The Fintech revolution in India: bridging the digital divide

Indian fintech sector has gained significant strength as a consequence of healthy economic growth, increasing digitization, support from the Indian government and development of technologies such as the India Stack. Within Fintech, LendingTech and WealthTech have emerged as amongst the fastest-growing verticals in India. LendingTech is expected to grow at a CAGR of 35–40% over the next five years to reach a USD50–60 billion market in FY28; WealthTech in turn is expected to grow at a CAGR of 30–35% over same period to reach a USD15–20 billion market for digital-first players in FY28.

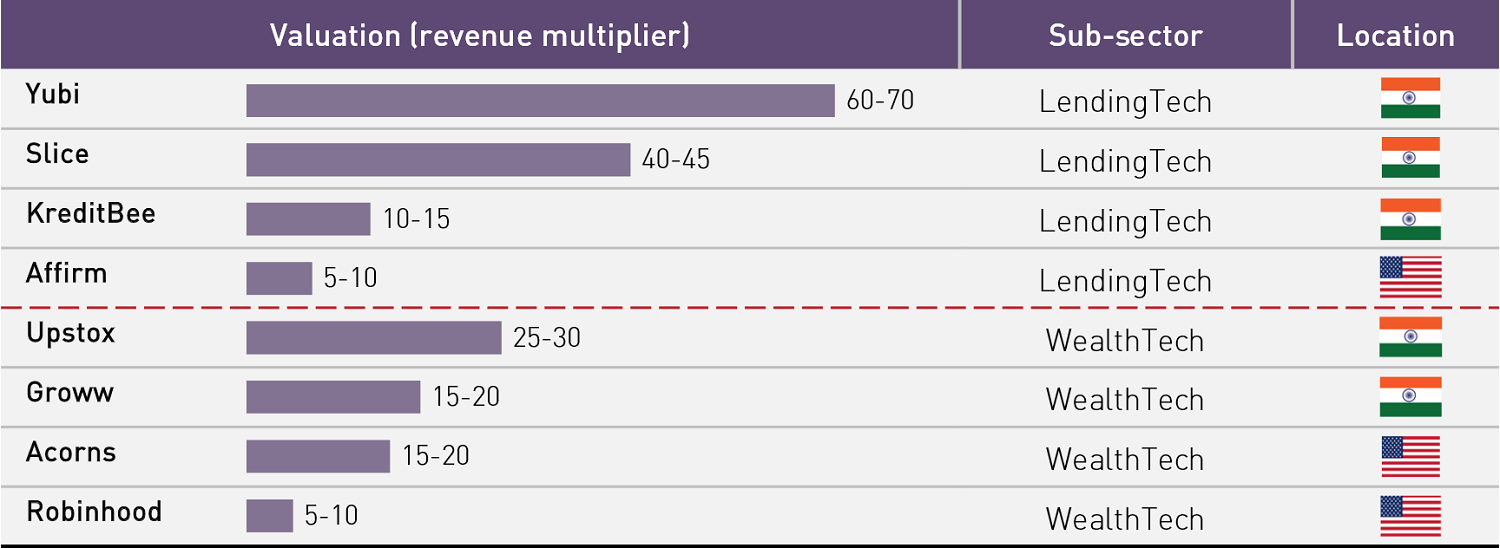

Due to the phenomenal growth of the Fintech industry in India, it has created the greatest number of unicorns (17) compared to any other industry in the country. Indian Fintech players are being valued at a slight premium compared to their global peers on account of the significant headroom for further growth.

The Indian Fintech ecosystem has observed rapid growth as digital-first players have created accessibility for the previously unserved population

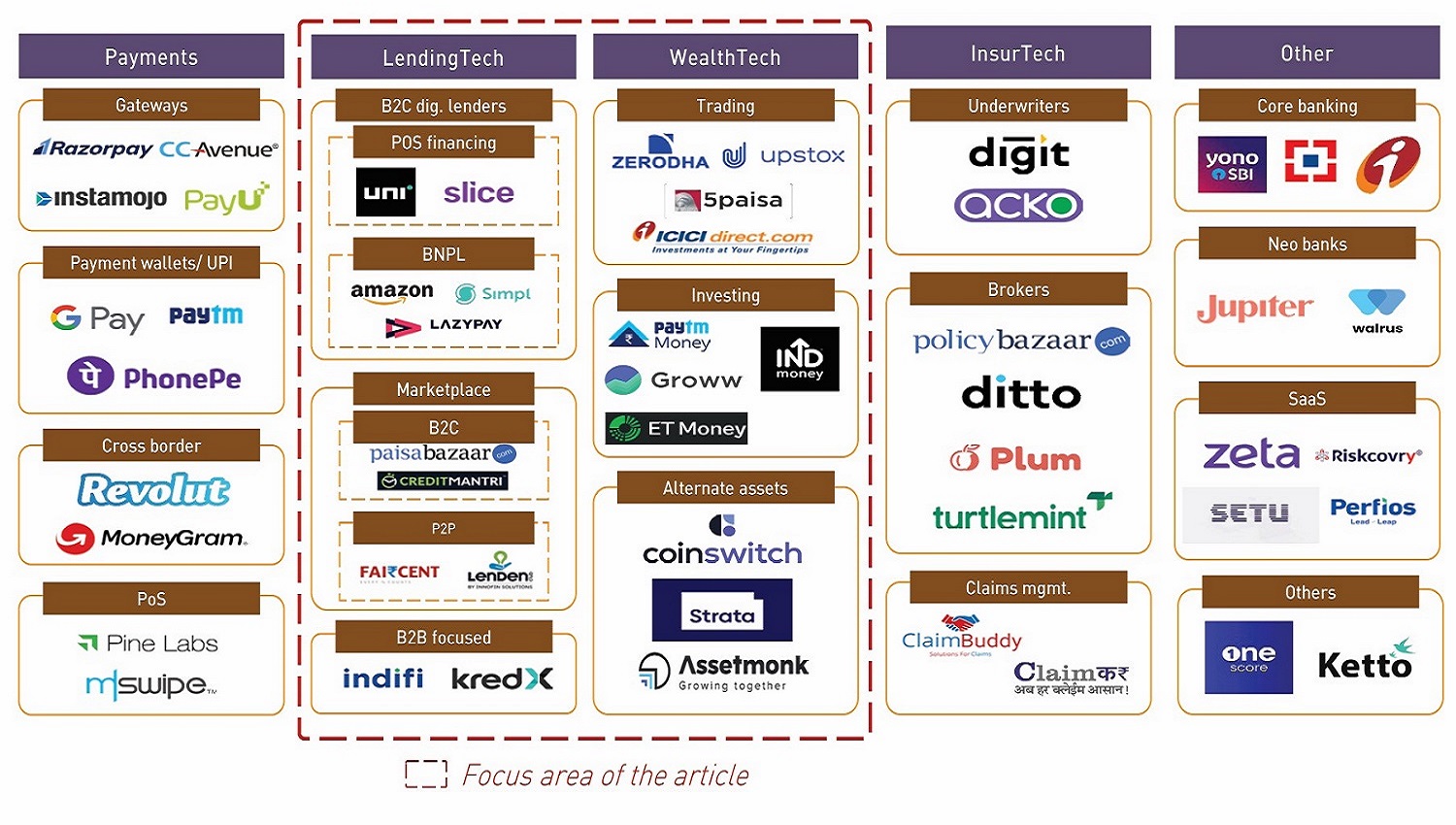

Over the past few years, the Fintech ecosystem in India has seen rapid growth. Numerous new players have emerged and existing players have scaled up to provide services across verticals such as digital payments, lending, investment, insurance and banking, among other software-as-a-service (SaaS) offerings.

LendingTech has emerged as the most important proposition for businesses to succeed in this space, and is touted as the endgame for most businesses

Digitalisation of consumers and business, and tech advancements (including development of the India Stack) have been the key drivers of the proliferation of digital-first lending platforms. Underlying ‘open’ tech infrastructure has caused a paradigm shift in the lending ecosystem, allowing lenders to make quicker lending decisions (credit worthiness, disbursal, etc.).

Investment in financial assets is still highly underpenetrated in India compared to other developed economies, highlighting a huge headroom for growth

Increasing disposable income and growing awareness of financial assets have been the key drivers of the WealthTech vertical in India. Investment in financial assets (such as stocks, mutual funds) is still highly underpenetrated in India compared to other developed economies, highlighting a significant opportunity for growth.

WealthTech business models typically rely on high transaction volumes and low commissions, since it is challenging to create differentiation in terms of the asset being sold (stocks, mutual funds, crypto assets, etc.).

Indian Fintech players are valued at a slight premium due to significant headroom for further growth and impressive adoption of digital payments (UPI)

Typically, WealthTech and LendingTech players globally are valued at 5–15× revenue multiples. However, Indian players are valued at a slight premium compared to their global peers on account of the significant headroom for further growth across both the LendingTech and WealthTech verticals.

The emergence of UPI over the past couple of years has drastically shifted the consumer mindset towards digital-first Fintech services, and, if we take UPI as a reference, these valuations may be justified in many cases.

To download the full newsletter, click here.

Authors

Rohan Dhamija

Managing Partner | Director Head - Middle East and India (South Asia)

Ashwinder Sethi

Partner