BT’s announcement to make EE its flagship brand may signal greater fixed–mobile convergence in the UK

Listen to or download the associated podcast

BT Group announced on 27 April 2022 that it will make EE its flagship consumer brand. Analysys Mason takes a favourable view of this strategic shift, which we believe will put more pressure on standalone operators in the UK. This article explores the reasons for this move and the consequences that it will have for other operators in the UK.

BT has historically adopted a multi-brand strategy, which has restricted convergence

BT’s attempts to build convergence in the UK have, so far, been limited by its multi-brand strategy. Unlike other fixed–mobile mergers in Europe, BT has not yet unified its EE and BT brands or offered fixed–mobile convergence (FMC) benefits across its EE and BT brands. There are three potential reasons for this.

- Brand mismatch. BT is a legacy incumbent brand specialising in fixed services. EE positions itself as a premium digital mobile brand and a fixed broadband disruptor.

- BT has been slow to integrate back-office systems. BT fully merged its databases and billing systems for EE and BT customers in 2020.

- Lack of competitive pressure. BT was the only infrastructure-converged operator until VM and O2 merged.

BT’s move towards using the EE brand for FMC has several drivers

BT had a convergence strategy in place prior to this announcement but it has had little success. The number of reported convergence accounts have grown slowly, and both BT Mobile and EE broadband have failed to establish significant market share. BT reports that only 21.5% of all its customers are converged as of 4Q 2021, and this has grown by less than a percentage point in a year, with average revenue generating units (RGUs) per address similarly flat over this period.

Converged operators do not always employ unified branding strategies (for example, VodafoneZiggo retained both the Vodafone and Ziggo brands following their merger in 2017). However, a unified brand ensures that FMC offers are coherent and easier to understand for consumers.

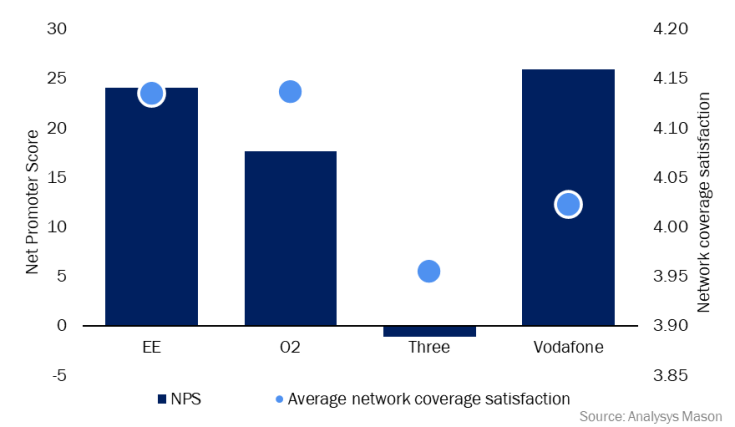

It makes sense for BT to choose EE as its primary brand: the BT brand is the legacy incumbent brand and is trusted among an older demographic, but it is not as future-proof as the EE brand, which is marketed as a digital brand. BT’s latest announcement also referred to the launch of innovative new services beyond connectivity, and the EE brand is well-positioned to deliver such services. Moreover, according to our 2021 consumer survey,1 the EE brand has among the highest Net Promoter Score (NPS) – and the highest network coverage satisfaction scores – of any flagship mobile network operator (MNO) brand in the UK. EE’s high network coverage satisfaction scores therefore make it a logical brand to use to cross-sell FTTP connections, which is a core objective for BT Group. The BT fixed broadband brand also trails EE’s fixed broadband brand in NPS and speed satisfaction.

Figure 1: Mobile Net Promoter Score and average network coverage satisfaction2 of flagship MNO brands, UK, 2021

Fixed–mobile mergers also offer cost savings benefits associated with operating a single brand rather than multiple brands: overall costs savings generally account for double the revenue synergies associated with these deals.3 BT has retained all the fixed and mobile brands it operated before the acquisition of EE, which will have limited the operating cost synergies it has been able to achieve to this point. Although BT may continue to exist as a peripheral fixed brand, it is likely that BT Mobile will be retired.

BT’s announcement will result in increased convergence in the UK

Following the announcement, BT will likely move towards using the EE brand to build its converged subscriber base. The EE brand has around 20% mobile market share, with 35% of these customers currently subscribing to a BT Group broadband service. The potential for cross-selling fixed broadband through the EE mobile brand is therefore strong, particularly if superfast speeds are emphasised. If customers of BT-branded fixed broadband can be migrated onto the EE brand, EE mobile customers could also be given service bonuses (such as speed boosts or mobile data bonuses), which could lower churn.

It has often proven easier to use a fixed broadband brand to grow mobile subscriptions because broadband players can target multiple household members. EE would be using its mobile brand to grow a fixed broadband base so growth in the number of convergence net additions is likely to be slow, and this growth is likely to be restricted by the lower churn rates among fixed broadband customers generally.

This announcement increases the pressure on standalone players going forward, particularly as VM–O2 is increasingly emphasising its own FMC strategy. These strategic shifts could lead to further fixed-mobile mergers and acquisitions. Although standalone FTTP challengers may have success in the short term due to their initial local network superiority, the BT announcement increases the likelihood of these players being acquired by an MNO in the coming years.

BT’s decision is the correct one, but some issues remain

The trusted status of the BT broadband brand suggests that it still has some role to play. If customers are migrated onto the EE brand, BT must ensure that it does not alienate long-term subscribers who may be unfamiliar with the EE brand. If customers are not migrated, the synergies associated with unified branding will not be realised in the same way. There are also questions around BT’s pay-TV branding: EE currently does not offer traditional pay-TV services and must decide whether to offer triple-play (or quad-play) packages in the same way that the BT brand has.

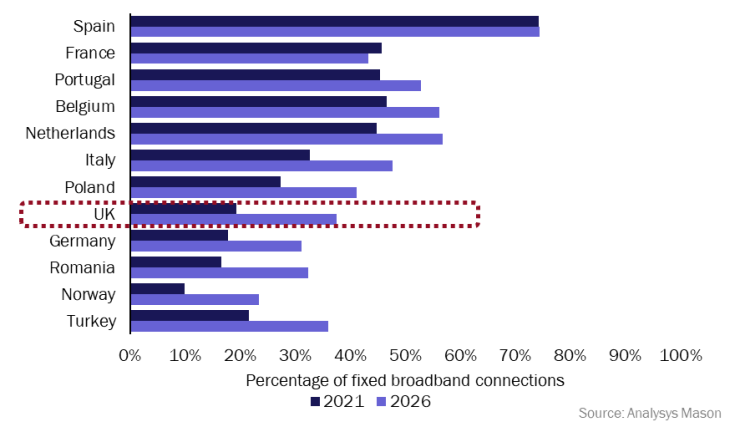

Convergence will approach 40% of all UK fixed broadband accounts by 2026

The lack of an integrated incumbent has held back convergence in the UK market. BT’s announcement will result in an acceleration of convergence growth, with converged accounts representing an estimated 40% of all fixed broadband accounts in the UK by 2026 (see Figure 2).4

Figure 2: FMC accounts as a percentage of fixed broadband accounts, selected European countries, 2021 and 2026

1 For more information about Analysys Mason’s consumer survey, please see our Consumer survey overview page.

2 As part of Analysys Mason’s consumer survey, respondents were asked to rate their satisfaction with network coverage on a scale of 1–5. We take a mean of the customer scores associated with each of the MNO flagship brands.

3 For more information, see Analysys Mason’s Fixed–mobile mergers and acquisitions: case studies and analysis.

4 For more information, see Analysys Mason’s Fixed–mobile convergence in North America, Europe and Asia–Pacific: trends and forecasts 2021–2026.

Article (PDF)

DownloadRelated items

Article

AT&T will focus on mobility, fibre and FMC to drive growth in the consumer and business segments

Survey report

Fixed–mobile customer satisfaction and experience: consumer survey

Article

Consumer trends to watch in 2025: consolidation and new players force operators to adopt new strategies