The case for 5G: mobile operators must move beyond smartphones and encourage connected device take-up

Mobile operators have failed to properly address the opportunity presented by connected tablets and laptops. Connectivity on these devices is not seen as a benefit, and is therefore not offered upfront to consumers. If operators are to bring to life their vision for a 5G future that involves multiple connected devices, they must make significant changes to the way they set tariffs for multiple devices, how they pitch these products to consumers and how they measure device sales and usage.

Mobile operators have a well-established and successful formula for smartphone sales, but connected device take-up remains low

Using a full keyboard to draft emails while waiting on the tarmac for a departure slot; relaxing in the park while watching the Olympics; getting that critical email sent without having to rely on poor Wi-Fi – these are all everyday use cases where connectivity with a tablet or laptop is exceedingly persuasive. However, the take-up of such devices remains very low, particularly among consumers. The barriers to greater take-up are purely commercial and as such are in the hands of the mobile operators themselves.

Mobile operators have developed a very successful formula for selling smartphones in their millions: everything is a 2-year contract with no (or trivial) upfront payments. Each device comes with its own monthly contract, and each sale contributes to outmoded targets for subscriber numbers and ARPU.

Operators have historically approached the marketing and tariffing of tablets in the same way as smartphones: a heavily discounted upfront price, with a large subsequent monthly fee. However, a tablet or laptop is a fundamentally different device.

A tablet, for example, is:

- typically viewed as a ‘discretionary’ purchase, whereas a smartphone is increasingly classed as a necessity. People making discretionary purchases want to buy a device and then forget the costs; tying the consumer into a large monthly bill will just remind them of that financial commitment, which may then be exposed as an expensive mistake for something that is used infrequently.

- not carried everywhere, and usage is more sporadic: it may be used exclusively on a home or office Wi-Fi network for months at a time, but then see periodic spikes of potentially intense mobile usage, perhaps when working remotely or on holiday.

- sold through fundamentally different channels to smartphones: consumers do not go to mobile phone shops to make such purchases. The majority of consumers who wish to buy a tablet, for example, will visit a general consumer electronics store in person, or purchase it online. Neither of these channels is good at promoting connectivity ahead of price as the key purchasing criteria. There is currently no incentive to buy extra connectivity – it is not seen as a benefit, and is not offered upfront. This means that mobile operators are losing the opportunity to be seen as ‘connection providers’, selling a range of connected devices.

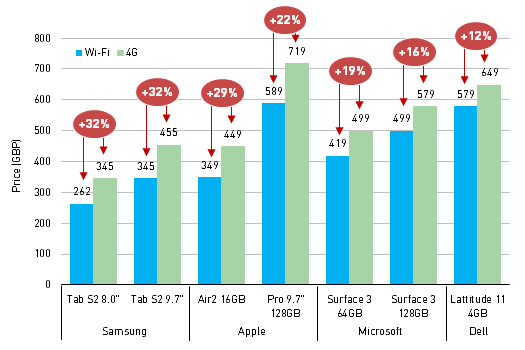

The additional cost of mobile-enabled variants has restricted take-up. For example, 4G-enabled tablets typically retail for at least 20% more than the equivalent Wi-Fi-only version, which does not encourage discretionary purchases.

Figure 1: Wi-Fi-only and 4G device pricing differential (GBP) [Source: Analysys Mason and equipment vendors' websites, June 2016]

In the corporate world, connected laptops have been a challenge to administer. Each laptop conventionally needs its own SIM, with a recurring monthly cost, even when usage is confined to the office Wi-Fi network. In this case, companies are paying for services that are not used. In situations where mobile connectivity is used, control over data usage has proved difficult. Embedded SIM devices have therefore been rejected in favour of dongles or (latterly) MiFi devices, which are easier to swap and share; they are also typically cheaper.

Therefore, a theoretically compelling use case has been let down by poor commercial implementation. Rather than feeling empowered by mobile data connectivity, customers head for the nearest Wi-Fi hot spot, or struggle through when typing a long email on their 4.7” smartphone – neither a particularly pleasant experience.

To encourage connected device adoption, mobile operators must consider consumers’ needs and improve their tariff structures

Mobile operators can address these use cases, but fundamental changes are required in how the communication needs of consumers are met and how services are priced:

Pooling of data between devices

Tariffs need to be changed to allow new devices to be added to an existing SIM for a small monthly charge. A data-only device (that is, one without voice capabilities) could be added to an existing SIM for as little as GBP3 a month. An integrated tariff would remove a significant barrier to adoption.

The data allowance is then shared between devices, so usage of the smartphone and tablet, for example, could become interchangeable. Consumers need more opportunities to use their whole data allowance (most are not currently doing so), and a data allowance shared between devices could drive this usage, eventually motivating consumers to opt for bigger data bundles.

Elimination of additional upfront costs for mobile-enabled devices

Mobile-enabled tablets and laptops need to be much closer in price to Wi-Fi-only versions. To reduce costs, 2G and 3G could be ripped out; as should the SIM slot (eSIMs are ideal for tablets). The price differential needs to be small enough for the consumer to purchase the connectivity in case they need it in the future.

More-informed and joined-up product support in different retail channels

Consumer electronic store channels need substantially more support from operators; in-store promotions could extol the freedom of mobility, while reassuring the prospective purchaser that there is no chance of ‘bill shock’.

Focused corporate initiatives can hand power to the enterprise IT team: laptop connectivity needs to be simple to provision and control. As companies roll out Microsoft Windows 10, they can take advantage of the background functions that automatically limit data usage and large downloads.

Changes to reporting KPIs

The traditional voice-centric reporting for key performance indicators (KPIs) of subscribers (such as SIMs) and ARPU needs to change. Traditional reporting reinforces the perception that every SIM or device needs to generate the same ARPU, rather than examining it from an account perspective; operators have already done this for M2M.

It is possible to argue that with enough Wi-Fi and tethering, the need for connectivity on laptops and tablets has been fulfilled for now, but this is missing the bigger picture. The 5G business case is predicated on multiple connected devices. Without fully understanding consumer interest and activity beyond the smartphone, mobile operators risk not being able to take commercial advantage of 5G technology when it becomes available.

Mobile operators need to start to reimagine their relationship with a subscriber base that is wary of large monthly contracts and traditional billing mechanisms. Only then will they be able to deliver the data-centric 5G business case to their shareholders.

If you are considering the business case for 5G, or just wondering why connected tablets aren’t selling, then please reach out to the author, Charles Murray (+44 7770 238704, charles.murray@analysysmason.com).

Downloads

Article (PDF)Authors

Charles Murray

Partner, expert in transaction servicesLatest Publications

Podcast

Future trends and challenges in spectrum policy for mobile networks

Project experience

The case for replacing ALFs for UK mobile licensed spectrum

Report

Impact of additional mid-band spectrum on the carbon footprint of 5G mobile networks: the case of the upper 6GHz band