Operators struggle in enterprise ICT services – acquisitions may provide a route into this market

This article explores enterprises’ adoption of and level of interest in ICT services, based on our survey of over 1600 enterprises, and discusses the role of operators in this market. Operators are well positioned to improve their position in ICT services, but they need to build on a base of solid traditional connectivity services. Operators that participate in this market must gain capabilities through acquisitions and improve enterprise customers’ satisfaction with their traditional services, which is currently low and will limit operators’ ability to sell additional services.

Operators have struggled to gain market share in most ICT services, despite having several advantages

Operators already have the necessary ecosystem to be major ICT providers. They have large customer bases and wide sales and support channels. Furthermore, operators are uniquely positioned to offer multiple ICT services on a single bill. Many enterprises would value having a single provider for all ICT services, especially when seeking support.

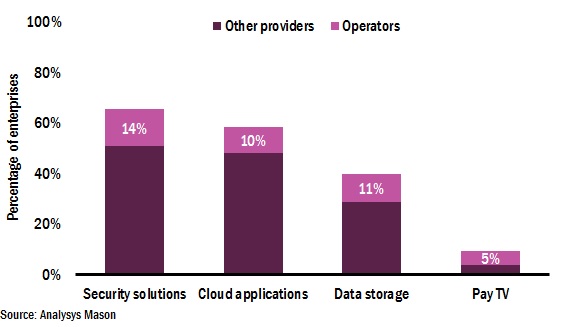

However, operators have struggled to gain a significant market share in any service except pay TV (which is only adopted by a small minority of businesses), despite these advantages (Figure 1).

Figure 1: Percentage of enterprises using ICT services by service type and provider

Two main factors have prevented operators from gaining significant ground in this market.

- Sales teams struggle to sell new services. Operators’ sales teams may not have the skills or the incentives to sell new products. Selling ICT services will require sales personnel with advanced and technical product knowledge. Furthermore, sales commission per product is likely to be small, as the incremental revenue from each new service is likely to be low. Sales teams may therefore have little motivation to gain the required product knowledge unless incentive structures are altered.

- Customers are dissatisfied with core connectivity products. Most enterprises are dissatisfied with their core telecoms products, making them unlikely to purchase additional services from their operator.1

Operators must build on a base of solid connectivity services if they are to compete in the ICT market

Operators will struggle to sell additional services to customers that are unhappy with their core connectivity products. Our research suggests that enterprise customers’ satisfaction with legacy and customer services is low in most countries and may be hampering operators’ efforts to increase their share of the ICT market.

For example, satisfied customers (who gave their providers scores of seven or more out of 10 when asked how likely they were to recommend their providers) are more than twice as likely to buy security products from their telecoms provider than dissatisfied customers (who gave their providers scores of six or less on the same scale).2 Fundamentally, operators will struggle to improve their position in this market if they do not provide excellent basic services – good customer support, fast and reliable networks, and simple online tools and portals that enterprises can use to track and manage their services. Operators can only drive their position in the ICT market through the relationships and trust built on high-quality legacy services.

Acquisitions may provide operators with a route into the ICT services market

Operators that are successfully selling ICT services to enterprises penetrated the market through strategic acquisitions. Markets for new products, such as software-as-a-service (SaaS) and security, are not yet saturated, but they are maturing rapidly. This leaves little room for operators to enter the market organically (by building services from the ground up). Instead, operators may need to strategically acquire established vendors to gain the necessary capabilities and increase their market shares.

The large number of acquisitions that have taken place over the last 2–3 years supports this conclusion. Figure 2 provides selected examples of ICT acquisitions where operators have gained key capabilities.

Figure 2: Selected ICT acquisitions by telecoms operators (Source: Analysys Mason 2017)

| Operator (year) | Company acquired | Value | Capability gained |

| Telia (2017) | Nebula | USD185 million | Small and medium-sized enterprise cloud services |

| CenturyLink (2016/2017) | Many, including SEAL Consulting, ElasticBox and netAura | Not disclosed | Security, cloud and IT services |

| KPN (2016) | DearBytes and RoutIT | Not disclosed | Security and cloud services |

| NTT (2016) | Dell Services | USD3 billion | Enterprise and vertical IT solutions |

| TDC (2016) | Cirque and Adactit | Not disclosed | Office 365 and unified communications services |

| Orange (2015) | Cloudwatt | Not disclosed | Cloud services |

| Singtel (2015) | Trustwave | USD810 million | Security |

Operators have a compelling case for building better ICT portfolios

Developing an ICT portfolio can enhance brand recognition, create a strong differentiator and strengthen operators’ enterprise offerings – operators with the most advanced ICT portfolios are reporting the strongest enterprise revenue growth. For example, Singtel’s enterprise revenue grew by 3.7% between 2015 and 2016, largely due to a 12.9% increase in ICT revenue.

There is a compelling case for operators to expand their ICT portfolios. However, this expansion must be built on a base of strong traditional connectivity services and will require operators to be bold, particularly in making strategic acquisitions.

Analysys Mason is helping a number of clients to develop their enterprise strategies, both through our published research and through consulting projects. For example, we are currently assisting a European operator in developing its approach to new ICT services. For further information, or if you wish to discuss this further, please contact Tom Rebbeck (Research Director, Enterprise and IoT).

1 For further information, please see Analysys Mason’s Report Enterprise survey 2017: fixed services satisfaction and churn for large enterprises

2 For further information, please see Analysys Mason’s Report Enterprise survey 2017: ICT services for small and medium-sized enterprises

Downloads

Article (PDF)Authors