disruption of traditional payments.

- Initially, mobile payments in emerging markets were targeted at smartphone users

- the objective was to facilitate an increase in Internet commerce by encouraging customers to move away from cash-on-delivery (CoD) payments

- The mobile payment proposition is increasingly moving into physical commerce

- it is also being used to support developing market propositions such as bill payments and prepaid top-ups

- P2P transfers are typically free

- This mobile payment model supports multiple payment mechanisms such as bank accounts, credit/debit cards and stored value (e.g. gift cards), and there is increasing innovation around the type of payment mechanisms supported

- The space is dominated by 2–3 large players in each market – these large players have achieved their strong position by providing discounts for specific use cases, which also results in high customer acquisition costs.

In developed markets, the innovation around mobile payments has been focused on facilitating the use of existing payment instruments (e.g. credit cards) across more use cases to increase the percentage of cashless transactions.

- Paypal and Square are two solutions that have made it easier to use cashless transactions when paying smaller merchants on the Internet and in the physical world

- Apple Pay and other contactless solutions (e.g. MasterCard PayPass) enable credit card payments for small-value transactions.

The unique emerging markets proposition is creating an ecosystem that could leapfrog developed market approaches

The emerging market mobile payment proposition has grown both in terms of the value of transactions as well as the development of new services/payment mechanisms.

Mobile payments in emerging markets are growing faster than traditional payment mechanisms:

- China surpassed the USA as the largest global mobile payment market in 2015, with USD225 billion of transactions. The momentum is continuing with USD15 billion of Alipay sales on Singles’ Day 20161

- In addition to providing stored value and stored account as a payment basis, Alipay has expanded its services. It offers payments through a line of credit (Huabei) as well as payment through a money market fund (Yu’E Bao):

- Huabei accounted for 20% of transactions during Singles’ Day 2016, up from 8% in 2015

- Yu’E Bao is the largest money market fund in China and provides daily interest to customers who can use this as a source of funds for mobile payments

- Alipay has also created Zhima credit – a credit scoring system. The credit score is used to determine Huabei credit limits, but is also used as financial proof with third parties

- Paytm in India reported 7 million daily transactions in 2016 (driven by the recent demonetisation of large currency notes), which was at the same level as credit and debit cards in India in August 2016.

New mobile payment systems are challenging traditional approaches to physical commerce, for instance by enabling P2P payments and thus removing the need for physical card readers. Examples include using QR codes (Wechat pay) and a mobile-number-based clearing platform (UPI in India).

MNOs’ success in emerging markets has been limited, as the mobile payment business model is an ‘acquire first/earn later’ model

In emerging markets, MNOs initially tried to adopt the m-pesa payment options used in developing markets, but this met with limited success. Subscriber fragmentation, stringent regulatory conditions and the need for investment in an agent network have been key constraints. MNOs considering the introduction of a broader payment proposition will need to take account of the following:

- Creating a service that is open to all – creating the widest user base possible by not restricting the service to their own customers

- this is necessary to create demand among customers as well as merchants

- Identifying propositions beyond P2P, prepaid top-up and bill payments

- while these areas have proven use cases, they are also increasingly very competitive

- physical and Internet commerce are critical areas to explore – the major value will be derived from increasing merchant acceptance

- Consider involving financial strategic investors to help drive the business

- the biggest challenge for MNOs is duplicating the business model of Internet companies that spend significantly in customer acquisition, leading to negative cash flow for 3–4 years, as the traditional MNO business model is not compatible with an ‘acquire first/earn later’ business model.

As part of our broader Digital consulting services, Analysys Mason works with MNOs and investment firms in assessing the appropriate strategic approach to mobile payment market participation. For more details please contact Amrish Kacker.

1 Press reports. Singles’ Day is a yearly event on 11 November which started in China, and is now the biggest global online shopping day.

Downloads

Article (PDF)Latest Publications

Article

Developed Asia–Pacific market update 4Q 2024: New Zealand utility operators cross-sell to increase revenue

Article

Emerging Asia–Pacific market update 4Q 2024: two factors drove rapid 5G adoption in Vietnam

Report

AI for connectivity: how policy makers can help digitalisation