The rapid growth of the MENA gaming industry, and why Saudi Arabia is the key driver

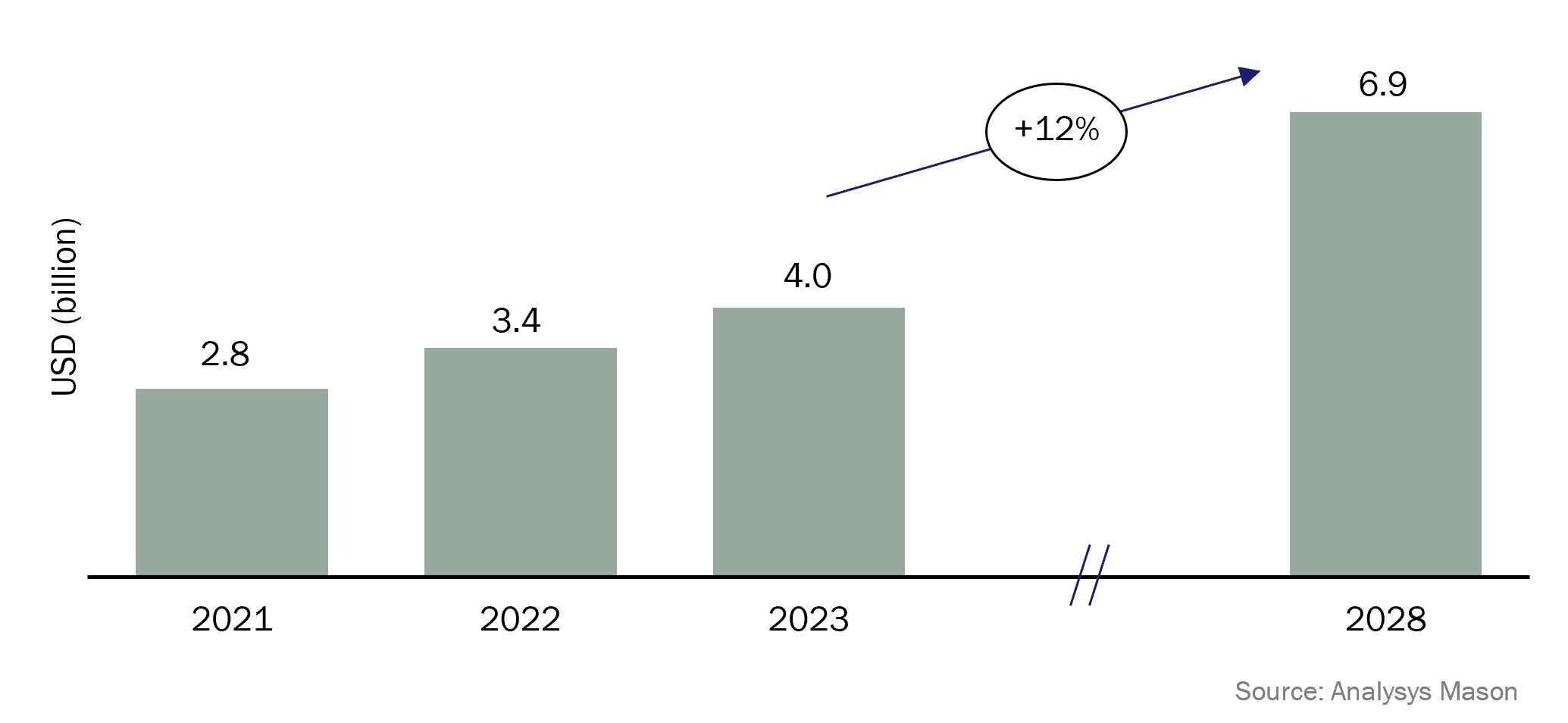

In recent years, the digital gaming market in the Middle East and North Africa (MENA) region has experienced a significant surge in popularity and growth. The gaming industry in the region is expected to amount to ~USD4.0 billion, with a total of ~380 million players (~65% of the region’s population) in 2023 – projected to grow at a compound annual growth rate (CAGR) of ~12% to reach ~USD6.9 billion in 2028.

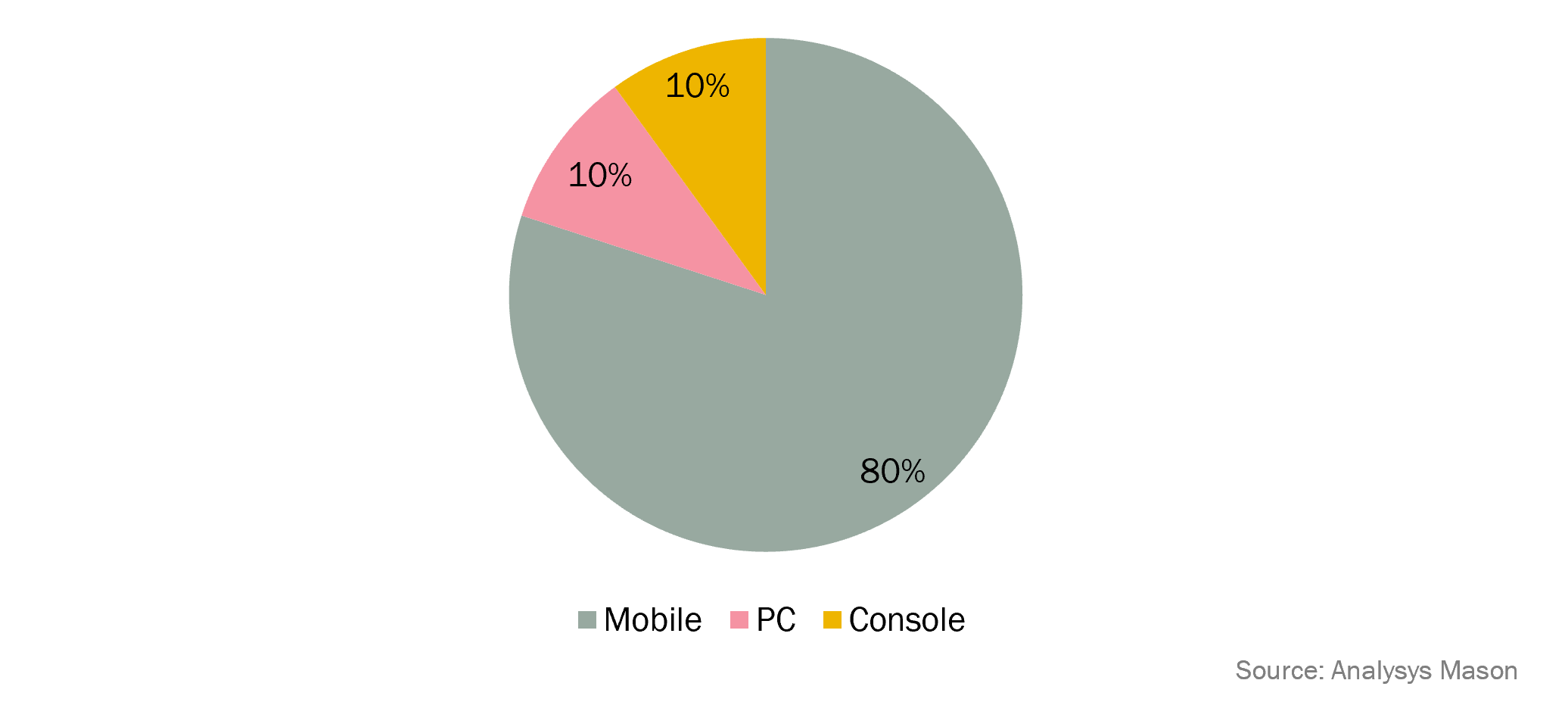

Mobile gaming accounts for ~80% of the gaming market in the region, while PC and console gaming each account for ~10%. Saudi Arabia is the leading gaming market, accounting for ~40% of MENA’s overall market share, followed by the United Arab Emirates (UAE). Saudi Arabia has made a significant push in the gaming industry through government initiatives, such as the establishment of the Saudi Esports Federation (SEF), development of national strategies to boost the industry, and sector investment. Additionally, major telecoms operators (such as stc, Zain and Mobily) have also acted as key facilitators in this booming market, through efforts like establishing their own gaming arms or platforms, and investing in the industry.

The following summary highlights some key points related to this fast-emerging sector. For a more comprehensive version, which includes insights from some of our recent work, click on the adjacent download.

Digital gaming is growing rapidly in MENA, with mobile gaming accounting for ~80% of the market

There has been a significant surge in the digital gaming market in MENA, especially in Saudi Arabia in recent years. The key drivers of growth can be attributed to a large, young and tech-literate population base, government efforts and initiatives such as the SEF, national gaming and e-sports strategies and investments in the sector plus technology advances and new use cases, such as immersive technologies, gaming events, online streaming and broadcasting.

Saudi Arabia is the leading gaming market in the region, accounting for a ~40% share of the MENA market, followed by the UAE (~15%). Mobile gaming accounts for ~80% of the gaming market in 2023, given its ease of access driven by smartphone ubiquity, high-speed mobile networks, and the region’s ability to capture even casual gamers. Saudi Arabia is also one of the leading countries worldwide in terms of gaming acquisitions and investments by the likes of PIF (Saudi Arabia’s sovereign wealth fund), telecoms operators and private investors. Major telecoms operators in the region (such as stc, e&, Zain and Mobily) have also established their own gaming arms or platforms.

Figure 1: Size of the gaming market in MENA

Figure 2: Share of gaming industry revenue in MENA, by platform (2023)

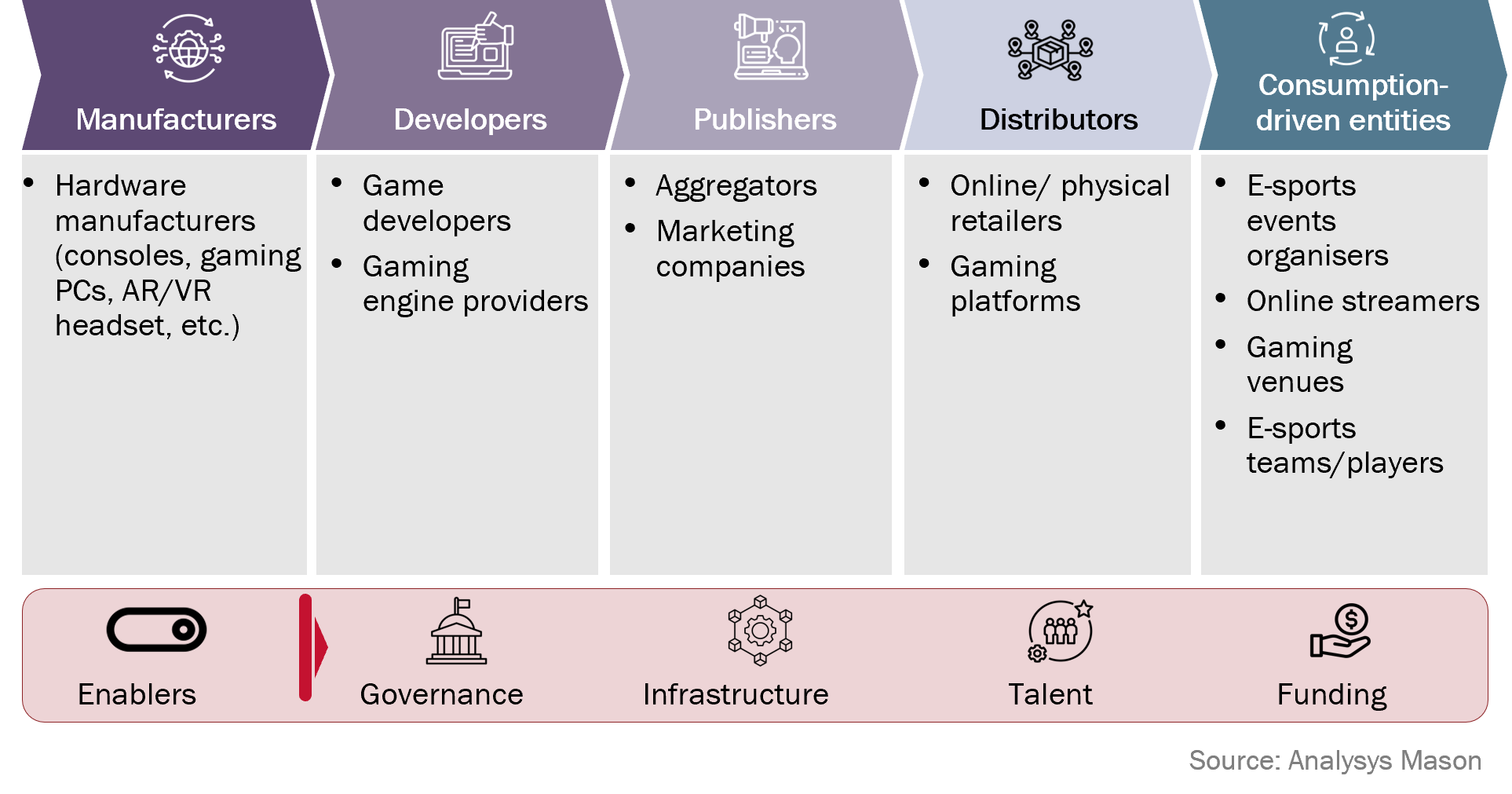

New trends are fuelled by strong growth across the gaming value chain including localisation of games, new distribution modes and emergence of consumption-driven entities

Various new trends have emerged across the gaming value chain in order to successfully cater to the strong growth of the MENA gaming industry. Developers and publishers are localising selected global games and relaunching them in Arabic markets with Arabic speech, subtitles and localised user interfaces.

Streaming platforms (such as STARZPLAY and Netflix) are increasing their focus on gaming and aiming to take cloud gaming, with a payment model based on subscription gaming, to the TV set – targeting casual gamers.

Various new consumption-driven entities are emerging, including online streaming and e-sports events, teams and players

Figure 3: Gaming value chain

In summary, over the past few years the digital gaming industry in the MENA region has experienced a significant surge in popularity and growth, driven by a young and tech-savvy population. This growth is supported by the government’s efforts to boost the industry. Initiatives includes the establishment of the SEF, which has organised gaming events with prizes worth over USD10 million, the development of multiple national strategies, and investments in the sector. Major telecoms operators, such as stc, e&, Zain and Mobily, have also played a pivotal role in this booming market, either by establishing their own gaming arms/platforms or by investing in the sector. With these combined efforts, the gaming industry in the region is poised for substantial growth in the future.

In summary, over the past few years the digital gaming industry in the MENA region has experienced a significant surge in popularity and growth, driven by a young and tech-savvy population. This growth is supported by the government’s efforts to boost the industry. Initiatives includes the establishment of the SEF, which has organised gaming events with prizes worth over USD10 million, the development of multiple national strategies, and investments in the sector. Major telecoms operators, such as stc, e&, Zain and Mobily, have also played a pivotal role in this booming market, either by establishing their own gaming arms/platforms or by investing in the sector. With these combined efforts, the gaming industry in the region is poised for substantial growth in the future.

About us

At Analysys Mason, we are proud to have supported some of the recent marquee transactions in this sector in India, the Middle East and elsewhere. Additionally, our Global Emerging Technologies Hub has also supported multiple governments and corporations worldwide in their journey to adopt emerging technologies including AI. For more information, please contact Rohan Dhamija (Managing Partner), Ashwinder Sethi (Partner) or Rahul Nawalkha (Manager).

Newsletter (PDF)

DownloadAuthors

Rohan Dhamija

Managing Partner | Director Head - Middle East and India (South Asia)

Ashwinder Sethi

Partner