Artificial intelligence in global tech: an emerging superpower

The past couple of years have seen dramatic progress in global artificial intelligence (AI) trends and advancements, and developments in foundational AI technologies have spurred a wave of AI start-ups in India and elsewhere. AI-driven innovation is becoming a must-have technology for businesses across various industries, and many new and existing Indian players are developing niche AI solutions to target businesses globally.

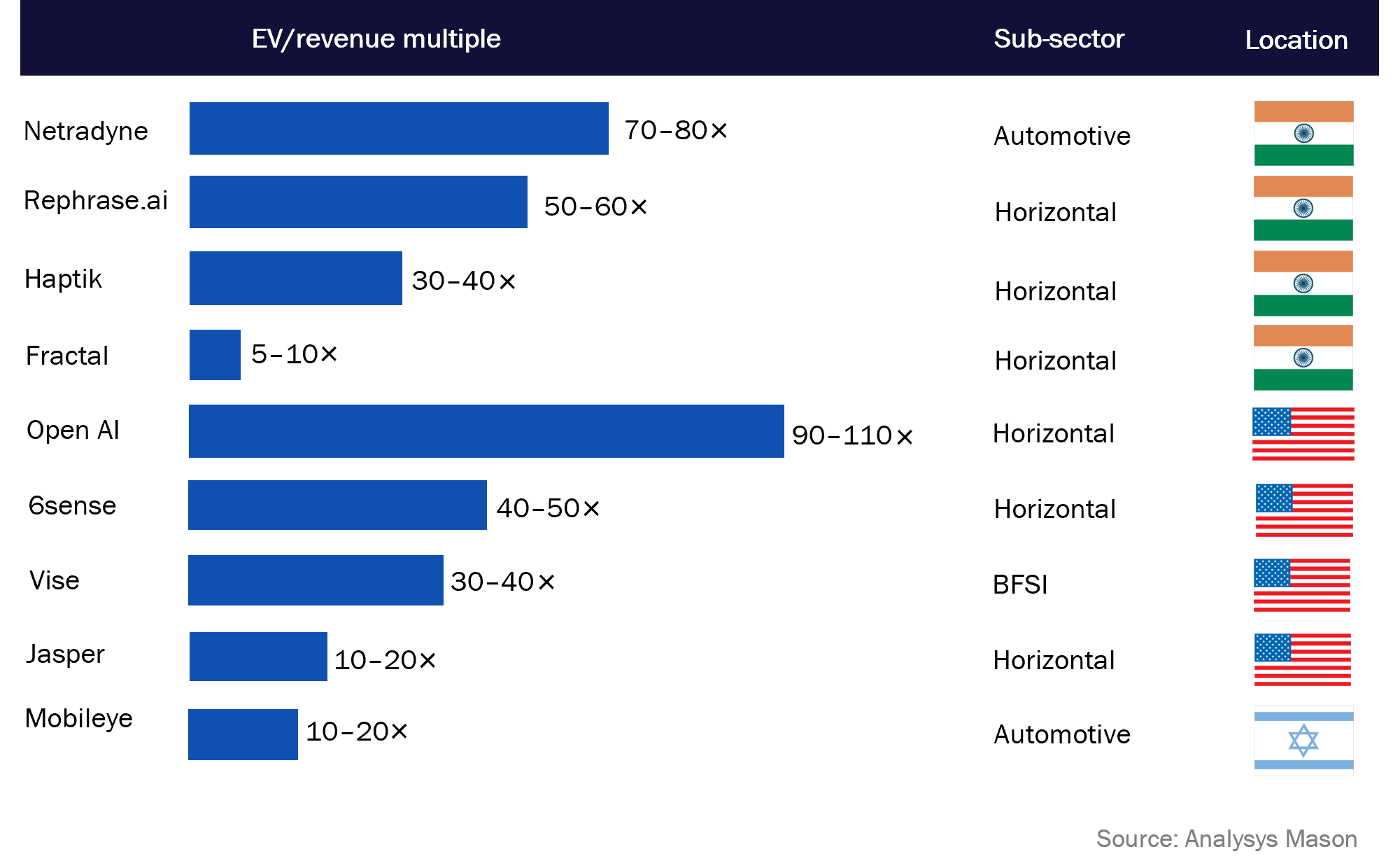

Investors worldwide have seized this ‘once-in-a-lifetime’ opportunity and invested ~USD5.1 billion in Indian AI players in 2022. Valuations of AI players can primarily be seen from the same lens as other software-as-a-service (SaaS) players, unless the outcome from the AI solution is truly unique and disruptive. Many AI businesses in India and other countries are currently being valued at much higher revenue multiples compared to their SaaS counterparts, due to their potential to disrupt industries and scale exponentially, their limited competition and first-mover advantage, and the hype and positive sentiment associated with AI. However, investors should be very diligent while assessing these businesses and understanding where such high multiples do or do not make sense.

The following summary highlights some key points related to this fast-emerging sector. For a more comprehensive version, which includes insights from some of our recent work, click on the adjacent download.

Indian AI players are increasingly developing their own foundational AI tech, spurring a major change in the AI ecosystem

Indian businesses investing in AI are progressively moving towards creating their own foundational AI models and services, marking a strategic shift in their role. The boundary between such foundational service providers and domestic players creating solutions using them is increasingly getting blurred.

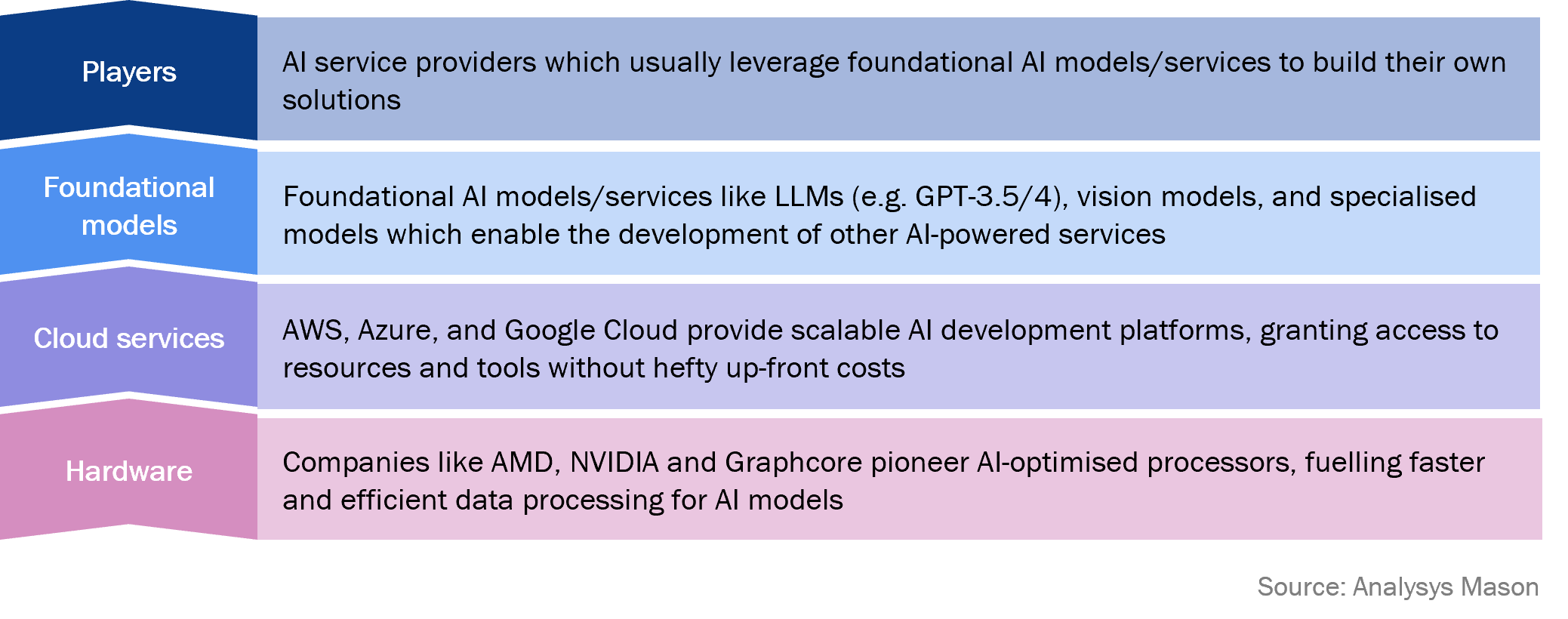

The AI stack consists of four main layers: hardware, cloud services, foundational AI models and services, and players. Each layer plays a crucial role in shaping the AI technology ecosystem.

Figure 1: The key layers of the AI stack

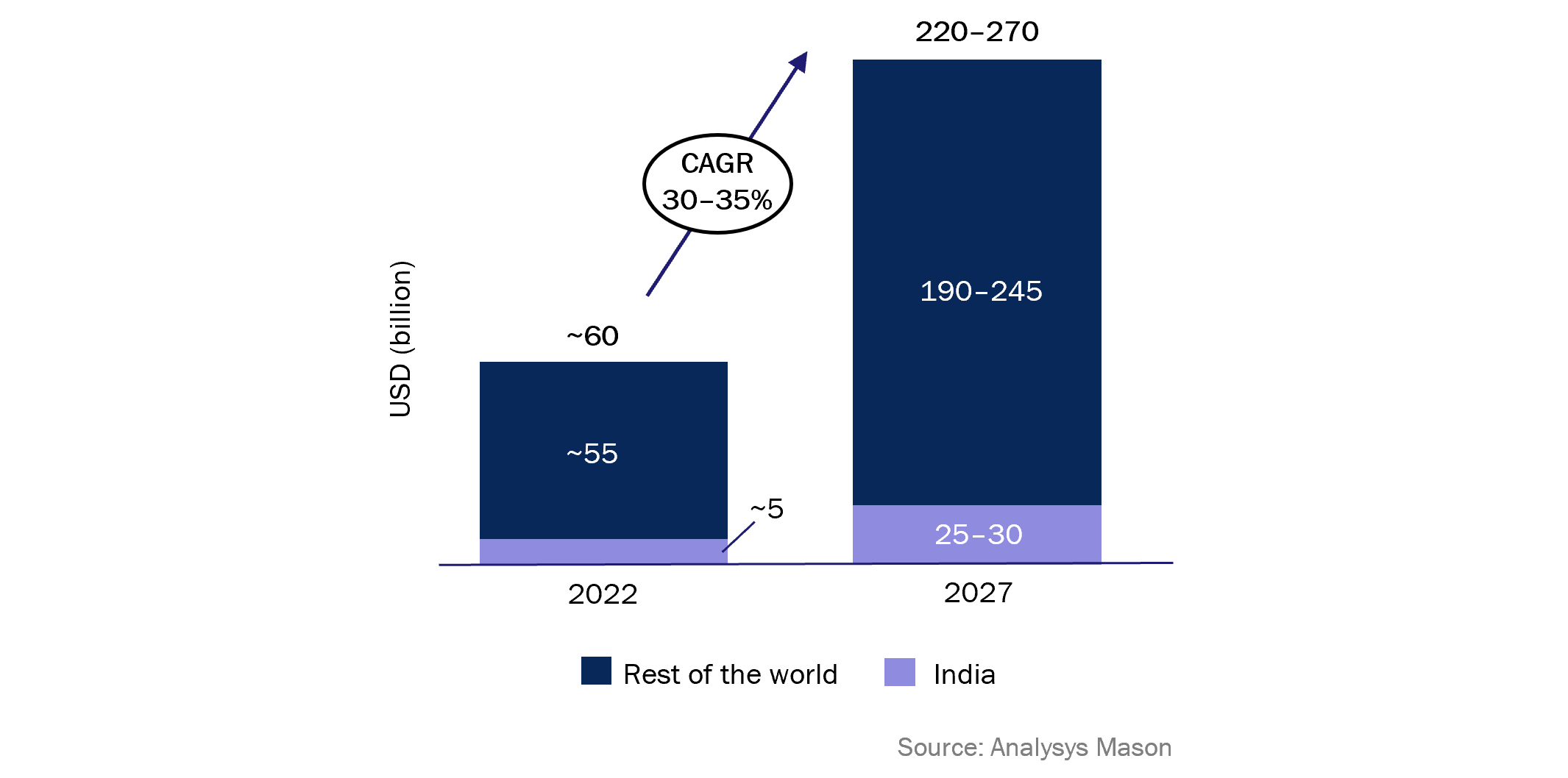

Catering to the global market where there has been a rapid increase in AI spend provides tailwinds for Indian AI players

Indian AI players, like their SaaS counterparts, are creating high-quality product and service propositions using cutting-edge AI technologies targeting use cases across multiple industries such as healthcare, banking, e-commerce and agriculture. This enables them to target customers from across the globe.

Figure 2: Total AI spend across addressable markets

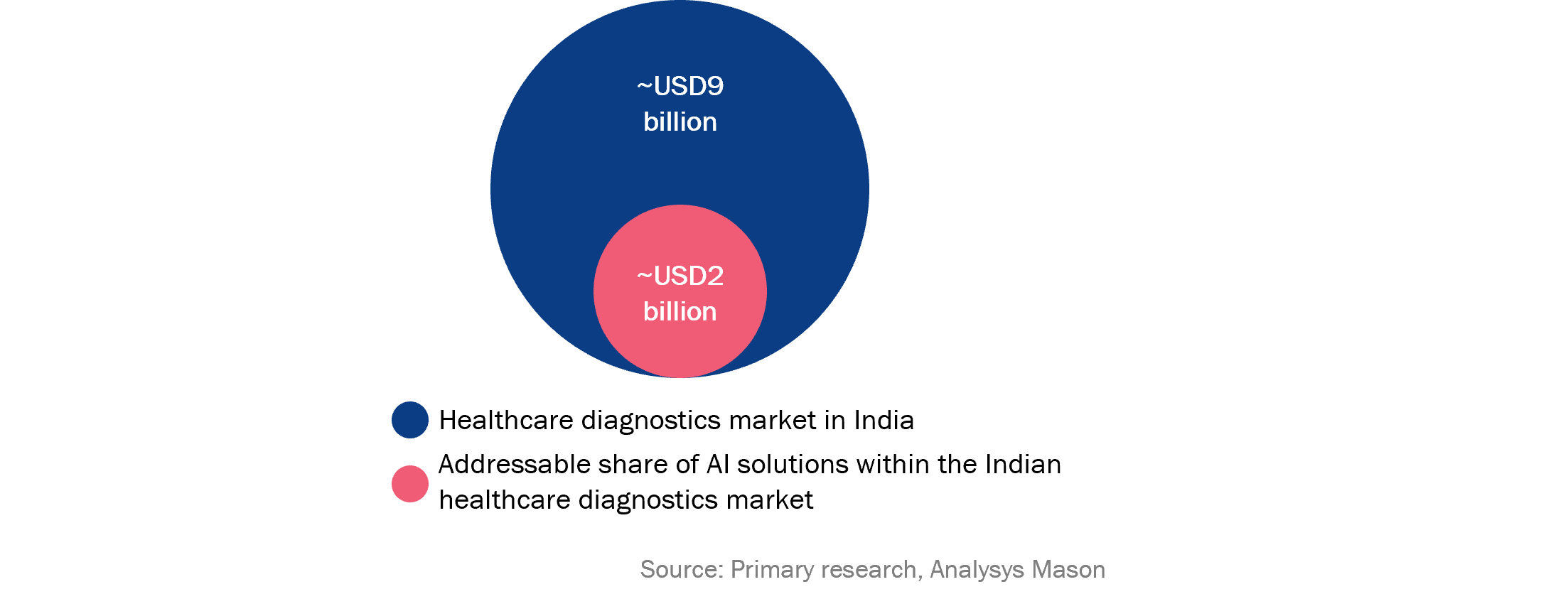

Example case study: Analysis of total addressable market (TAM) for Indian healthcare diagnostic AI solutions within India

The Indian healthcare diagnostics market in radiology and pathology amounted to ~USD9 billion in 2022 and so far has solely relied on technicians and doctors to assess test results.

Indian players like Niramai, qure.ai and nference, among many others, are paving the way for the adoption of AI-powered applications in the sector by developing AI solutions to analyse electronic medical records (EMRs) like blood tests, imaging studies (such as X-rays, MRI and CT scans), ECGs, etc. for improved detection (accuracy, speed, lower costs) of potential illnesses.

Figure 3: Addressable share of AI solutions within the Indian healthcare diagnostics market (2022)

Many businesses will exploit the AI hype

Valuations of AI players can primarily be judged through the same lens as SaaS players:

- scale and growth (current revenue/annualised run rate (ARR) and outlook, historical growth trends)

- profitability (unit economics, margins, earnings before interest, taxes, depreciation and amortisation (EBITDA), and path to profitability)

- defensibility of the AI tech (patents, proprietary algorithms, data assets, etc.).

Some AI businesses are creating truly revolutionary fundamental technologies, but a lot of other businesses are riding the wave of AI enthusiasm with little impact. Investors should be diligent when assessing these businesses and understanding where such high revenue multiples do or do not make sense.

Figure 4: Comparison of revenue multiples for select AI players

About us

About us

At Analysys Mason, we are proud to have supported some of the recent marquee transactions in this sector in India, the Middle East and elsewhere. Additionally, our Global Emerging Technologies Hub has also supported multiple governments and corporations worldwide in their journey to adopt emerging technologies including AI. For more information, please contact Rohan Dhamija (Managing Partner), Ashwinder Sethi (Partner) or Rahul Nawalkha (Manager).

Newsletter (PDF)

Download

Bringing human intelligence to AI

Authors

Rohan Dhamija

Managing Partner | Director Head - Middle East and India (South Asia)

Ashwinder Sethi

Partner