Decisive action is needed to ensure the long-term provision of universal postal services

Scrutiny of the financial sustainability of universal postal communications services is intensifying across Europe and beyond, and significant reductions in service are being proposed and/or implemented in various countries. However, the sets of changes proposed or implemented to postal USOs are not co-ordinated nor consistent across different markets. This is usually due to national differences between sector fundamentals and to the priorities which are associated with state-owned and/or state-branded national postal operators. Declining financial sustainability means that difficult country-specific decisions are needed now.

We believe that decisive action, based on stable policy and clear regulation, will bring lasting benefits. A key benefit of a well-thought-out solution is the flexibility to enable further adaptation in the future. Action should not focus solely on the short term, but should be purposeful, cognisant of future uncertainties and flexible enough to enable reaction to alternative scenario outcomes.

In this article, we summarise recent monitoring of the monitoring of the provision of universal postal services, and highlight the expert views of Analysys Mason and PLCWW, which have worked together advising on policy, regulatory, USO and operational aspects in a number of different postal markets worldwide.

Appetite for change is present in the sector

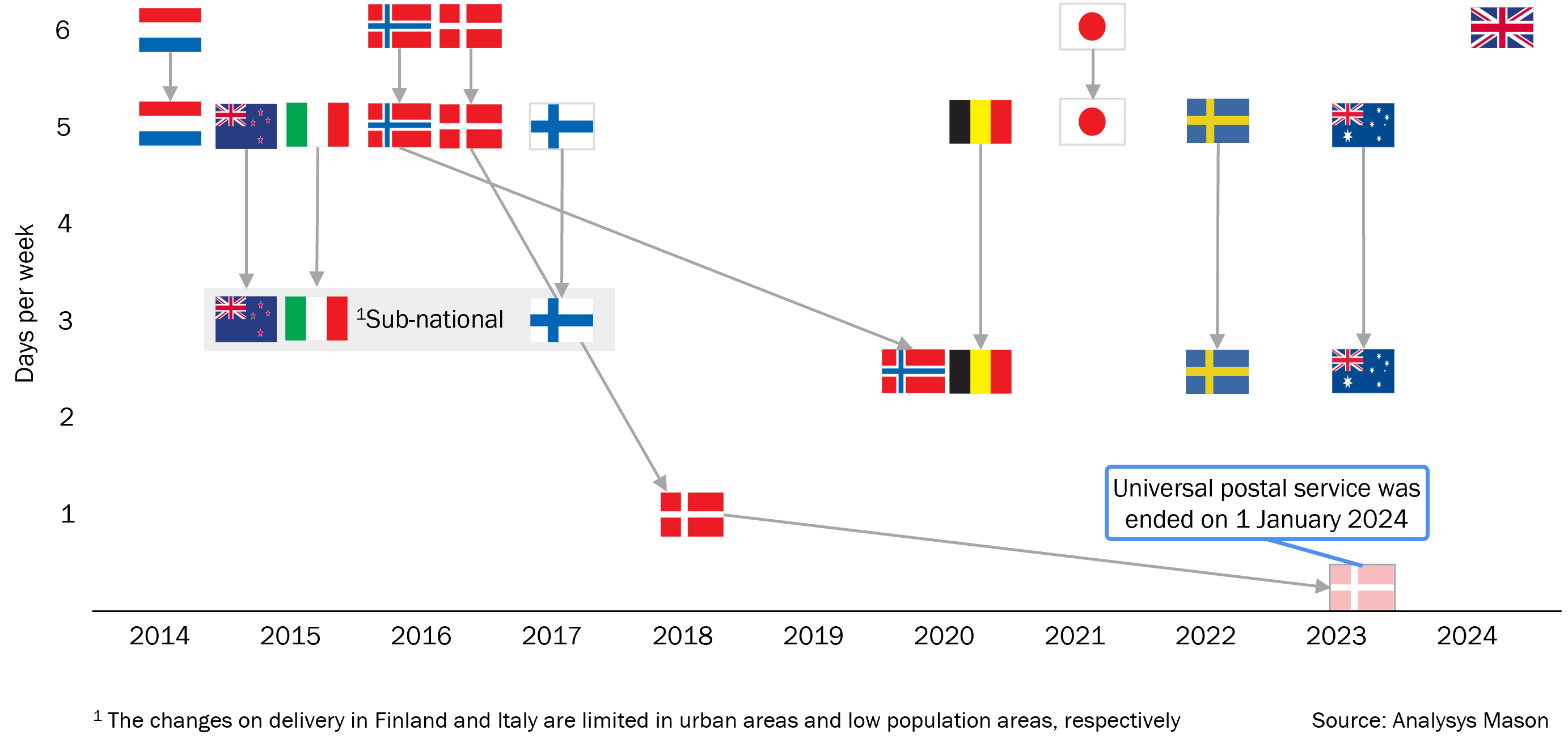

A small number of countries have amended their postal USOs in the last ten years. An example of these would be the Nordic nations – with Denmark having moved first and furthest so far – and New Zealand (notably, in urban but not rural areas). Now, some of the larger markets are seeing an appetite for change coming from their regulatory authorities, and, just as importantly, from the postal operators themselves:

- UK. In January 2024, the UK regulator, Ofcom, launched a call for input on the future of the universal postal service, exploring a broad range of options.1 Royal Mail’s response proposes a series of significant changes:

- alternate day delivery for all non-first-class (non-priority) letters

- changes to wholesale bulk mail product specifications (which constitute a major proportion of all letter mail in the UK)

- revised quality-of-service targets and new reliability measures.

- The Netherlands. Post NL recently stated its wish to see a law change to allow it to deliver most mail within a two-day window and move to three days over time, while retaining the next-day service but at a higher price point.

- Germany. The German government has been deliberating on proposals to reduce the letter delivery obligation to within three days. In early 2024, Deutsche Post ceased overnight airmail for domestic letters, moving volumes to lower CO2-emitting road transport solutions.

- Australia. Following a move to alternate day delivery for ordinary letters, Australia Post has stated that it will work with the government on further reforms which are needed in order for it to remain financially sustainable beyond 2026.

Large divergence in the fundamentals of the postal sector in developed markets means there is not a common national solution within an overarching framework

Across developed markets worldwide, significant disparities exist within the postal and parcel sectors. There are some harmonised guidelines, notably from the Universal Postal Union (UPU), which governs minimum standards within the postal sector as part of its United Nations remit. The European Commission also legislates for EU member states through its Postal Services Directive, which focuses mainly on matters related to market liberalisation, as well as the requirements and limits of universal services. These guidelines shape the sector, however, many differences persist and the sector remains far from homogeneous. For example:

- annual volumes of letters received per head of population vary significantly

- the market share of the national postal operator in (upstream) bulk mail also varies, and the degree to which government, businesses and consumers have switched to paperless and online interactions is inconsistent across national markets

- the role and business model of the national post office network is changing, and how it is integrated with other retail services including banking, financial services, insurance, utilities, local government etc.

- the market share of the national postal operator in the parcel and courier market also fluctuates, with the emergence of major multinational parcel e-tailers, and online marketplaces such as Amazon, Alibaba and Vinted; some of these market entrants are expanding their services to cover the entire process of order fulfilment, from initial order placement to final delivery, specifically targeting domestic consumers (e.g., Amazon)

- the availability and use of alternative delivery methods which avoid the national postal operators’ traditional nationwide last-mile delivery network is also a factor; final-mile solutions such as parcel lockers and pick-up drop-off (PUDO) networks have proliferated in some but not all markets

- ownership of the national postal operator is also changing, with fully privatised and partly privatised examples already in place.

These differences have important impacts on the finances of the national postal operator. When combined with geography (in many countries, this includes the requirement to serve large rural areas), it is evident that the national solution for the provision of universal postal services has led to different outcomes. The figure below illustrates one important dimension of this, namely the number of delivery days per week for non-priority services; this is typically the most important dimension from the perspective of financial impact, postal workforce numbers and alignment with consumer needs.

Figure 1: Delivery days per week for non-priority services

Operational considerations for implementing change

Postal networks have grown organically over decades, serving what was predominately a letters market. Typically, this reflected a USO requirement to deliver to every address five or six days a week. The vast networks that have emerged since the 1800s are characterised by a high degree of fixed costs, and recent attempts to move to a more variable cost base have been limited in scope and, ultimately, in impact. The number of days per week serving every (residential and business) address is a strong driver of the amount of fixed costs which cannot easily reduce as the number of items per delivery point steadily declines.

Collections from street furniture (such as mail boxes) are also regulated via the USO, and dwindling numbers of items being posted in rural post boxes exacerbates the gap between income derived and expenditure incurred in order to meet the requirement to perform a collection at least once per location per day.

What is the endgame?

The long-term demand for basic letter mail is uncertain: how far will it fall and how fast? Denmark is frequently referenced in this context, as the country which has reduced its USO specification much earlier and further than all other nations. The Danish government took the final step in early 2024 of abolishing the USO altogether and retaining only services for remote islands, the visually impaired and international mail via a tendering award. However, the endgame in Denmark does not easily transfer across to other nations: e-government and digitised/electronic services are highly advanced in Denmark, but in other European countries such as France and Spain, social, administrative and legal practices may not be so technically enabled or widely accepted in digital form.

There are important areas to address now in order to reconsider and redefine postal USOs from a regulatory perspective, while at the same time being prepared to assess a growing number of proposals from struggling national operators to instigate change (e.g., reduction in USO scope).

These deliberations are taking place during a time of growing financial pressures. While some of these pressures can be mitigated by short-term provisional solutions, such approaches are highly unlikely to be durable or flexible enough to embrace ongoing technological change.

We think that the decisive action needed today must be based on a detailed market assessment of the next five years and an informed trend analysis to predict the conditions that may characterise the five years after that. The challenge for regulators, policy makers and operators is twofold: how to apply static adjustments to rapidly address current financial pressures while, at the same time, fostering a stable policy and regulatory regime which can permit long-term flexibility and adaptation.

This challenge requires timely and decisive action. Analysys Mason and PLCWW bring together policy, regulatory, strategic and operational expertise which can assist stakeholders in charting the course to follow.

For further information, please contact Ian Streule (Partner). Analysys Mason thanks Gavin Macrae (independent adviser) for his contribution to this article.

1 Considerations of the advantages, disadvantages and impacts of different options on the market, finances, services as well as the employees of Royal Mail have been made more complex by the recent take-over bid for Royal Mail’s parent company IDS by EP Group.

Article (PDF)

DownloadAuthor

Ian Streule

Partner

Gavin Macrae

Chairman, Postal and Logistics Consulting WorldwideRelated items

Case studies report

Optimising the operator TV opportunity: case studies and analysis (volume II)

Article

GOVSATCOM 2025 reveals that security and resiliency are driving increasing demand for in-orbit services

Article

KubeCon 2025: open-source tools that support the operationalisation of AI are evolving rapidly