Data-centre yieldcos are becoming a valuable route to funding in a capex-hungry market

24 December 2024 | Transaction support

Alessandro Ravagnolo | Daniel Ponte Fernández

Article | PDF (4 pages)

Traditional financing models may not be sufficient to fund the enormous investments required to keep pace with the plans for data-centre construction. The investment community needs to be creative in finding ways to generate funds.

The current unprecedented build rate of large data-centre campuses is being fuelled by the spread of artificial intelligence (AI) and cloud-based computing. Analysys Mason forecasts the total installed IT load capacity1 is set to triple by 2030, at a capex cost of over USD1 trillion required worldwide by 2030.

Conventionally, data-centre operators have sourced funds for capex through a mix of debt financing (direct or through asset-back securitisation) and direct equity investments. However, the scale of the required investment is so large that traditional funding routes are unlikely to be sufficient: it will take a more creative spirit to find funding options and financial structures that can address the demand. An emerging financial construct to bring more capital into the industry is the creation of data-centre ‘yieldcos’.

Yieldcos: carving out stabilised assets

Investors find it easier to invest larger sums into assets that are stabilised, yield-generating entities. Most data-centre companies do not naturally fall into this category due to substantial exposure to new developments. However, operators and investors can shape investment vehicles specifically to meet these criteria by carving out yield-generating (or ‘stabilised’) assets into a special purpose vehicle (SPV) that can be fully or partially sold to an investor with low cost of capital.

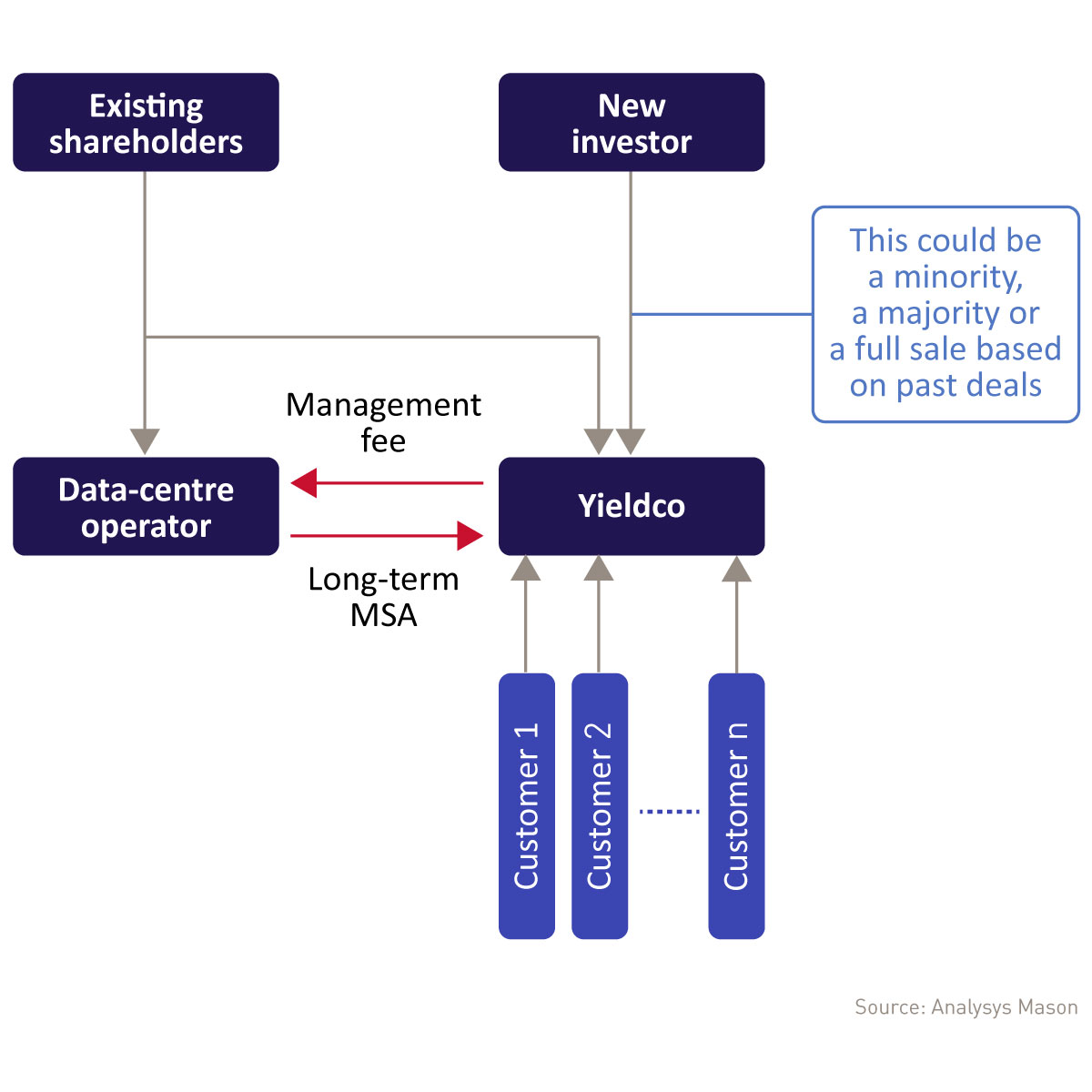

These assets (data-centre yieldcos) are designed to be downside-protected businesses, with high visibility of cashflow, backed up by long-term contracts with customers (for revenue) and the data-centre operator (for cost).

The entity is typically fully built and rented out and will continue to be operated by the original data-centre company through a technical service agreement (TSA). The data-centre operator receives a payment in the form of a management fee, calculated as a percentage of the yieldco’s turnover.

Figure 1: How a yieldco works2

Data-centre yieldcos offer significant benefits to stakeholders

Several data-centre players have already launched yieldco processes, and many others are considering following suit given that the model offers several benefits to operators and their shareholders:

- more equity without the loss of control of stabilised assets

- more funding opportunity by increasing the pool of co-investors at a low cost of capital (for example, investors that focus specifically on assets with low cost of capital, mid-cap infrastructure funds, regional focus, limited exposure to deployment risk)

- opportunity for existing shareholders to recycle capital and crystalise value without exiting

- freeing up of capital to build new data-centre facilities.

Data-centre operators with strong development capabilities get better returns from building and driving up utilisation on new data centres than just extracting yield from highly utilised assets. This is especially true in a supply-constrained market, where the supply chain struggles to deliver sufficient additional capacity to meet demand.

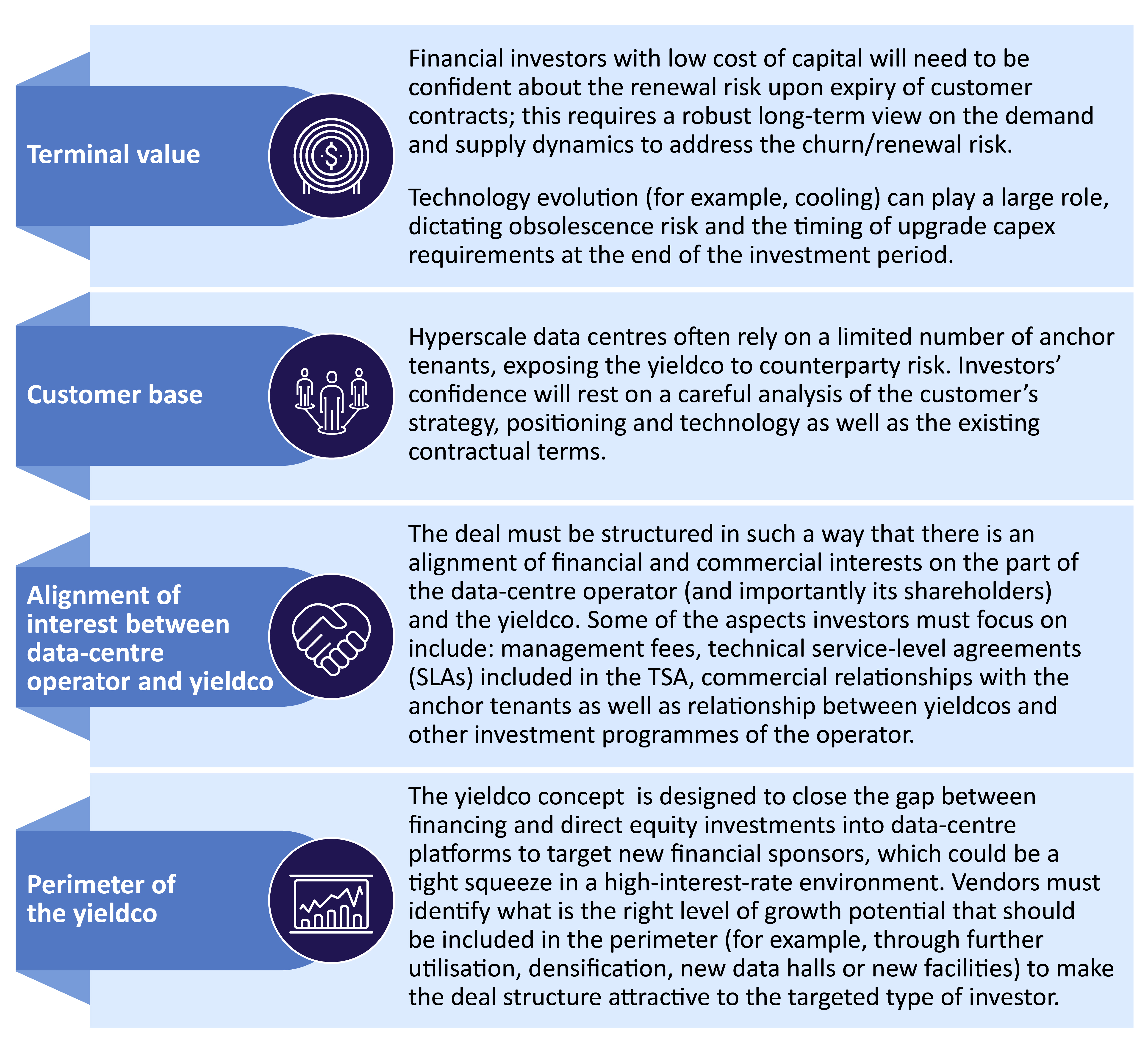

Potential investors need to be aware of four key diligence questions

While these assets have been created specifically to offer downside protection, there are both commercial and technical diligence questions that will need to be explored if investors are to gain confidence and comfort in the investment model.

Figure 2: Four key considerations for investor confidence in the yieldco investment model

Source: Analysys Mason

Caution will give way to confidence

In the short term, data-centre yieldcos are expected to increase in popularity. With interest rates expected to decline, yieldcos will become more attractive vis-à-vis financing instruments, and the investment model will grow in maturity. Buy-side investors will become increasingly familiar with it and sell-side parties will tune the structure of the deal to maximise the appeal of the yieldco.

In the longer term, there is a question of what will happen to the large number of facilities that are self-built by hyperscalers, whether for cloud or AI training/inference. Hyperscalers are usually seen as having deep pockets and operate through data centres they have built themselves and some that were built by third parties. Hyperscalers’ need to stay ahead of technology requires large ongoing investments (in research and development (R&D) and supporting infrastructure). This may lead them to weigh the benefit of offloading data-centre infrastructure that is sitting on their balance sheet by creating yieldcos. Such a move could represent a paradigm shift for the industry and present investors with investment opportunities of unprecedented size.

Data-centre yieldcos could also be seen as a model that is replicable across other digital infrastructure asset types. There could be an opportunity for fibre businesses that have a proven track record in take-up and low churn (for example, separating earlier and more mature roll-out cohorts) to replicate this investment model. Digital real-estate businesses (that is, land leases, switches/nodes) may be a natural fit for this investment model. While mobile tower assets offer limited benefits (as towercos are, in effect, yieldcos already), the yieldco model could be more attractive for small-cell businesses.

Analysys Mason is the commercial and technical adviser of choice in the transaction support space, having played a key role in over 1000 deals since 2020. Our independence allows us to offer long-term and unbiased views on the evolution of the technology, media and telecoms industry, with particular benefit for long-term financial investors in the digital infrastructure space. Our unique understanding of the commercial dynamics underpinning the co-location, cloud and AI businesses coupled with our deep expertise in technology make us the ideal partner for investors needing independent and quantitatively robust support on data-centre deals. For further details, please contact Alessandro Ravagnolo.

1 The total installed IT load capacity refers to the maximum power required by all IT equipment in data centres.

2 Master service agreement (MSA).

Article (PDF)

DownloadAuthor

Alessandro Ravagnolo

Partner, expert in transaction services

Daniel Ponte Fernández

Principal, expert in transaction servicesRelated items

Article

High stakes for data-centre investors and operators: GPUaaS specialists offer growth with risk

Article

CFO interview: Netomnia’s Wil Wadsworth on raising finance in a challenging debt environment

Project experience

Providing end-to-end, essential support to a regional digital services company’s first Project Gigabit win