Lessons can be learned from the unsuccessful partnership between Qualcomm and Iridium for satellite D2D services

Qualcomm terminated its direct-to-device (D2D) deal with Iridium on 9 November 2023. This is a disappointing development for the D2D market because the deal was meant to be a pioneering D2D service enabling satellite messaging and emergency services in smartphones powered by Snapdragon Mobile Platforms. However, D2D is still in the very early stages, and it is natural that some developments will not succeed.

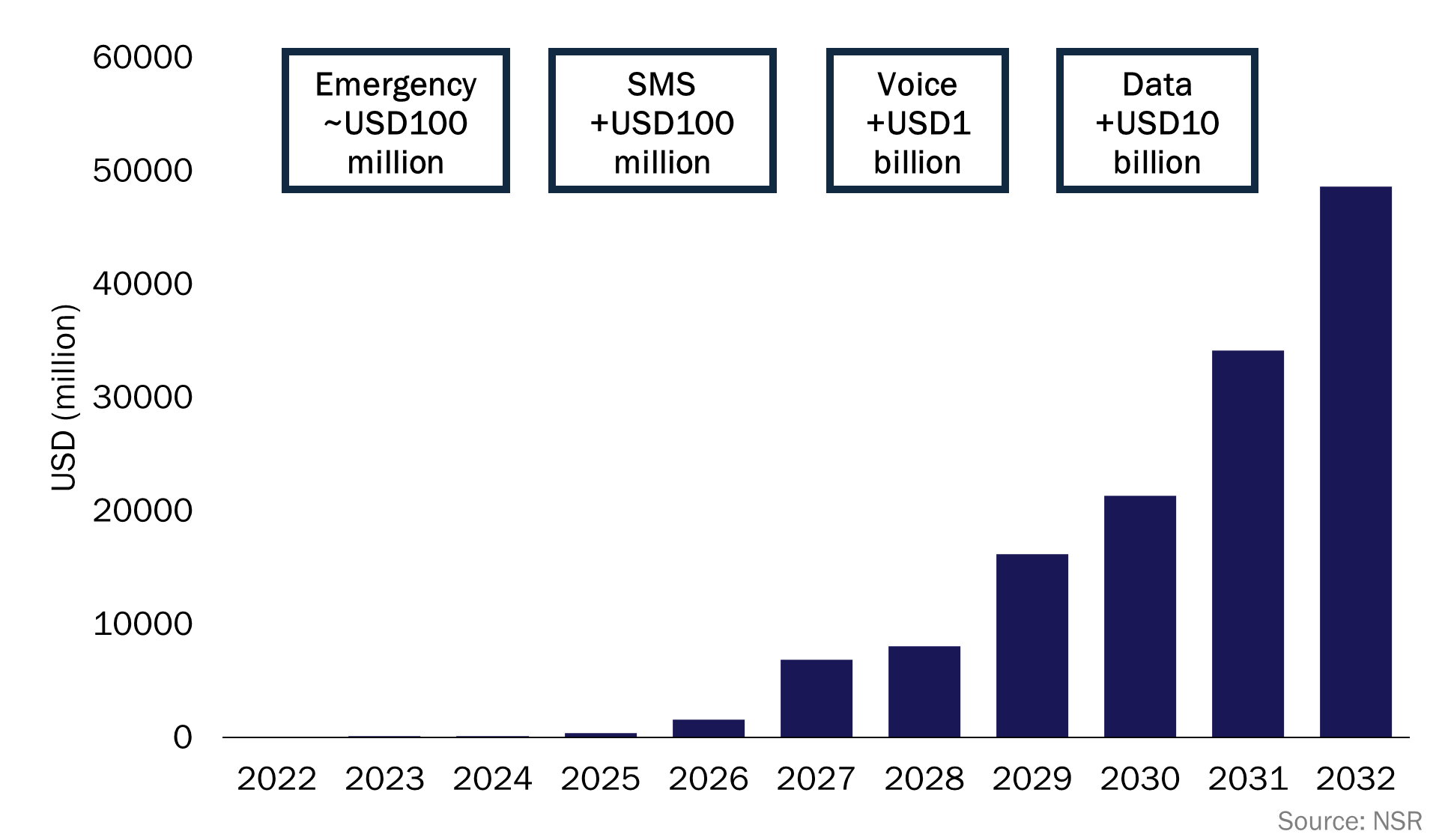

Several lessons can be learned from this outcome and can be applied to future offers to unlock the USD137 billion cumulative service revenue opportunity in satellite D2D between 2022 and 2032, which we explore in more detail in our report Satellite direct-to-device market, 4th edition.

Figure 1: Satellite D2D service revenue, worldwide, 2022–2032

Qualcomm was unable to create an enticing offer for OEMs, and its solution ignored the importance of MNOs’ role in this market

The biggest challenge for the success of this development was aligning the interests of all the actors in the satellite D2D value chain. Qualcomm took the lead in the development of the platform, gaining access to Iridium’s services and hoping that original equipment manufacturers (OEMs) would adopt the satellite-enabled chipset. However, the current satellite features, emergency alerts and messaging, as well as Qualcomm’s plan to maintain tight control over the revenue stream did not convince a significant number of OEMs to sustain the business, particularly SAMSUNG.

Furthermore, the model proposed by Qualcomm did not consider a role for mobile network operators (MNOs). A similar business model has been adopted for the satellite D2D solutions developed by partnerships such as Apple/Globalstar and Bullitt/MediaTek/Skylo without MNO involvement. Although this model may be acceptable for these early stages of the market, MNOs’ relationships with end users mean that MNOs must play a major role in order for the model to scale.

Interestingly, one group of actors, AST SpaceMobile, Lynk and Starlink, does not have access to satellite spectrum but plans to partner with MNOs to use terrestrial spectrum from space. This group will need to solve key challenges such as interference, technology and getting approval to use terrestrial spectrum from space. However, it is possible to have a faster ramp-up of services by partnering with MNOs and by taking advantage of the potential to be backward-compatible with existing phones.

Satellite D2D capabilities are still basic and need to evolve for this market to scale to a +USD10 billion revenue opportunity

Satellite D2D capabilities are still very basic at this early stage of the technology. Existing satellite networks such as Iridium, Globalstar or Inmarsat only have sufficient capacity supply to offer emergency alerts and messaging. According to NSR’s research, this could translate into a limited revenue opportunity in the range of +USD100 million per year (see our Satellite direct-to-device market, 4th edition report for more detail).

However, the market has the potential to ramp up at an extraordinary pace. As soon as satellite D2D capabilities can be used for voice and data services at scale, the market will accelerate, generating +USD10 billion per year. For this to materialise, abundant satellite capacity supply needs to be launched. Actors such as AST, Lynk, Starlink, Echostar Lyra or OmniSpace have already announced aggressive launch plans to develop the necessary supply. In parallel, 3GPP continues to work on the standardisation of 5G non-terrestrial networks (NTNs) with the expectation for 3GPP Release18 to enhance the initial narrowband over satellite services included in Release17.

The development of satellite D2D is unstoppable and early challenges are just a natural part of the evolutionary process

Despite the failure of the Qualcomm/Iridium venture, the industry can still extract some positives. The partnership between Qualcomm and Iridium was another validation that integrating satellite connectivity into mainstream phones is technically possible. Certainly, actors still need to figure out the most-appropriate business models, and technology needs to evolve, but satellite D2D has a bright future.

The telecoms ecosystem plans to offer extended coverage and to progressively incorporate enhanced satellite capabilities. The developments in 3GPP, the expansion of satellite connectivity features on the iPhone 15, or the long list of MNOs signing up for satellite coverage with various constellations together demonstrate the latent demand for a satellite D2D solution.

Article (PDF)

DownloadAuthor

Lluc Palerm

Research Director, space and satellite, expert in satellite strategies for telcosRelated items

Forecast report

Satellite consumer direct-to-device: trends and forecasts 2023–2033

Forecast report

Consumer and enterprise broadband via satellite: trends and forecasts 2023–2033

Article

Predictions for the space industry in 2025