Towerco ESG initiatives should be intentional and prioritised based on a strategic framework that considers stakeholder priorities

We have entered an era where all leading companies must develop a compelling environmental, social, governance (ESG) strategy. This is especially relevant to towercos because they operate and manage strategic infrastructure that is highly exposed to criticism about visual and environmental concerns. Although many towercos have already committed to sustainability initiatives in some form, it is has become essential to carry out these initiatives as part of a comprehensive framework rather than on a piecemeal basis.

Many beneficiaries of towercos, such as mobile network operator’s (MNO’s) end users, may not precisely understand the purpose or role of the towerco, meaning that a clear ESG communication strategy is vital. Towercos must consider the priorities of varied stakeholder audiences and should develop their ESG reporting beyond any base legislative requirements (such as the EU’s disclosure regime, discussed here). Listed towercos have been leading on this front and have begun disclosing ESG progress and third-party ratings. For example, IHS Towers reports sustainability spend and American Tower Corporation reports progress toward climate targets in annual sustainability reports,1 while INWIT in Italy presents its improvements in third-party ESG ratings on its website.2

Towercos must consider the priorities of their key stakeholders

Analysys Mason has identified four types of stakeholders that towercos should consider.

Investors

Towercos must improve their ESG credentials to effectively compete for funding (both equity and debt), especially since access to financing has tightened over the last year.

Equity investors are committing to increasingly ambitious ESG goals. For example, a recent report3 states that 81% of surveyed institutional investors in the US, and 84% in Europe, plan to increase their allocations to ESG products (including ESG-friendly companies) over the next few years, and predicts that the share of ESG assets under management globally will account for over one fifth of all assets by 2026. Investors have also started to require increasingly detailed reporting of ESG metrics.

Debt capital markets are issuing green bonds and several other financial instruments that are indexed to sustainability metrics. These include instruments that support a low-carbon economy (e.g. renewable energy projects) and the basic needs of underserved populations and communities. Such instruments typically offer competitive rates and companies are only eligible for lending if they meet stringent ESG reporting standards.

Customers

MNOs are striving to optimise supply chain sustainability (see Analysys Mason Research article here) as part of their ESG strategies. For example, Vodafone UK aims to cut operational emissions (scope 1 and 2) to net zero by 2027 and halve emissions from its supply chain (scope 3) by 2030,4 before achieving net zero across its entire carbon footprint by 2040. As a result, towercos must ensure that their operations align with the ESG aims of mobile customers and other potential tenants to continue growing their lease-up rates.

Local communities and municipalities

Towercos should engage with local communities and municipalities to enhance their corporate image and benefit from operational advantages and cost savings. Potential benefits include:

- Greater chance of permit acceptance and reduced wait times, which enable towercos to more easily deploy new sites or upgrade existing assets.

- Reduced risk of vandalism, as locals can better understand the lifestyle benefits (i.e. connectivity, jobs) and actual risks (e.g. from electromagnetic emissions) associated with the infrastructure; for example, Analysys Mason has observed reduced security concerns for neutral host solutions deployed in remote areas in Africa as a result of community involvement in the asset’s protection.

- Better management of ground lease costs, due to stronger relationships with landlords. This can reduce the threat of land aggregators and, in turn, mitigate the risks of forced site movements and steep increases in lease costs.

Towercos are already implementing varied community-partnership schemes (such as Helios’ pilot of free phone-charging points)5 and other community-engagement initiatives to improve the business case to deploy new sites and, therefore, are expanding the addressable market.

Employees

To attract and retain talent (especially when the labour market is tight) towercos must appeal to sustainability-conscious workers. Towercos have been committing to internal corporate social responsibility (CSR) initiatives, such as net zero targets, diversity and inclusion commitments, and training and safety initiatives for site technicians.

Towercos must devise a tailored approach to best navigate stakeholder priorities

Towercos can extract significant advantage if they are able to successfully execute their ESG initiatives and communicate the impact to stakeholders. Towercos should develop a playbook of initiatives that form part of a coherent ESG strategy. Such a playbook cannot be the same for every towerco because it should be tailored to reflect specific stakeholder priorities, which can be difficult.

Accordingly, the ESG contribution of a towerco should be measured, taking into account the company’s specific circumstances and markets of operation. For example, while towercos in emerging markets typically use more fossil fuels due to a higher share of deployment in off-grid areas, their investments play a crucial social role in reducing the digital divide and connecting communities. Only a comprehensive framework that accounts for market nuances and company-specific factors can effectively assess a towerco’s ESG impact and credentials.

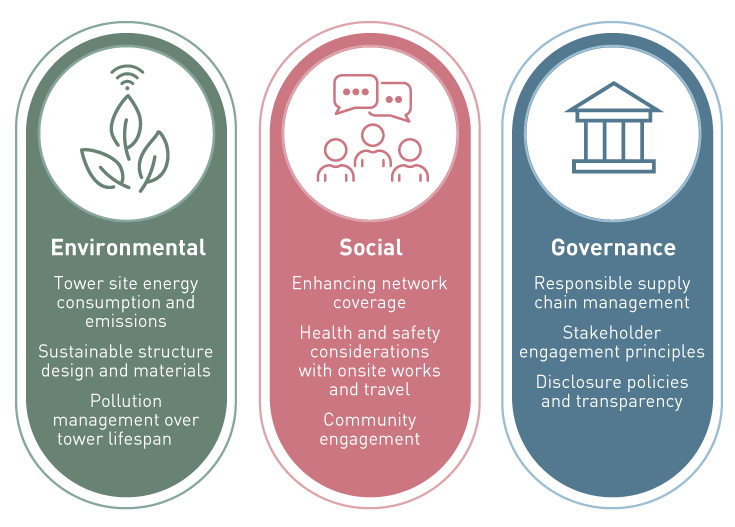

Although relative priority can vary, we have identified some typical key ESG priorities below.

Figure 1: Towerco-specific ESG priorities [Source: Analysys Mason, 2023]

ESG initiatives that have low or no trade-off between financial (return on investment) and social benefit are often deemed high priority. Examples of such prioritised initiatives include Vantage Towers’ investment in micro wind turbines,6 reducing electrical running costs, and IHS Nigeria’s partnerships to improve digital literacy, which are expected to drive mobile take-up and thus generate more demand for towerco services.

Analysys Mason’s experience in developing ESG frameworks can help towerco management to prioritise initiatives and guide investments that are consistent with the company’s positioning and stakeholders’ main concerns. Our frameworks can help investors correctly assess the towercos’ ESG policies and the effectiveness of initiatives during the due diligence process.

Analysys Mason recommends that towercos create a coherent ESG framework that incorporates:

- Initiatives that are designed and developed collectively: ensuring that each initiative is selected and approached in a way that delivers synergies within the towerco’s broader ESG effort.

- Market and stakeholder alignment: prioritising fit-for-purpose initiatives that consider unique market characteristics, ideally supported by extensive stakeholder consultations so that towercos may better understand nuanced industry pressures.

- Effective ESG communication: integrating a comprehensive ESG reporting framework and communication strategy to reassure key stakeholders, especially investors.

Analysys Mason is the partner of choice of towercos and investors targeting the sector. We offer actionable (and analytical) advice supporting key commercial, technical and operational decisions. The combination of our in-house ESG expertise (over 30 projects) with our unrivalled knowledge of the towerco market (150 projects in the last four years) make us an ideal partner for towercos seeking ESG advisory to achieve sustainable competitive advantage and for investors looking for ESG conscious targets. For further details, please contact Sabre Konidaris, Alessandro Ravagnolo and Maria Tunberg.

1 IHS Towers website: Our performance - IHS Towers; American Tower Corporation website: Sustainability (americantower.com)

2 INWIT: ESG Rating – INWIT

3 PwC report (2022): Asset and wealth management revolution 2022: Exponential expectations for ESG (pwc.com)

4 Vodafone UK Carbon Reduction Plan (September 2022): carbon-reduction-plan.pdf (vodafone.co.uk)

5 Helios Towers Sustainable Business Impact Report 2021: ht-sustainability-report-2021.pdf (heliostowers.com)

6 Vantage Towers News Release (2022): 220119-pr-vt-mowea-eng.pdf (vantagetowers.com)

Article (PDF)

DownloadAuthors

Alessandro Ravagnolo

Partner, expert in transaction services