Non-traditional players offer unique strengths to the data-centre industry, but the business model must be right

As businesses continue to explore new use cases for artificial intelligence (AI), the digital infrastructure that underpins AI – data centres – has seen intense activity. New opportunities have emerged for conventional players (data-centre providers, equipment manufacturers) but also for non-traditional players. Companies whose core business might be real-estate logistics, power transmission or even manufacturing are assessing their assets and expertise with a view to exploiting growth in the data-centre market. The prospects for innovative entrants to the data-centre market – and, by extension, their investors – hinge on their ability to exploit their unique characteristics, and the ability to identify and implement the right business model.

Brownfield sites may be ideal for digital infrastructure

The last decade’s dazzling growth in demand for data-centre capacity has attracted companies from outside the digital infrastructure industry. For example, real-estate logistics companies have been some of the most successful thanks to unique advantages around scarce resource availability, cost and speed to market:

- Land availability: the real-estate logistics business model means that these companies have substantial landbanks that are already zoned for industrial use and are strategically located in easily accessible locations. Such companies have well-developed capabilities in land acquisition and development, including established relationships with local brokers, land aggregators and developers.

- Power availability: current and former heavy industrial zone areas tend to have good access to power supplies. Some parts of existing brownfield portfolios may therefore be especially attractive options for the deployment of data centres.

- Cost advantages: prior experience in the construction of large warehousing facilities is relevant to data-centre deployment, offering cost advantages relating to material and labour. Existing warehouse facilities can be converted into data centres at much lower economic and environmental costs than a conventional new-build deployment.

- Speed to market: logistics companies generally have a strong track record in securing the relevant permits and power needed for building a data centre because of their experience with warehouses. They can exploit this expertise to expand their own portfolios rapidly, or to offer accelerated time to market to data-centre operators seeking to expand into a new market. Logistics companies’ ability to convert existing warehouse facilities into data centres also facilitates shorter time to market than greenfield builds.

Other companies – such as power companies and manufacturing companies – may also hold relevant capabilities and assets that could be used for data centres. For example, these could be sites with ageing infrastructure but excellent power connections. Such locations are highly desirable for data centres, given that access to sufficient power is rare but critical.

Three models for potential entrants

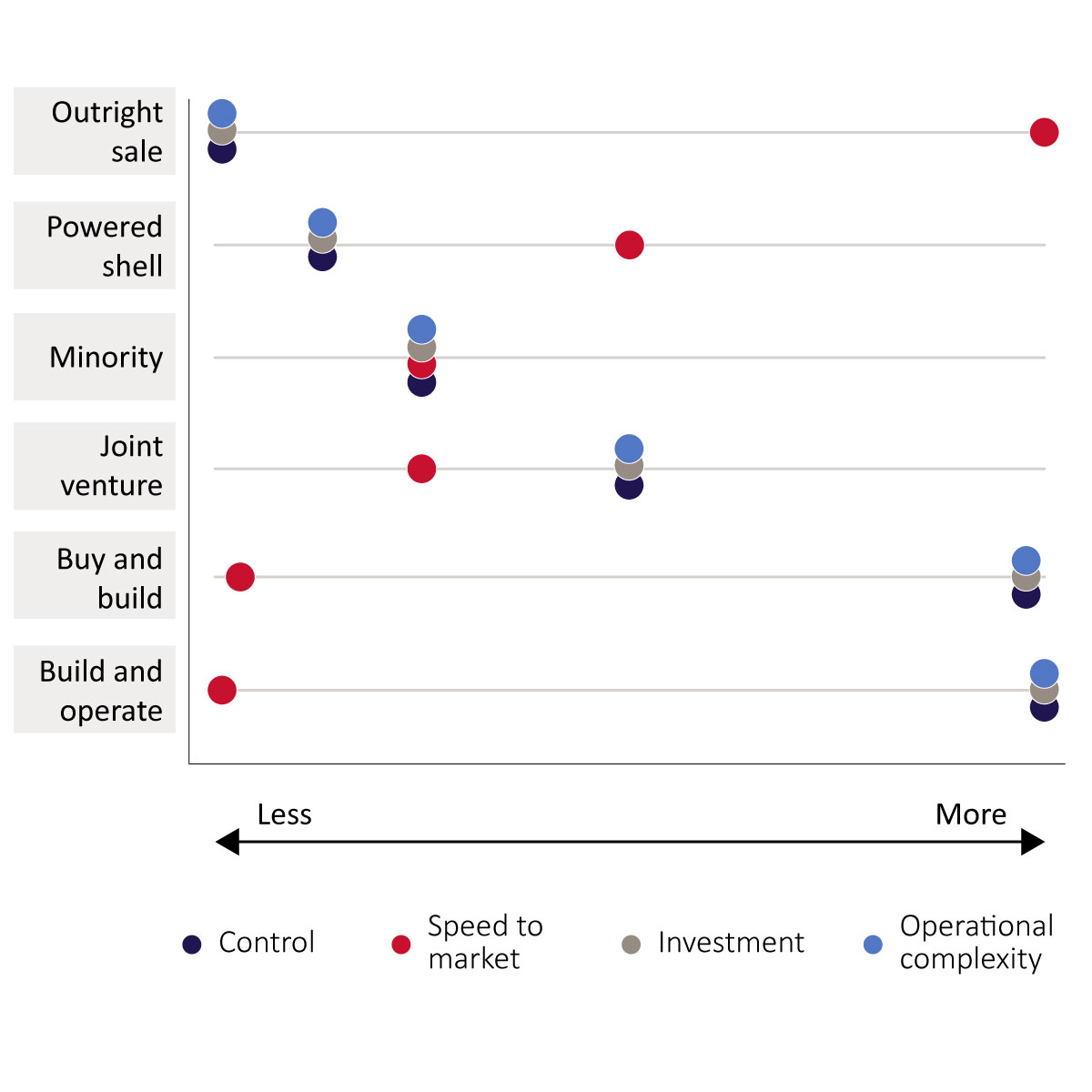

There are three main options for a non-traditional player when entering the data-centre market, each with varying levels of involvement and risk. Investors have a vital role to play in supporting the entry of non-traditional players, but ensuring that the business plan is right is as important as ever.

- Outright sale or lease is a simple model that crystallises the desirability of well-located assets. Optimising an outright sale or lease requires a good understanding of the buyers’ business model to support negotiations that ensure fair value for the asset.

- land-only: typically, the simplest and lowest-risk option and sometimes the preferred approach for counterparties

- powered-shell leasing: the non-traditional player builds the shell of an entire building (along with the necessary power infrastructure and, occasionally, basic security) and leases it to a single client which bears all responsibility for ongoing operations

- Partnership with data-centre operators involves sharing the risk and complexity of the process with an expert partner. The increased involvement and collaboration should create synergies and extra value but will involve greater financial commitment.

- minority stake: the non-traditional player contributes to the partnership through (any combination of) land, power resource, capital injection, but may be less involved in the construction and operating process

- joint venture: this is similar to having a minority stake, but typically involves some aspects of the construction and/or operating process

- Self-build involves the highest risk-to-reward ratio, with success hinging on collaborations.

- build and operate co-location service: the non-traditional player builds and operates data centres by itself

- buy and build: the non-traditional player acquires an existing data-centre operator to buy in expertise and uses it to expand the operational footprint

Figure 1: Potential business model options for non-traditional players in the data-centre market

Source: Analysys Mason

How Analysys Mason can help

Analysys Mason is well-positioned to support non-traditional players and their investors seeking to capitalise on these new opportunities. We help to identify, assess and prioritise potential assets for development, and help to shape the business case.

- We offer support across all stages of the data-centre journey. We offer support in the assessment of options, feasibility studies, business plan development, engagement with stakeholders and negotiation support, as well as operational support during the construction phase (including our experience supporting the operationalisation of the Skygard data centre in Norway).

- We support investors and aspiring data-centre operators in reaching a comprehensive understanding of the attractiveness of existing assets to facilitate decision-making and negotiations. Our experience of working with real-estate companies, power companies and manufacturing companies with ageing assets gives us a deep understanding of the disparate factors that determine attractiveness and value. Our proprietary methodology for assessing these attributes is rooted in our extensive experience with data-centre operators. Investors will benefit from our ability to assess and compare attractive locations and land characteristics in any given country, and to prioritise effort in the most promising areas.

To learn more about how we could support the data-centre industry and its investors, please contact Miltos Andriopoulos (Principal) or Johnson Chiu (Senior Consultant).

Article (PDF)

DownloadAuthors

Miltos Andriopoulos

Principal

Johnson Chiu

ManagerRelated items

Article

Data-centre yieldcos are becoming a valuable route to funding in a capex-hungry market

Article

Analysys Mason’s data-centre hype index: why investors must scrutinise new capacity announcements

Article

Data centre investment opportunities in APAC are expanding beyond the established ‘Tier 1’ markets