Open RAN: on the beach in the UK for the G7 summit, but more work to do to make it widely available

There have been several important announcements about Open RAN over the last few weeks. During the G7 summit in Cornwall (UK) in June 2021, Vodafone proudly showcased connectivity built upon open standards, for surfers and world leaders alike. More seriously, and relevant to the prospect of Open RAN as a new network paradigm, Vodafone also announced that it has procured 2500 Open RAN sites in the UK from Samsung. This builds upon a commitment by major MNOs in Europe to focus their network procurement on Open RAN-compliant hardware and software.

Mobile operators’ margins are under pressure but Open RAN could help

This momentum is building in a context of 5G requiring significant investment, although mobile network operators (MNOs) continue to be uncertain about service demand and the business case for 5G. MNOs’ margins remain under pressure, due to commoditisation, competition, growth in data demand and an increased focus by governments on resilience and security. Capital efficiency has increased, however, because MNOs have benefited from carving out towers to strategic and financial investors, at high valuations. The trends are similar in emerging markets, but infrastructure carve-outs are limited and many people cannot access, or afford, mobile broadband services.

Open RAN promises to help MNOs to manage some of these challenges, as will independent yet related innovations around software-driven networking and automation, and trends such as network sharing and possibly network-as-a-service delivery models. As a set of standards, however, Open RAN will depend on a developing supply chain to design, productise, manufacture, test and ultimately sell Open RAN-compliant networks, in a context where a small number of large, highly efficient vendors are already entrenched and benefiting from significant economies of scale.

MNOs have taken a leading role in convening and organising industry initiatives where they can come together with vendors and other supply chain participants to innovate and bring to market solutions that respond directly to operators’ requirements, in a quick and cost-effective manner. This creates opportunities for vendors, and for systems integrators who are essential to bring together interoperable but disparate components into coherent, tested and validated solutions that they can deploy and maintain for MNOs. One such initiative is the Telecom Infra Project (TIP), which has been driven by Facebook and operators such as Telefónica, Vodafone and many others, and which has successfully attracted chipmakers such as Intel, systems integrators such as Dell and Infosys, and infrastructure providers such as edotco.

In a recent report that we prepared in partnership with TIP, we specifically looked at the potential economic benefits of Open RAN solutions, as part of the broader trend towards open and disaggregated network technologies. The impact of these technologies on networks globally could be transformational in several ways, by enabling faster innovation, tailored solutions to specific deployment challenges, including those in remote and rural areas, and improved security and resilience of networks and supply chains.

If Open RAN is successful, it could result in a more innovative, diverse supply chain that should bring benefits in terms of supply cost and the total cost of ownership (TCO) of mobile networks. MNOs would then be able deploy more flexible and performant networks, resulting in more people worldwide being connected in a meaningful way, and having greater access to information and services that generate wider socio-economic benefits. We estimated that with modest TCO benefits (10–20%) and fairly broad diffusion of open solutions round the world (progressively reaching 55% of network coverage by 2030), the impact on GDP could reach USD91 billion annually (in real 2020 terms) by 2030, and USD285 billion cumulatively over the next decade.

The success of Open RAN could be accelerated by a combination of industry and policy efforts

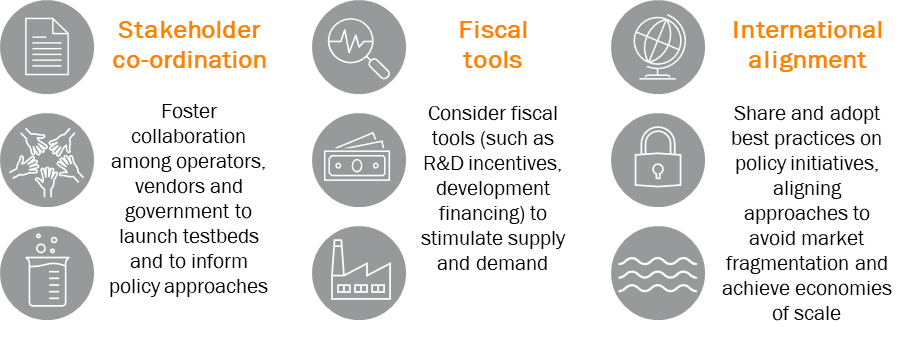

Governments and regulators have expressed clearly that they intend to shape policy to improve network economics, resilience and security (see Figure 1). Open and disaggregated network technologies, and Open RAN in particular, are increasingly seen as one part of a broader solution to these challenges. For example, the UK’s telecoms supply chain diversification strategy specifically identifies open and disaggregated technologies as one of the tools to achieve a more secure and resilient sector, and agencies such as NTIA in the USA and Ofcom in the UK are testing Open RAN systems.

Figure 1: Ways in which policy makers can support supply-chain diversification to build network resilience and improve connectivity

Source: Analysys Mason

The industry has challenges to overcome of course, both in terms of the capability of the technology, and the ability of new supply chains to serve a variety of needs for operators globally. All players in the ecosystem need to focus on openness and interoperability to enable products to be developed more quickly. In addition, global systems integrators need to actively participate in the value chain to increase the level of solution testing and integration, which is core to fostering understanding and trust in these solutions, including by MNOs that may not have the resources to drive some of these developments themselves.

We look forward to continuing to support stakeholders across the ecosystem to develop and execute strategies that will achieve the best possible outcome for the telecoms industry in these times of rapid change.

For more information, please contact the authors.

Article (PDF)

DownloadAuthors

David Abecassis

Managing Partner, expert in strategy, regulation and policy

Shahan Osman

ManagerRelated items

Article

Policy makers must explore all possible levers to achieve gigabit connectivity ambitions

Report

AI for connectivity: how policy makers can help digitalisation

Report

LEO satellite broadband: a cost-effective option for rural areas of Europe