Long-term planning is needed now for the universal postal, parcel and logistics services of the future

The last 9 months have provided an insight into the future of postal, parcel and logistics services, precipitated by COVID-19-related lockdowns, business closures and remote working. In future, consumers are likely to perform most transactions online; commerce will be delivered directly to the home or to a convenient click-and-collect or local parcel delivery point (PDP); and businesses will reduce the number of physical letters that they send to each other and to consumers. In addition, we will increasingly rely on regular, fast and convenient delivery services with limited human interaction. However, postal regulation in the European Union and the UK defines and controls universal services based on 20th century needs (including the weekday collection/delivery of letters and basic packages at a uniform price nationwide), with some differentiation being made between priority next-day and slow, multi-day services (as is the case in countries such as Belgium, Denmark and the UK).

The postal, parcel and logistics services of the future will be diametrically opposed to today’s universal services, and long-term planning is needed to achieve a vision for 2030. This will be driven by:

- changes in volume

- users’ needs for how and when parcels are delivered

- a new vision for the sector

- new universal infrastructure1 and services.

Post and parcel volumes are changing

The volume of addressed letters sent has been in steady decline since the turn of the century, falling by approximately 33% per decade. At the same time, the number of e-commerce-driven parcels is growing strongly and at current growth rates it is likely to double every decade.2 In many countries at some point before 2025–2030, the number of addressed letters received by the average household will decline to less than the number of parcels received. This trend will continue beyond 2030 so that parcels will account for a dominant share of the postal, parcel and logistics sector, with letters forming only a minority share (25% or less of the market volume). Addressed letters will account for an even smaller percentage of market revenue. However, the addressed letter anchor service currently underpins the postal service USO in many countries.

Parcel delivery needs are evolving

E-commerce purchasers and parcel recipients are placing growing importance on same-day, next-day, tracked and conveniently delivered items. Recipients are also prepared to collect items from nearby PDP or pick-up locations and this may become the preferred choice as people return to city centre offices, leaving homes empty throughout the day. Improved tracking (down to the minute) provides certainty for consumers, but also drives dissatisfaction when a home delivery fails at the last stage (for example, the scheduled timeslot gets missed or pushed back, or the package is left on the (wrong) doorstep).

A future vision for the postal industry is needed

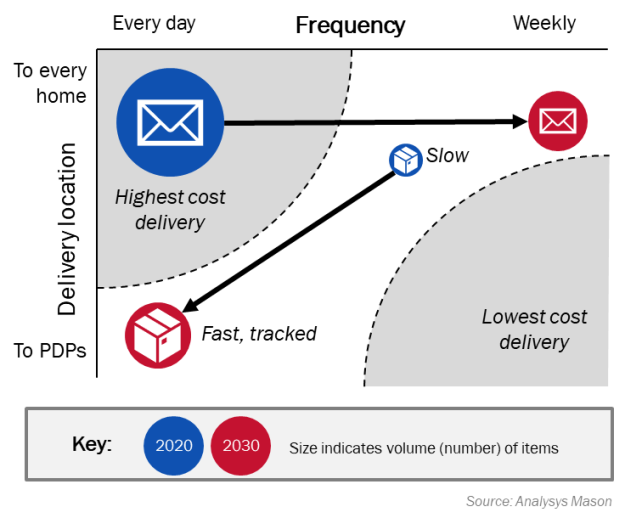

We expect a paradigm shift for the sector, but change takes time and effort from the industry, and consumers may also need to change their default behaviour around delivery locations. While there is a place for planning incremental changes, these are not a substitute shaping a longer-term vision. Preparations should therefore be made now to meet the requirements for 2030 rather than those of just the next 2 to 3 years. This will include support for the following shifts (illustrated in Figure 1):

- a letter USO that moves from the highest cost daily delivery service to a less frequent service, but retaining the convenience of delivery to the home

- a parcel USO that moves away from a combined delivery with letters to a service that focuses on rapid, regular delivery to centralised but convenient parcel delivery points, combining speed with tracking and technology.

Figure 1: A vision for postal, parcel and logistics services by 2030

Universal infrastructure and services

The deployment of a nationwide universal PDP infrastructure will be needed, which must be accessible for all users. This must include effective APIs for e-commerce, distribution points that are open 24/7 and within convenient reach, and that have enough capacity to be available without disruption. A key consideration for a universal, forward-looking parcel service is the extent to which the market will provide universally accessible, uniformly priced solutions. This varies considerably by country, according to the geographical areas with (less) economical costs of delivery. It is also unclear whether the market will (fail to) provide open access to PDPs for multiple carriers to support competition, and this is where a ‘universal infrastructure’ can assist. Services will need to be fast, next-day or same-day, and likely delivered every day. The industry may also find innovative adjacent services that can be combined with parcel delivery points such as e-grocery pick-up facilities.

Next steps

Some industry players are addressing these questions by conducting studies of user needs, as well as undertaking scenario analyses and policy development. However, the bigger challenge is to plan further into the future. The following two countries have indicated such a vision.

- Ireland. ComReg stated3 that it is seeking the provision of a ‘de-minimis’ (that is, a very limited) USO.

- Singapore. The country has embarked on a government-led national infrastructure4 deployment to provide ubiquitous PDP availability that includes carrier-neutral open-access principles.

Policymakers’ long-term aims are likely to include ensuring that the industry provides universally available, uniformly/competitively priced and high-specification parcel delivery services. In addition, policymakers will want to ensure that these universal services operate with efficient, environmentally friendly logistics and much reduced but cost-effective letter services in order to provide the future economic and social glue5 across all businesses and households. Finally, these services must be delivered with the resilience and reliability needed to safeguard social welfare and economic development. Analysys Mason can assist with this long-term planning now.

For further advice, please contact Ian Streule, Partner, Consulting. Additional information on the anticipated changes in the postal sector can be found here on the Analysys Mason website.6

1 Universal infrastructure refers to nationwide, universally available physical installations (including associated electronics and operating software platforms) that are deployed and maintained as necessary for ubiquitous physical delivery requirements.

2 Data is taken from UPU and regulatory authorities in typical European markets.

3 Commission for Communications Regulation (20 December 2019), Postal Strategy Statement 2020–2022. Available at: https://www.comreg.ie/?dlm_download=postal-strategy-statement-2020-2022-2.

4 Locker Alliance. Available at: https://www.lockeralliance.net/.

5 A concept introduced by Richard Hooper for the universal postal service in 2008. For more information, see Saving the Royal Mail’s universal postal service in the digital age (September 2010). Available at: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/31808/10-1143-saving-royal-mail-universal-postal-service.pdf.

6 Related articles on the Analysys Mason website include the following:

Article (PDF)

DownloadAuthor

Ian Streule

PartnerRelated items

Article

Policy makers must explore all possible levers to achieve gigabit connectivity ambitions

Report

AI for connectivity: how policy makers can help digitalisation

Report

LEO satellite broadband: a cost-effective option for rural areas of Europe