Infrastructure investment by online service providers

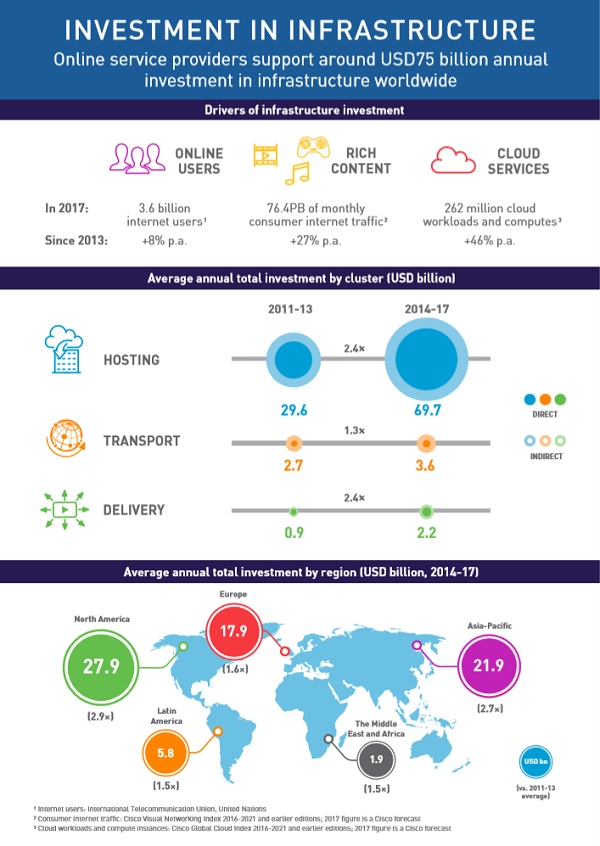

A study by Analysys Mason, updating the ground-breaking work we published in 2014, shows that since 2014, online service providers (OSPs) have invested over USD300 billion in internet infrastructure. This amounts to USD75 billion per year, which is more than double the 2011–13 average annual investment of USD33 billion.

Over 90% of this investment has been in hosting infrastructure as OSPs build hyperscale data centres to support the explosion in online content and cloud services, and install equipment in third-party colocation facilities.

OSPs are making significant investments to extend their networks, moving ever closer to end users. This includes spending on new data centres in more locations, and a diversification of data centre investments to smaller and more localised cloud facilities. To reach these facilities and exchange traffic in ever more places with ever more operators globally, OSPs lease, purchase or invest in terrestrial and submarine fibre networks. Finally, OSPs are driving investment in delivery networks, to support quality of service by bringing content as close as possible to end users.

In addition to ongoing investments in infrastructure, OSPs also continue to dedicate billions of dollars each year on research and development (R&D) to improve their products. The total R&D spend for nine of the major OSPs more than doubled from 2013 to 2017, as companies continue to invest in innovative technology, much of which is designed to improve the efficiency of their future infrastructure deployments and operations.

OSPs are not simply providing content and services using third-party networks and facilities, but are making a large and growing contribution to the infrastructure that underpins the Internet. OSP investments are typically made in parallel with investments from a variety of other stakeholders in the global internet landscape. Revenues from OSPs’ activities support investments by players including telecoms carriers, data-centre operators and internet service providers, providing benefits to the whole ecosystem. Further growth in investment, both directly by OSPs and indirectly through other service providers, can be expected in the coming years, as OSPs strive to keep pace with the growing demand for content and cloud services across all regions of the globe.

To download the report, click here.

Infrastructure Investment by Online Service Providers

DownloadAuthors

David Abecassis

Managing Partner, expert in strategy, regulation and policy

Richard Morgan

Partner, expert in transaction support

Shahan Osman

ManagerLatest Publications

Tracker

Pay-TV quarterly metrics 4Q 2024

Article

Stakeholders must collaborate to prove the security benefits of Open RAN and de-risk early deployments

Strategy report

Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions