Operators’ network spending is evolving and towercos should consider how to best address it

Towercos are making a cautious rush towards diversification

There is a recurring debate within the tower industry regarding whether, and how far, towercos should diversify into adjacent or even totally new businesses. Publicly, towercos express their enthusiasm about differentiation, and some of them are proud to define themselves as all-around netcos or infracos to highlight their wider remits. However, towerco leaders show more caution behind the scenes. They recognise the multi-faceted nature of the discussion and understand that it has implications for the identity of their organisations. Management, investors and other stakeholders may have different priorities and opinions regarding towercos’ future roles in the digital infrastructure ecosystem.

However, we are seeing an increase in diversification as suggested by:

- the emergence of challenger towercos that have more-disruptive business models and are targeting market niches (such as ultra-remote,1 indoor or active networks solutions)

- M&A activity initiated by some established players, leading to inorganic diversification.

Telecoms operators’ network spending is evolving, so towercos should also evolve

Towercos’ attitudes towards diversification change based on how they define their addressable markets.

- Traditional. The addressable market was traditionally defined in terms of new sites, co-locations and amendments, which is consistent with the grass-and-steel model.

- Disruptive. An alternative way to define the addressable market is in terms of network spending (opex and capex), which is more conducive to diversification and the adoption of disruptive business models.

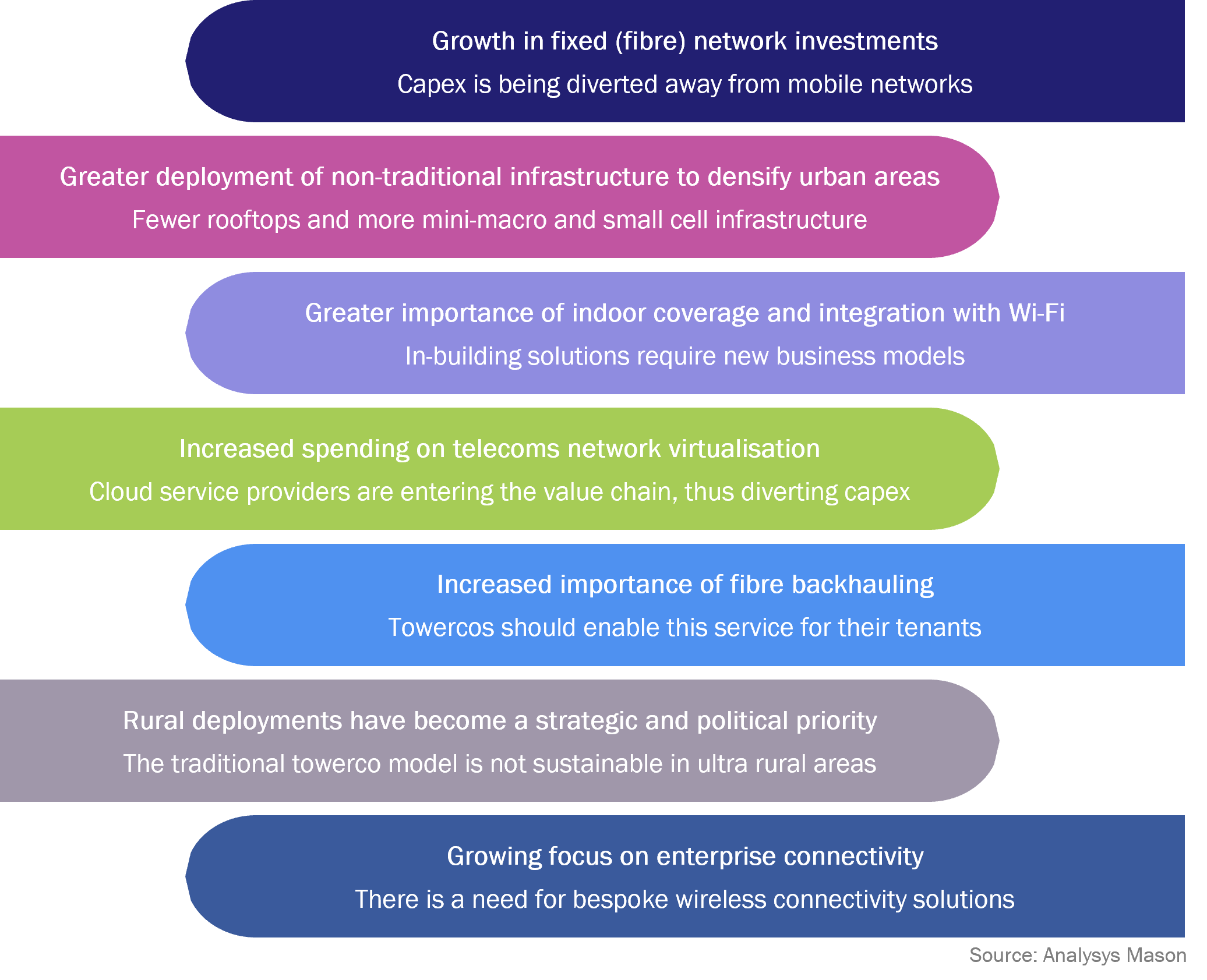

The main argument in support of diversification is the evolving nature of telecoms operators’ network spending, as shown in Figure 1. A substantial amount of capex is being spent in areas that do not drive further demand for the traditional towerco business model.

Figure 1: Trends in telecoms operators’ network spending

Towercos must change their perimeters and/or adopt new business models in order to meet the evolving needs of telecoms operators and enable them to strengthen their relationships with mobile customers and grow or maintain their share of network spending.

The competitive angle should also be considered. Analysys Mason observes that an increasing number of alternative players are adopting disruptive approaches without the legacy of a traditional towerco business. Some established towercos appear to be ignoring the challenge associated with this. Their main argument is that the newcomers are focusing on market niches (such as ultra-rural solutions and private networks) and are not taking business away from established towercos’ core markets. However, there is a risk that these niches become Trojan horses. Ignoring them may enable new players to establish strategic relationships with telecoms operators, which could result in niches growing into mainstream markets.

Towercos should avoid losing sight of their core business

So, should all towercos transform themselves into all-around netcos? Not exactly. The demand for traditional network deployment continues to be significant. The amount of network spending that can be addressed using a traditional towerco model is not expected to fade. Indeed, it could even increase as operators continue to outsource more of their passive infrastructure, especially in geographies where the towerco model has not yet matured.

Therefore, the traditional towerco model still offers sizable growth opportunities, and investors will always appreciate organisations that do not lose sight of a cash-generating core business with stable and predictable returns. Also, even if diversification is attractive, existing customers are more likely to consider buying new services/products from a towerco if they are satisfied with their traditional offering.

Towercos must be selective because not all adjacent businesses are compatible with their investment criteria

There exists a continuum of options, so most towercos are likely to take an approach that is somewhere in between the traditional option and the disruptive one.

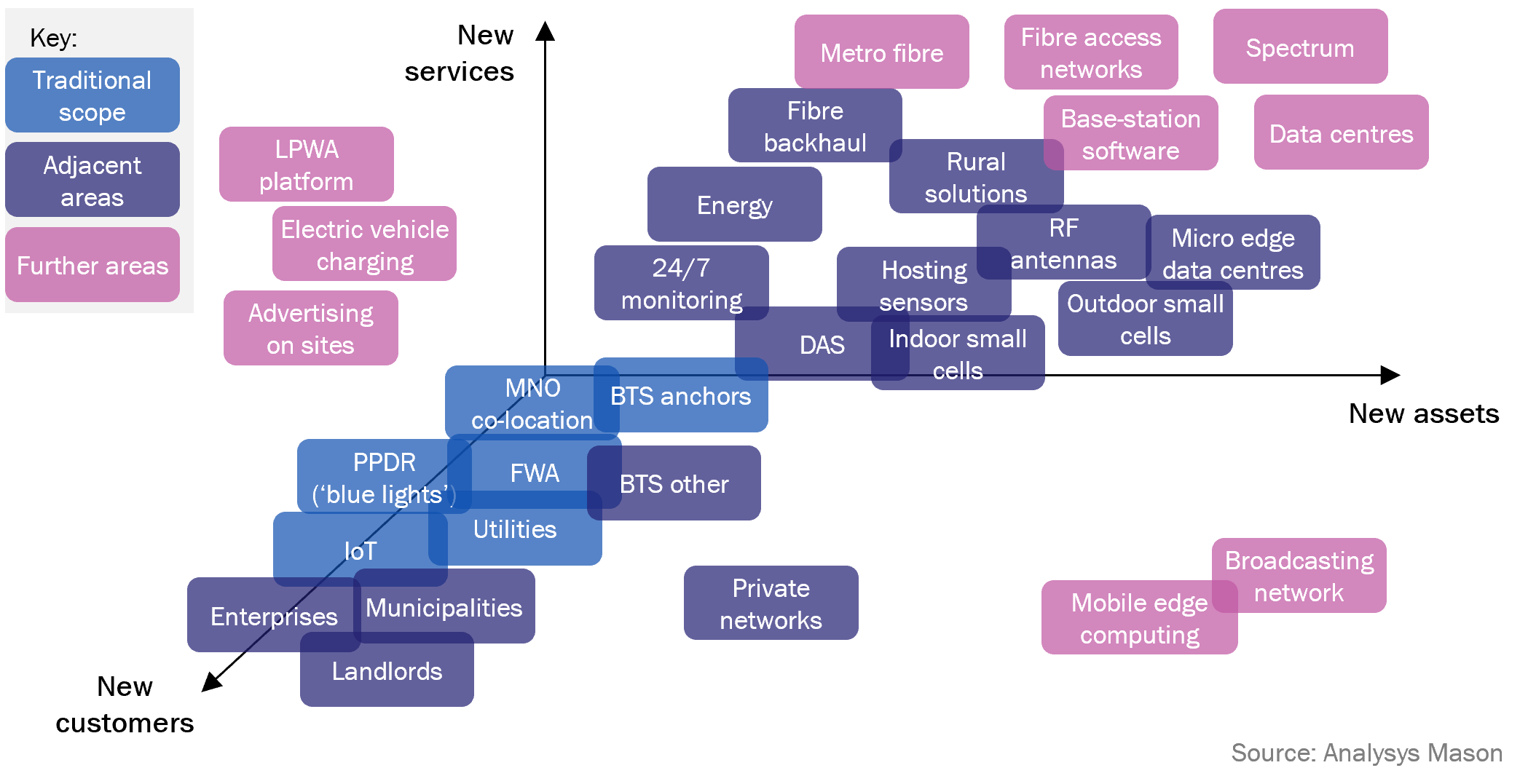

Many towercos have already moved into adjacent businesses such as distributed antenna systems (DAS), power-as-a-service and fibre backhaul (Figure 2). These businesses have characteristics that are quite similar to those of the traditional towerco business: they are operator-led, have upfront capex, high margins and long-term contracts with predictable cashflow and offer the possibility of reusing infrastructure for other customers at low incremental cost. These are all characteristics that made the tower sector a prime target for low-cost-of-capital investors.

However, there is a long list of other, more-disruptive opportunities that remain largely unaddressed. These may not have the same characteristics and may not be suitable for some towercos because of the markets in which they operate, their strategic positioning and their shareholding structure.

Figure 2: Towercos can grow in adjacent areas along three axes

Towercos should take a holistic approach to assessing and prioritising new businesses

Established towercos should adopt a framework of analysis to assess the portfolio of opportunities and compare their merits (Figure 3). It is unlikely that an organisation can (and will want to) pursue all available opportunities, so prioritisation is essential. The approach should be holistic and should not be exclusively based on a discounted cashflow comparison that would only consider revenue, cost and synergies with the existing business.

Figure 3: Compatibility framework for towercos

The outcome of the analysis may be different based on the geographies in which the towerco operates and where they sit in the maturity curve. Management must carefully decide whether an opportunity should be pursued through M&A or partnerships because acquisitions cannot be the answer to everything.

Analysys Mason offers strategic support to towercos on key commercial, technical and operational decisions. We have an intimate knowledge of telecoms networks and a long-term view on their future evolution. In-house technical expertise, coupled with the commercial understanding of the business and our growing operational capabilities make us towercos’ ideal partner throughout their diversification journey. Analysys Mason strongly believes that there is not a one-size-fits-all strategy, and we develop bespoke approaches to help our clients to develop long-term, sustainable, competitive advantages that are consistent with the company’s overarching goals and envisaged positioning.

For further details, please contact Alessandro Ravagnolo.

1 For more information, see Analysys Mason’s Neutral host models could create opportunities for investors in rural areas.

Article (PDF)

DownloadAuthor

Alessandro Ravagnolo

Partner, expert in transaction servicesRelated items

Predictions

GPUaaS revenue will quadruple in the next 5 years, powering new data-centre investment opportunities

Predictions

Regulatory policy will demand a pivot from higher speeds to network coverage and resilience

Predictions

AI adoption is surging, but <25% of portfolio companies’ AI tools will fully succeed in 2026