Green funding fuels fibre expansion for operators with the best sustainability credentials

The deployment of fibre networks is more sustainable compared to the deployment of other common network technologies. The sustainability credentials of fibre to the premises (FTTP) for broadband connectivity are excellent. The technology is energy-efficient and provides users with high-speed access to digital services which is becoming increasingly important for society as a whole. Additionally, FTTP supports sustainable economic development. Coherent environmental, social and governance (ESG) initiatives can help to amplify these benefits and to mitigate the risks of adverse impacts that are inherent to large-scale infrastructure deployment programmes. An effective ESG strategy can deliver business benefits to fibre operators by supporting positive engagement with investors, communities and public-sector bodies.

Fibre network operations are much more energy-efficient than alternative broadband technologies

Once deployed, FTTP offers clear benefits over other network technologies in terms of speed, reliability and operating costs. The infrastructure has a long lifespan (20–40 years for passive network elements) and lower maintenance requirements than alternatives.

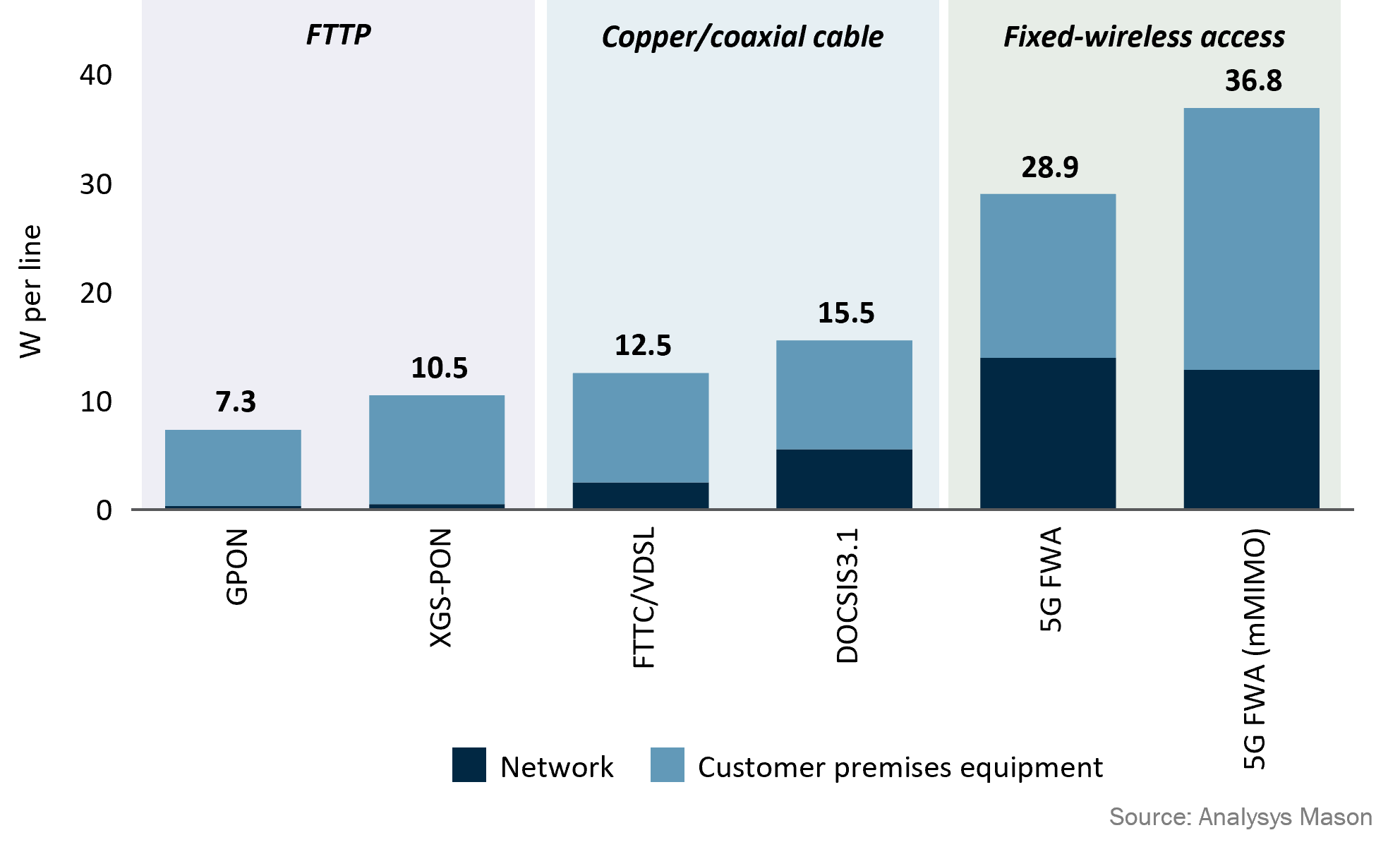

Figure 1 shows that FTTP is far more energy-efficient than other common network technologies while 10 gigabit symmetrical passive optical network (XGS-PON) equipment only has slightly greater power consumption than the previous generation of gigabit passive optical network (GPON) equipment, it delivers approximately five times the bandwidth of GPON. Both FTTP technologies use less energy per line than copper-based or wireless networks, while also offering much higher data throughput.

Figure 1: Fixed broadband power consumption per line at full usage1

Fibre deployment must be resource-efficient and should minimise impact on local communities

Fibrecos generally seek to maximise the use of existing infrastructure (such as ducts and poles) to reduce disruption and resource wastage. Where existing infrastructure is unavailable, operators are increasingly adopting methods such as directional drilling and micro-trenching which can reduce both costs and environmental impact. For example, the Finnish altnet, Fibernet, estimates that the emissions generated through micro-trenching are only 2% of those generated through traditional excavation trenching in an asphalted area.

Fibrecos can make sustainability considerations a significant factor in their purchasing decisions, for example, by procuring ducting and cabling with high levels of recycled materials. They can also examine their Scope 3 emissions, which relate to the indirect footprint attributed to upstream and downstream activities and are coming under increasing regulatory scrutiny. This approach would involve selecting deployment and maintenance contractors that have well-documented sustainability strategies and sourcing criteria and have implemented initiatives such as a transition to electric vehicles. Verizon in the USA, for example, promotes responsible procurement practices by accounting for factors such as carbon footprint, labour practices and ethical sourcing.

Fibre operators are adapting to the more ESG-focused landscape demanded by policy makers and investors

Fibre operators are increasingly focusing on ESG as the topic receives more focus from stakeholders including public-sector bodies and investors. The FTTH2 Councils Global Alliance 2023 sustainability survey found that 81% of European respondents had an ESG strategy and 55% had set targets for greenhouse gas emissions.

From a regulatory perspective, the positive sustainability credentials of fibre networks mean fibre networks receive less direct intervention on ESG than other types of digital infrastructure (such as data centres and mobile towers). However, ESG is an important consideration for policy makers in the context of public-sector broadband interventions. For example, the UK Government’s Project Gigabit subsidy programme awards 10% of the bid score based on operators’ plans regarding fighting climate change, encouraging equal opportunities and tackling economic inequality with fair work.

From a financing perspective, meeting the ESG criteria of investors and debt providers is vital in light of the substantial funding that operators need in order to continue to build out their networks and connect customers. Analysys Mason forecasts that fibrecos will deploy FTTP networks to over 550 million more premises worldwide from 2023 to 2029 with over USD440 billion of capex expected over that period. Sustainability-linked financing is gaining traction, as demonstrated by Australian operator NBN Co’s latest AUD850 million (around USD570 million) green bond, issued in August 2023.

Fibrecos that successfully improve their ESG credentials can unlock further funding from investors and other commercial benefits. For less mature operators, this means laying a compliant foundation (meeting regulator/investor requirements) to increase long-run profitability and ‘investability’. Operators in mature markets should consider the impact of ESG initiatives on fundraising or a potential sale. This means developing a sustainability programme that includes comprehensive monitoring, reporting and strategies for improvements. Investors are also driving development of these ESG strategies within existing portfolio companies, to ensure they are prepared for successful exit options to new funds or to strategic investors as the fibre industry expects further consolidation.

Fibrecos have an opportunity to pursue a community-centric ESG effort

When compared to data centres and mobile towers, the distance between FTTP infrastructure and the customer is smaller, and its deployment tends to be more visible to communities. Underground deployments may require disruptive road closures, whereas aerial deployments can cause friction with local residents where new telegraph poles are being installed. Fibrecos can minimise disruption and impact on reputation by adopting effective planning processes and early engagement with residents, and through working to reuse existing infrastructure wherever possible.

Beyond the network deployment phase, many fibre operators are pursuing community engagement models to help develop local relationships. These initiatives can have social benefits for local communities, while the fibreco can also see reputational benefits which can support greater customer take-up. Effective communication of ESG initiatives can help to give fibrecos a competitive edge commercially and in the labour market.

Community Fibre in the UK, for example, has established a Digital Ambassadors Programme, which involves training residents and assisting them in supporting their local community members in learning digital skills. Under this programme, the altnet hosted 186 digital inclusion events across London in 2022. While delivering social benefits, such programmes can also bring commercial benefits by helping more residents develop the skills required to engage with digital services.

About Analysys Mason

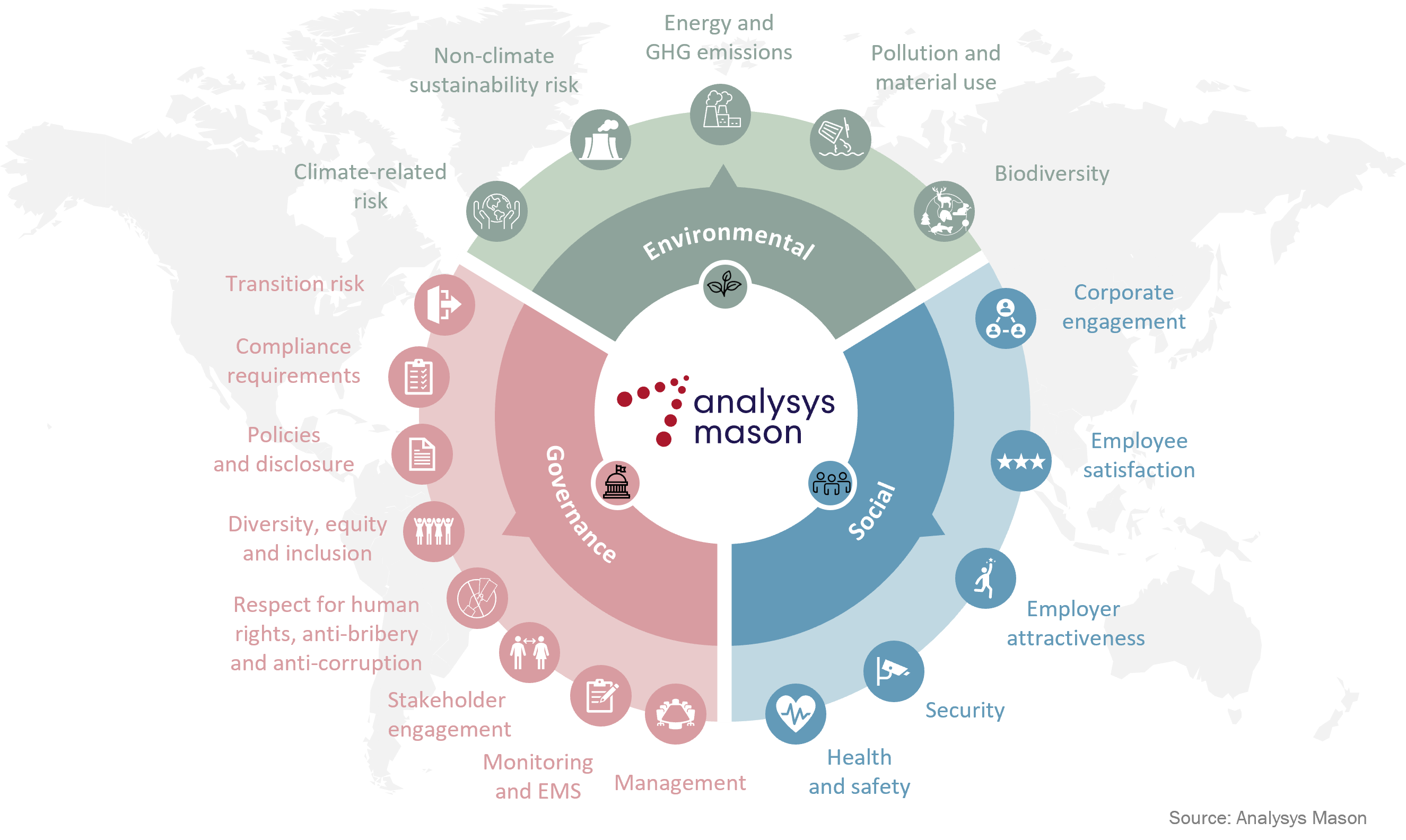

Analysys Mason is the partner of choice of fibrecos and investors targeting the telecoms sector. We offer actionable (and analytical) advice supporting key commercial, technical and operational decisions. The combination of our in-house ESG expertise, which includes an established ESG due diligence framework (see Figure 2), with our unrivalled knowledge of the fibre market makes us an ideal partner for fibrecos seeking ESG advisory support to achieve sustainable competitive advantage and for investors seeking ESG-conscious targets. For further details, please contact Richard Morgan and Sabre Konidaris.

Figure 2: Analysys Mason’s ESG due diligence framework

1 For more information, see Driving down energy usage across telecoms networks: 5G RAN and beyond.

2 Fibre to the home (FTTH).

Article (PDF)

DownloadAuthors

Richard Morgan

Partner, expert in transaction support

Sabre Konidaris

ConsultantRelated items

Article

Ambitious ESG targets for digital infrastructure are achievable with the right tools: fibre assets

Article

Data-centre owners must enhance their ESG credentials to compete for customers and capital

Project experience

Assessing a fibre operator’s credentials against a stringent ESG framework