Operators are starting to look for new sources of revenue growth in light of the COVID-19 pandemic

Listen to or download the associated podcast

2020 was a challenging year for many telecoms operators, even though the telecoms sector performed better than many others. The growth prospects for many revenue lines have shifted (up or down) as a result of the COVID-19 pandemic, but we have yet to see any operators undertake a major rethink of their revenue growth strategies.

The effect of the COVID-19 pandemic on operators varied significantly based on their footprint

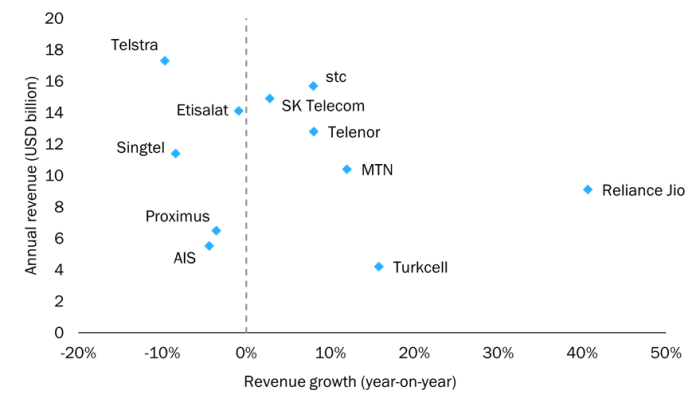

We analysed the results of a selection of operators of various sizes and in different regions around the world as part of an ongoing series of reports examining operator growth strategies. Operators in developed markets generally faced more challenges (in terms of growing their revenue and number of subscribers) in 2020 as a result of the pandemic than those elsewhere (Figure 1). Indeed, mobile revenue fell for most developed-market operators, notably due to a drop-off in roaming and declining device sales. This was offset to varying degrees by fixed broadband revenue growth. SK Telecom is an exception to this trend, perhaps because the impact of the pandemic in South Korea has so far been relatively minor.

Figure 1: Selected operator revenue, 2020, and year-on-year revenue growth, 2019–2020

Source: Analysys Mason, 2021

A few operators in our study reported very strong results in 2020, many of which were driven by strong mobile data growth in emerging markets. MTN posted a revenue increase of 17% in 2020, driven by 15% revenue growth (constant currency) from its largest opco, MTN Nigeria. Reliance Jio’s revenue growth came primarily from strong growth in the number of subscribers (it added 41 million customers in 2020) alongside increased ARPU. Customers in emerging markets have relied more than ever on their mobile devices and have prioritised spending on mobile data services during the pandemic.

Operators continue to look to digital services for revenue growth

The pandemic has raised a number of questions about operators’ long-term growth plans. We consider each of the main areas of operators’ retail activity in turn below.

- Core consumer. Fixed broadband is viewed as a strong revenue engine by many operators, and fibre investments continue apace (for example, AIS, Proximus and Turkcell). Many operators hope to use 5G to grow mobile ARPU and are building propositions around rich media content, including AR/VR and gaming. Convergence remains a guiding principle and many operators are emphasising a strong network proposition across both fixed and mobile (such as Proximus’s ‘Best Gigabit Network’ proposition). SK Telecom offers the boldest vision for its consumer business and aims to reposition itself as an ‘AI platform subscription company’. It plans to sell its own and third parties’ services, including financial, educational, rental and travel services.

- Business services. Operators continue to look to their ICT service portfolios for future revenue growth. Operators are strengthening their cloud capabilities and many are building strong security propositions, often supported by acquisitions. SK Telecom is building on its security capabilities to explore new use cases such as home, parking and contactless solutions in response to the COVID-19 pandemic. Prospects for enterprise connectivity have been weakened by the pandemic, though some operators are building propositions to address the needs of a newly distributed workforce. 5G features in many plans, but details are often lacking. For example, Singtel is deploying millimetre-wave services for “specific enterprise use cases”, though has yet to provide details of what these use cases are.

- Media. Many operators’ aspirations to move into the media space have waned in recent years. Operators’ pay-TV businesses generally suffered in 2020; most of the benefits of increased video consumption went to OTT providers such as Netflix and Disney+. Many operators are shifting their focus to emerging content categories, such as cloud gaming, that can stimulate increased demand for high-performance connectivity. For example, Singtel has teamed up with AIS and SK Telecom to invest in a regional joint-venture company to offer gaming and e-sports.

- Fintech. Fintech typically accounts for a low, single-digit percentage of revenue for operators that are active in the sector (for example, it accounts for approximately 3% of Singtel’s total revenue). However, mobile financial services have benefitted from behavioural changes during the pandemic, and many operators are aiming to grow the revenue from their existing mobile wallet services, while also looking to benefit from an expansion into related services such as insurance or digital banking. MTN was one of the best-performing operators in the fintech space in 2020: its fintech revenue grew by 24% and accounted for 8% of its total revenue.

- Data/analytics. These services are typically very small (usually less than 1%) contributors to operators’ overall revenue, and revenue from them has generally fallen during the pandemic. Revenue from Singtel’s Group Digital Life, which includes the Amobee advertising platform, fell by 20% between April and December 2020, largely due to decline in advertising spending worldwide. However, the sector is expected to rebound in 2021, along with an accelerated shift to digital channels, so many operators are looking to develop capabilities and get better returns on their data assets.

Operators will need to revisit some of their assumptions about revenue growth in light of the COVID-19 pandemic

Many operators evaluated the need to change their long-term growth strategies in response to the pandemic during 2Q 2020, when the crisis was still at an early stage. However, it became clear over time that telecoms spending was less severely affected by the pandemic than originally feared, though there was a high degree of uncertainty over the longer-term outlook for the economy at the same time. Consequently, very few of the operators included in this article have made significant changes to their approaches. More adjustments are likely to be necessary as we come to better understand the long-term economic and social impacts of the pandemic. Assumptions of a stable economy and a continuation of existing service and technology trends often underpin an operator’s strategic plan. These assumptions look outdated and may need a rethink for some of the services offered by operators, particularly business services. For example, many industries are being reconfigured to support higher levels of remote working, thereby exposing the frailties of a connectivity business built to serve centralised offices in CBDs. Cloud services, security and digitalisation have been given a boost. Sectors such as healthcare, transport and education are likely to be profoundly affected, and will potentially present new opportunities. There are signs that operators are starting to address these opportunities, but we expect that many operators will conduct more thoroughgoing strategic reviews in 2021.

Further information on operators’ growth strategies is available in our report, Telecoms operator growth strategies: case studies and analysis (volume IV), and further details about the changing industry opportunities can be found in Analysys Mason’s The post-pandemic landscape: the impact of COVID-19 and opportunities for telecoms operators.

For further details please contact Stephen Sale, Research Director.

Article (PDF)

Download