Harmonised timing of mobile spectrum licensing across Europe: a delicate balancing act

The digital infrastructure sector in Europe faces challenges

In February 2024, the European Commission published a white paper entitled How to master Europe’s digital infrastructure needs?. This white paper considers trends and challenges facing the digital infrastructure sector, identifies associated policy issues, and recommends some possible solutions.

The challenges identified include:

- Limited fibre coverage and delays in the deployment of 5G standalone (SA) services (e.g. although basic 5G coverage has reached 81% of the European Union (EU) population, 5G SA coverage is estimated to be below 20% and 3.5GHz 5G coverage stands at 41%).1

- Likely investments in the region of EUR200 billion to meet Digital Decade targets for Gigabit connectivity and 5G SA,2 with recognition that relatively low average revenue per user (e.g. compared to the USA) and modest financial health of the sector (e.g. declining return on capital employed) make this level of investment hard to achieve.

- The existence of 27 national markets with different supply and demand conditions and fragmented sectoral regulation, rather than a true digital single market.

- Other challenges related to a level playing field, sustainability and security in the supply and operation of networks.

In relation to the digital single market specifically, the white paper articulates various perceived problems with the current situation:

- Fragmented 4G and 5G roll-out landscapes, where some Member States are almost one wireless technology generation behind others (e.g. 5G deployment began in some Member States in 2015, but is still ongoing in 2024).

- Operators in some Member States paying higher prices than in other Member States for equivalent spectrum due to differences in award design (as well as supply- and demand-side differences between Member States), which the white paper suggests has led to a reduction in investment capacities and delays in services deployment.

- Multi-national operators running relatively separate operations in different Member States, with limited harmonisation of offerings and lack of ability to centralise operational systems, leading to questions over whether these operators are fully benefiting from their scale.

On this basis, the white paper questions whether the fragmentation of the single market affects the ability of operators to reach the scale needed to invest in their networks.

The European Commission suggests policy changes to 'complete' the digital single market

The white paper identifies three main areas in relation to spectrum management:

- EU-level planning of sufficient spectrum for future use cases

- strengthening EU-level co-ordination of auction timing

- considering a more uniform spectrum authorisation landscape (e.g. reserve prices, coverage obligations, auction design, etc.).

Whilst the merits of regulatory harmonisation in each of these areas require careful consideration, the remainder of this article focuses on EU-level co-ordination of auction timing.

Harmonising the timing of spectrum licensing has benefits, but also clear drawbacks

Harmonising the timing of mobile spectrum licensing could lessen disparities in wireless network deployment timelines among Member States. However, achieving this may also require policy changes to eliminate or lessen other deployment obstacles. Additionally, the targeted benefits may rely on factors outside policy makers’ direct control, e.g. a suitably developed device and equipment ecosystem.3

There are, however, some clear drawbacks associated with the harmonisation of the timing of licensing, including, but not necessarily limited to, the following:

- To minimise deployment timing disparities,4 licensing may need to be delayed in some Member States, not just expedited elsewhere. This could have a negative impact for Member States delaying licensing and potentially lead to a ‘lowest common denominator’ outcome, where the overall pace is dictated by the slowest Member State.

- Licensing should happen later in some Member States if use cases are not clearly established (otherwise operators could bid for long-term licences on the basis of flawed information about the value of the spectrum, thus risking inefficient spectrum assignment).5 This could also inflate spectrum prices, a phenomenon known as the ‘winner’s curse’, seen in the high prices of the original 3G licence auctions in Europe.

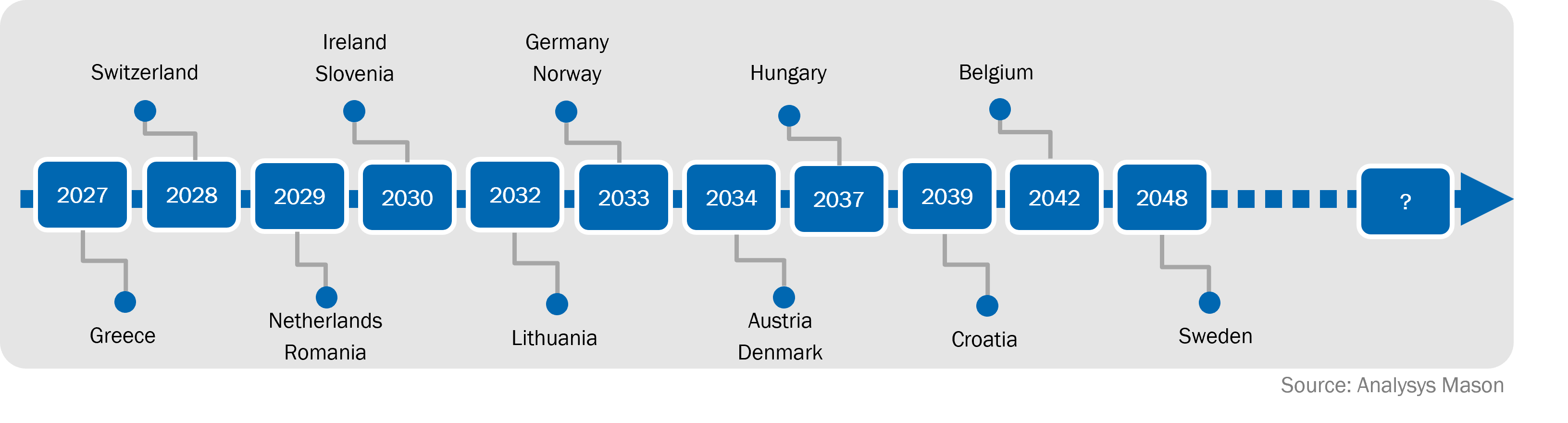

- Similarly, the timing of expiry of existing licences in a Member State may provide a reason to delay the auction of a new band, since a multi-band auction (including existing and new spectrum bands) may lead to a more efficient outcome than separate processes. Figure 1 illustrates this by showing the wide range of expiry dates of the 900MHz licences across Member States.6

Figure 1: Range of 900MHz band licence expiry dates across EU Member States

A related issue for harmonised deployment of a new technology generation such as 6G is that there may be a reliance on legacy and new spectrum bands to meet evolving customer needs. Co-ordinated re-farming of these legacy bands is likely to be challenging, with considerations such as continuing to adequately support legacy services varying by Member State.

Finally, we note that the practicality of harmonising licensing timing raises real questions. There have been numerous examples in Europe whereby appeals and litigation by one or more operators can significantly delay spectrum assignment processes. If the timing of an auction does not suit the operators in a particular Member State, such actions seem likely.

Analysys Mason has supported operators, regulators and industry bodies across Europe in tackling challenging policy issues relating to spectrum management. For example, we recently undertook a landmark study reviewing market mechanisms applied to mobile licensed spectrum in the UK. For more information, please contact Mark Colville or Janette Stewart.

1 White paper, Section 2.1.

2 White paper, Section 2.3.1.

3 Whilst licensing spectrum across Europe within a shorter timespan may help to encourage the development of an ecosystem, it is not the only factor driving this: for example, the commercial incentives of operators for widespread deployment will depend on customer needs and well-defined use cases for the spectrum.

4 Assuming this, rather than just achieving the earliest possible deployment in each Member State, is the aim.

5 Whilst market mechanisms, e.g. secondary trading of licences, may help to mitigate negative outcomes, there are significant question marks over the effectiveness of such mechanisms (across all market contexts).

6 The figure provides a non-exhaustive illustration of the range of expiry dates across a sample of countries in the single market in which 900MHz licences have been auctioned and data on licence expiry is readily available.

Article (PDF)

DownloadAuthors

Mark Colville

Principal

Janette Stewart

Partner, expert in spectrum policy, pricing and valuationRelated items

Article

Improved management of shared spectrum: a potential AI/ML use case

Article

Mid-band scarcity creates new dilemmas for regulators

Article

Valuation methods for spectrum in the 26GHz band represent an evolution of current best practice