How telecoms operators focus on digital investments in MENA to create new hooks for growth and diversification

As telecoms markets become ever-more saturated, telecoms operators are increasingly looking for growth opportunities in adjacent areas to create new hooks to drive growth and diversification. Leading telecoms players in the Middle East and North Africa (MENA) region have been amongst the frontrunners globally foraying into digital services through in-house development, mergers and acquisitions (M&A), or partnerships with digital solution providers across verticals such as fintech, edtech, e-commerce, Internet of Things (IoT), digital infrastructure and artificial intelligence (AI). They have actively explored both synergistic and tangential opportunities to their core business across multiple digital verticals. This has not only enabled them to preserve core telecoms revenue, add new revenue streams and reap financial benefits from the valuation upside of these digital assets, but it has also facilitated the development of the overall digital ecosystem in the region.

The following summary highlights some key points related to this fast-emerging sector. For a more comprehensive version, which includes insights from some of our recent work, click on the adjacent download.

Digital services in the MENA region are enabling telecoms operators to drive growth and diversify beyond their core offering

Digital services contribute 10–25% of operators’ revenue in mature digital services markets and globally they have emerged as one of the key levers for telecoms operators to drive growth and diversification. Operators have been exploring synergistic vertical sectors (such as fintech, content/media and gaming) and tangential vertical sectors (such as infrastructure, edtech and e-commerce). Telecoms operators adopt various approaches in developing their digital portfolios. These approaches can be broadly categorised into: in-house development, M&A, and partnerships with other companies. The most suitable approach for an operator depends on its existing capabilities, the type of digital sector (synergistic versus tangential), and the objectives behind entering the sector.

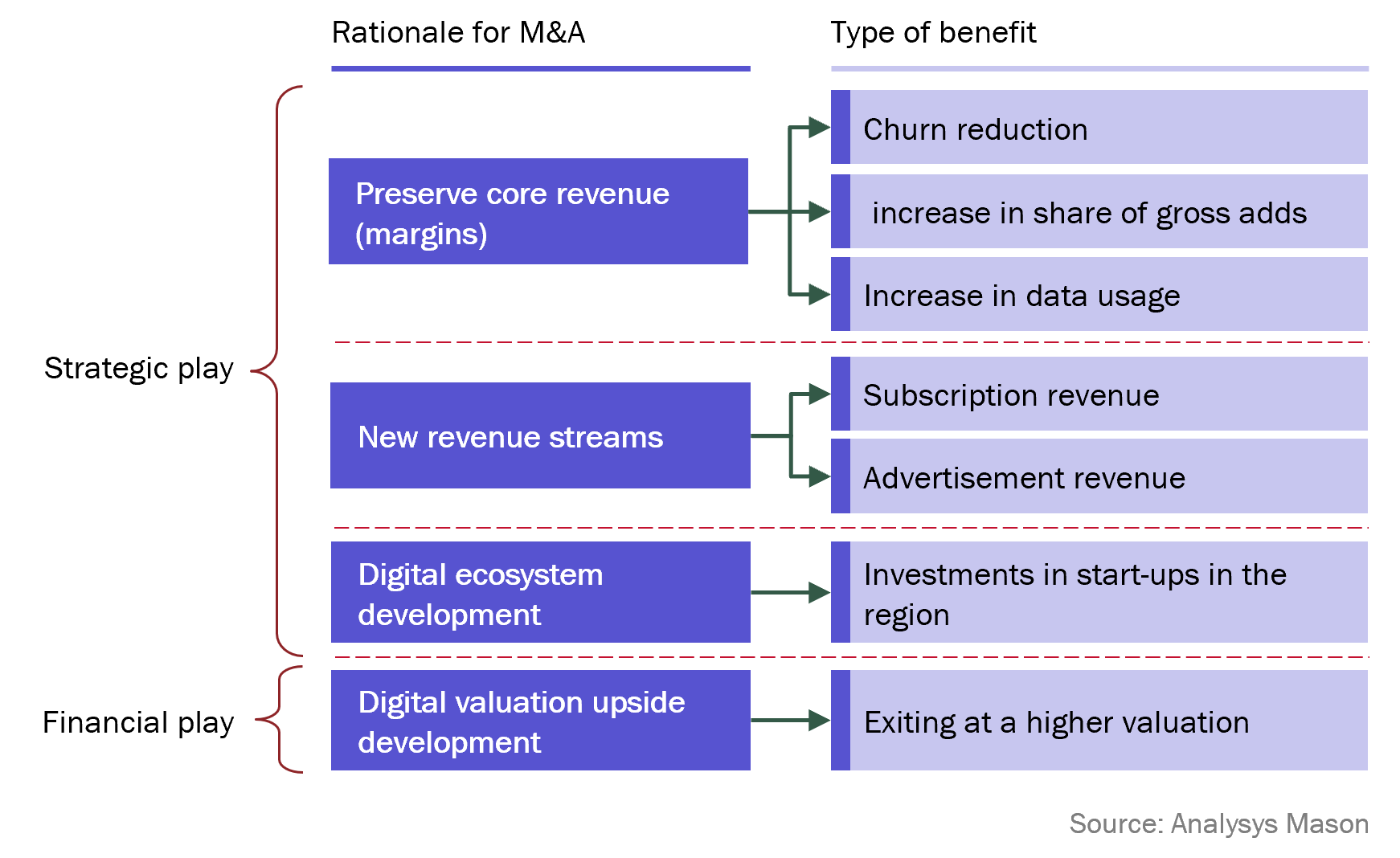

The key motivation for operators to enter the digital services market can largely be classified as either strategic or financial.

Figure 1: Rationale for operators to explore digital services and opportunities

Based on an Analysys Mason study, more than 60% of operators have already started at least one initiative in each of the following digital service sectors: healthtech, MFS/fintech, cloud services, e-commerce, adtech and edtech. In the healthtech and MFS/fintech sectors, this number increases to more than 80% of operators.

e& and stc have been amongst the global frontrunners embracing digital services and building digital services portfolios

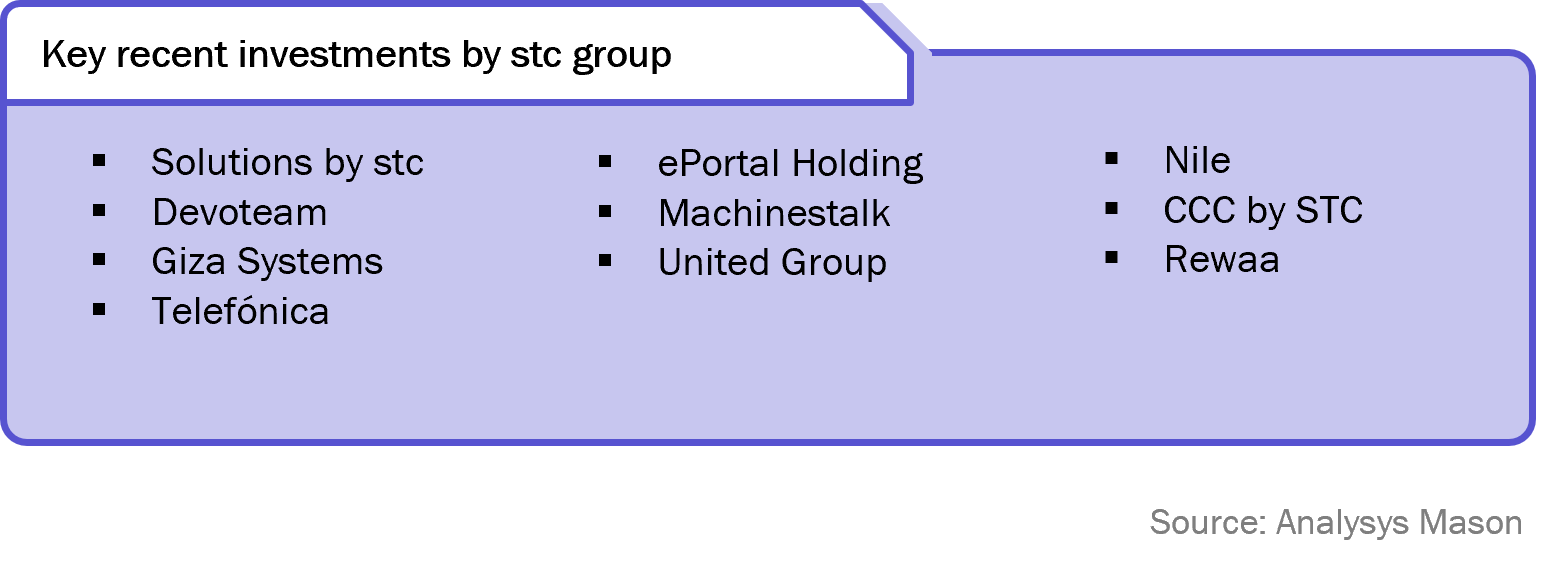

Saudi Telecommunication Company (stc) is the leading Saudi Arabian communication service provider (CSP) and one of the main operators in the region for explorations into various digital services. stc supports a broad range of investments across digital verticals through its multiple strategic investment vehicles.

Figure 2: Examples of investments by stc across digital verticals

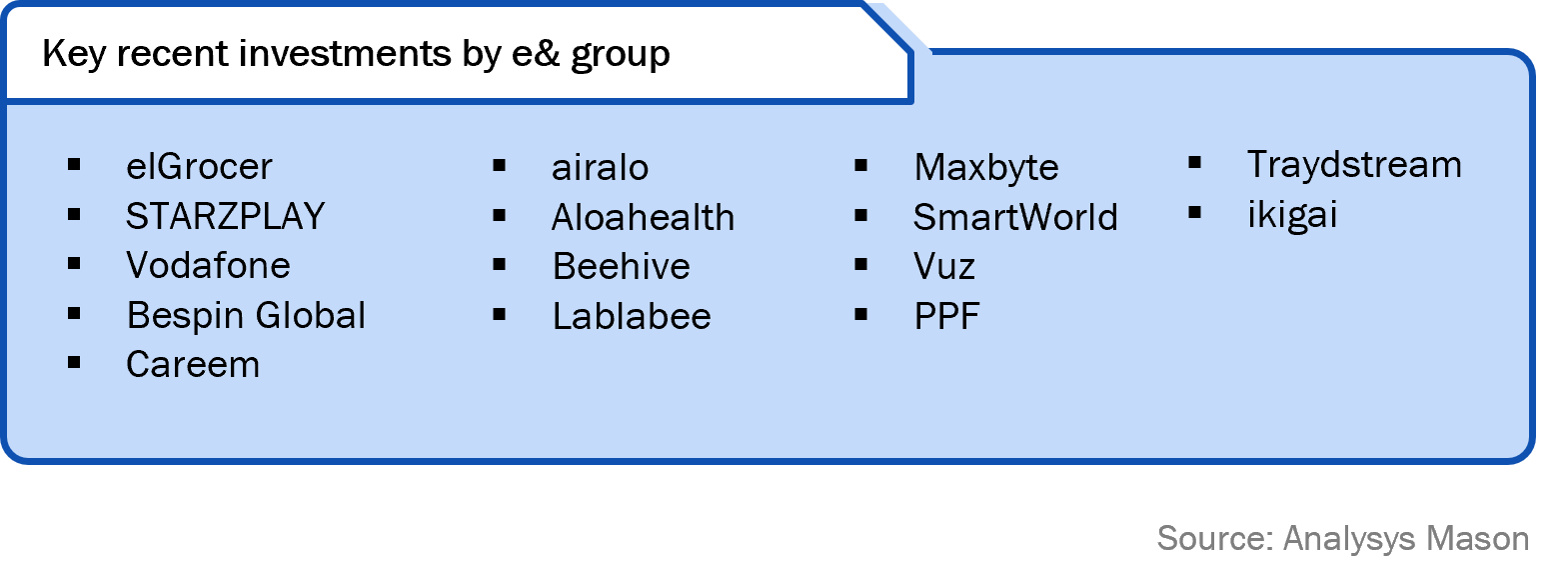

etisalat and (e&) is the leading CSP in the United Arab Emirates (UAE), with operations across 16 countries in Asia and MENA. e& has been one of the leading operators exploring various digital services through its multiple brands, namely etisalat, e& international, e& life, e& enterprise and e& capital.

etisalat and (e&) is the leading CSP in the United Arab Emirates (UAE), with operations across 16 countries in Asia and MENA. e& has been one of the leading operators exploring various digital services through its multiple brands, namely etisalat, e& international, e& life, e& enterprise and e& capital.

Figure 3: Examples of investments by e& in digital services

About us

At Analysys Mason, we are proud to have supported some of the recent marquee transactions in this sector in India, the Middle East and elsewhere. Additionally, our Global Emerging Technologies Hub has also supported multiple governments and corporations worldwide in their journey to adopt emerging technologies including AI. For more information, please contact Rohan Dhamija (Managing Partner), Ashwinder Sethi (Partner) or Rahul Nawalkha (Manager).

Newsletter (PDF)

DownloadAuthors

Rohan Dhamija

Managing Partner | Director Head - Middle East and India (South Asia)