AT&T will not launch any more satellites for DirecTV: is the writing on the wall for satellite TV?

14 December 2018

Article | PDF (2 pages)

“We’ve launched our last satellite”, John Donovan, CEO of AT&T Communications, told analysts in a presentation on 29 November 2018. This is a bold statement because it comes less than 4 years after AT&T paid USD49 billion to acquire DirecTV, the largest direct-to-home satellite TV operator in the USA.

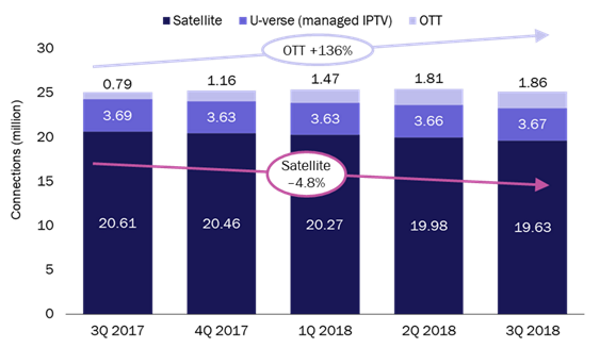

AT&T’s acquisition was motivated by an appetite for DirecTV’s content rights (notably for National Football League (NFL) American football matches) as much as its subscriber base, but the recent announcement indicates just how quickly the US pay-TV market is evolving. “We are seeing shifts in viewing from traditional TV viewing – cable, satellite – to on-demand viewing, and streaming on-demand viewing,” said Randall Stephenson, chairman and CEO of AT&T, in the same presentation. In the 12 months to 30 September 2018, AT&T lost nearly a million satellite subscribers (almost 5% of its subscriber base) but gained just over a million over-the-top (OTT) subscribers (see Figure 1). The company has stated that, in 2019, an increasing number of linear TV premium installations will use its thin-client OTT self-installed unmanaged set-top boxes.

Figure 1: Change in the composition of AT&T’s video connections

Source: AT&T, 2018

One of the reasons why the move to OTT is so rapid in the USA is that traditional pay-TV bundles are expensive. AT&T’s linear video ARPU was USD114.9 (EUR100.9) per month in 3Q 2018, which is over 8 times the price of the most-expensive Netflix package (USD14.0 (EUR12.3) per month). AT&T recognises that the high price of traditional pay-TV packages in the USA is an important factor. Indeed, in another investor conference on 4 December, Randall Stephenson said “The days of media companies accumulating massive amounts of content and shoving oversized bundles down on the consumer – those days are gone. There are a large number of customers who are just saying we’re not paying those kinds of prices.”

Analysys Mason estimates that the average spend per user on pay-TV in Western Europe is much lower than that in the USA at only EUR22.1 (USD25.1) per month. However, we believe that the total number of households taking satellite pay-TV services in Western Europe peaked in 2016 and will decline by around 1% per year until 2023. Conversely, the number of OTT users will grow by around 11% per year until 2023.

What does this mean for satellite TV providers? Analysys Mason agrees that IP-delivered TV and video services will eventually dominate the market, but it will be a long time before direct-to-home satellite services disappear entirely. In the meantime, satellite TV providers have three possible strategic options: segment, supplement or substitute.

- Segment. Satellite-based players may diversify into OTT to try to segment their market in order to minimise the risk of users migrating from higher-price to lower-price packages. Offering ‘skinny bundles’ of content as an OTT service, or pricing OTT services in such a way that larger satellite bundles continue to be the most cost-effective way for a consumer to get a wide range of content gives satellite players the opportunity to broaden its audience, while limiting the level of cannibalisation.

- Supplement. Most satellite players in developed markets now supplement their broadcast offerings with on-demand content. For the latest generation of satellite set-top boxes (STBs) this content is delivered over either managed IP or unmanaged OTT platforms. This IP-enablement can be taken further: some providers have started to support third-party OTT video services within their STBs, and have added features such as integrated billing. The ultimate goal may be to sign commercial deals with OTT providers that allow for the seamless integration of their content libraries into the satellite provider’s service, thereby evolving and enriching the pay-TV viewing experience for the nominal ‘satellite’ service.

- Substitute. More-forward-looking satellite providers are beginning to offer consumers a choice of access technology for their full pay-TV service packages. For example, in mid-2018, French satellite broadcaster Canal+ began giving new or renewing customers the option to choose between their satellite set-top box (which was limited to HD content) or an Apple TV containing Canal+’s app (which it emphasised would offer viewers both 4K content as and when it became available, and a superior viewing experience).

In all three of the above approaches, satellite players offer consumers great choice while continuing to support DTH access technology. Sky in the UK provides a good example of what can be achieved when all three of these approaches are combined. First of all, Sky started to bundle broadband services with satellite TV, becoming the second-largest ISP in the UK after BT. On the back of this, it built a successful hybrid offering which combines linear TV over satellite with catch-up TV and on-demand content delivered via OTT. Since 2013, it has also offered a low-cost pure OTT service based on a subset of its channels under the Now TV brand. In January 2018, the company announced that it would also launch an OTT version of its full satellite offering (although this product has yet to be launched at the time of writing). Finally, Sky has recently concluded a wholesale deal with Netflix, and subscribers to its high-end Sky Q package can now buy a bundle that gives access to Sky box sets and Netflix at a small discount over buying the two packages separately.

For more information on OTT strategies for satellite TV providers, contact Martin Scott. Analysys Mason’s report Pay TV and OTT video in Western Europe: trends and forecasts 2018–2023 is available now. Our North American pay TV and OTT forecasts will be available as part of our worldwide pay-TV and OTT forecasts in early 2019.

Downloads

Article (PDF)Latest Publications

Tracker

Telco–satellite investments and deals tracker 2024

Article

CFO interview: Netomnia’s Wil Wadsworth on raising finance in a challenging debt environment

Article

Satellite vendors must fix satellite supply chain problems to develop the space infrastructure business