The 'On-Demand' Utility

- New technologies are fundamentally changing the economics of providing utility products and services, disrupting well-understood historical business models and leading to the emergence of the on-demand utility.

- When compared with transformations in other technology-centric sectors like telecoms and computing, some interesting insights emerge. Most utilities should focus on either a return on asset investment and management, or service innovation and customer enablement.

- Neither competency – or the associated strategies – is business-as-usual; success will be dependent on the ability to realign capabilities and operations to flexibly and fluidly respond to both expected and unexpected challenges.

Most industries can benefit from looking outside their own sector to gain insights in to how they may overcome the challenges they face. In this article, we consider how the utility sector may learn from developments in telecoms and computing. All utility organisations will face a period of increasing change and uncertainty, though specific pressures will vary depending on the organisation’s particular characteristics. This is the result of the growing three-way tension between the need for security of supply, for prices to be kept at an affordable level, while ensuring environmental sustainability. Utility organisations that fail to balance these challenges are likely to see loss of equity/shareholder value and may be vulnerable to acquisition in a later consolidation phase of the industry. Those that succeed are likely to see significant gains in value and benefits to their local and regional economies. This success will need fundamental change in the operational and service models deployed by utility organisations, and will require novel approaches to embracing new technology. These organisations, which we are calling ‘on-demand utilities’, will need to realign themselves to be flexible and to respond fluidly to anticipated and unexpected challenges.

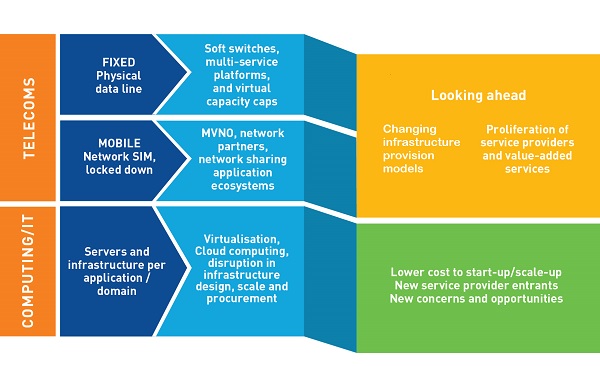

The fixed and mobile telecoms markets were historically both heavily based on the deployment of communications assets and the provision of communications capability on a dedicated circuit or connection basis. Figure 1 illustrates how this has changed. Innovation in the hardware/physical infrastructure and software areas of the fixed telecoms market enabled over time the emergence of multi-service platforms, soft switches and other systems that allow service delivery and operations to be more-dynamically managed. As a result, products and services are now far more responsive to customer needs. Mobile telecoms have changed at an even faster rate. Initially, mobile operators were highly competitive in providing and marketing their network coverage, and SIMs and handsets were locked to specific networks. In markets where coverage had become effectively ubiquitous, operators sought new ways to find competitive advantages, and adopted new models and approaches to extract maximum value from the investment in network infrastructure. Operators launched sub-brands in addition to hosting mobile virtual network operators (MVNOs) on their networks. Successive generational upgrades of technology and software platforms have allowed rapid advancement of services and have enabled smartphones to become one of the most used and valued personal consumer products of our time, allowing consumers to get on-demand access to various services disrupting many markets.

Figure 1: Ongoing transformation of the telecoms and computing sectors [Source: Analysys Mason, 2015]

Figure 1 also shows the computing/IT sector’s transition to a more cost-efficient, accessible and service-oriented sector. Virtualisation of the underlying computing infrastructure has removed the need to match a specific piece of infrastructure to a specific application. Use of computing resources not only became more efficient, the speed with which capacity can be increased has also dramatically improved. This resulted in large economies of scale, with a huge impact on accessibility, cost of innovation and service delivery and means that cloud computing has become mainstream and is now available on-demand.

Utility companies tend to have distribution networks with more-pronounced natural monopoly characteristics than in telecoms: this applies to energy systems in particular. This typically means that utility companies are either vertically integrated or have to work more closely and in concert with others to deliver services to consumers. Despite this, utilities can learn much from the recent transformations in the telecoms and computing industries. Utilities need to become more efficient and effective in dealing with a multitude of consumer, customer and stakeholder needs. Innovation and the ability to flexibly deploy services and technology are paramount. The operator will need to do this in response to customer needs, and in such a way that is both affordable and environmentally sustainable. Utility companies will have to become adept at optimising existing assets, while also flexibly and nimbly deploying new assets or capabilities.

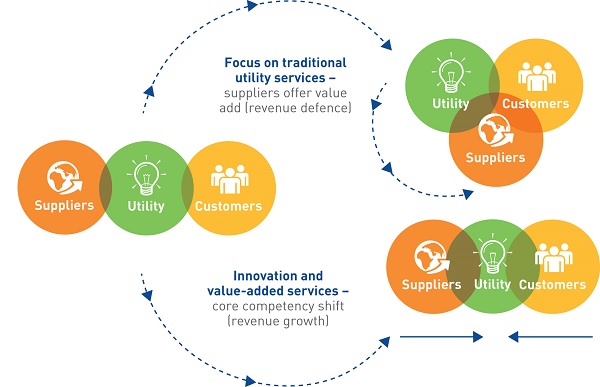

We believe that most utilities should focus on one of two core competencies. Utility incumbents should either focus on the return on asset investment and management (the revenue defence strategy) or on service innovation and customer enablement (the revenue growth strategy). These options are illustrated in Figure 2.

Figure 2: Strategic options for utility companies of the future [Source: Analysys Mason, 2015]

In both cases, the value chain will evolve. Utility organisations focusing on the revenue defence strategy will need to hand certain functions to their suppliers, surrendering some contact with customers, and with it a degree of influence and control over customer expectations and requirements. In this model, utility companies will still be responsible for significant elements of the service delivery. Those focusing on the revenue growth strategy, by contrast, will need to deepen their relationship with customers, offering them more value. To enable this closer relationship between utility companies and customers, many of the traditional utility competencies will need to be outsourced to the companies’ suppliers. Neither of these strategies should be seen as business-as-usual.

Whichever approach utility organisations choose, they will face ongoing and mounting challenges in the future. In order to succeed, they will need to realign themselves to be flexible and to respond fluidly to expected and unexpected challenges. The ability to plan for uncertainty and to firmly instil flexibility will be critical. In this way, the on-demand utility of the future will be able to generate value for itself and its customers. This holds true whether the utility takes a conservative or innovative approach to the products and services it wishes to provide.

Analysys Mason has a long history of supporting strategic and technical change across various industries. In particular its Smart Energy and Smart Cities team has experience in developing and leading among the most significant business and technical developments and innovations in the energy sector over the past few decades. For further information contact Sacha Meckler at sacha.meckler@analysysmason.com.

Downloads

Article (PDF)Latest Publications

Report

Do you have AI appeal?

Report

LEO satellite broadband: a cost-effective option for rural areas of Europe

Project experience

Providing end-to-end, essential support to a regional digital services company’s first Project Gigabit win