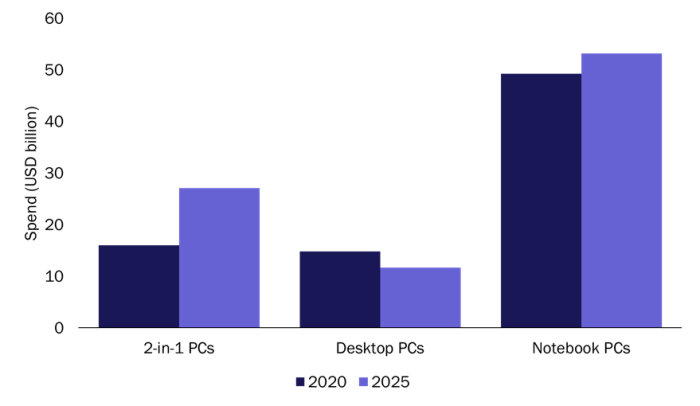

The 2-in-1 PC segment provides the largest opportunity for revenue growth in the SMB PC market

Analysys Mason’s SMB Technology Forecaster predicts that spending by small and medium-sized businesses (SMBs) on 2-in-1 PCs worldwide will grow by USD11.1 billion between 2020 and 2025 to reach USD27 billion, at a CAGR of 11.1% (see Figure 1).1,2 SMBs’ spending on notebook PCs will grow at a CAGR of 1.6% during the same period, while that on desktop PCs will decline (at a CAGR of –4.6%).3,4 As such, it is clear that the 2-in-1 PC segment has the greatest potential for revenue growth in the SMB PC market.

Figure 1: SMB spend on PCs, by form factor, worldwide, 2020 and 2025

Source: Analysys Mason, 2021

The increase in spending on 2-in-1 PCs can be attributed to:

- the rising demand for mobility and advanced notebook PCs among SMBs due to the COVID-19 pandemic (SMBs are replacing desktops with notebooks and tablets to accommodate remote working)

- the ability of the latest 2-in-1 PC to match the performance of most notebooks (there is no longer a trade-off between function and performance).

SMBs’ use of 2-in-1 PCs is growing due to the COVID-19 pandemic

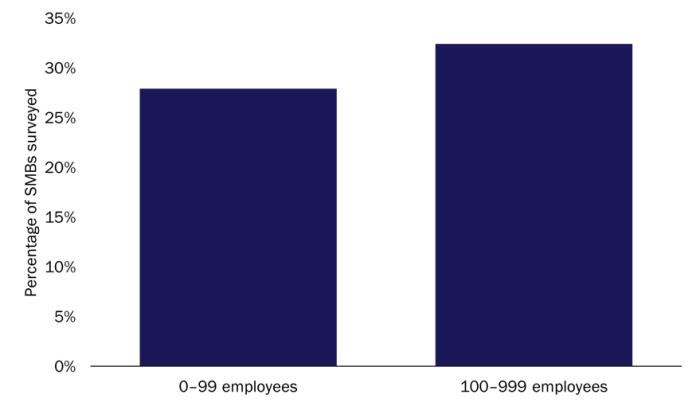

SMBs are investing in IT hardware and solutions that will enable them to operate while employees continue to work remotely. Many businesses are planning to increase the proportion of their employees that work remotely, even after COVID-19 restrictions are eased. Indeed, nearly a third of respondents to Analysys Mason’s survey of 1870 SMBs in Australia, Canada, the UK and the USA reported that they are prioritising replacing desktops with notebooks and tablets in the next 12 months because of the pandemic (see Figure 2).

Figure 2: Percentage of SMBs prioritising replacing desktops with notebooks and tablets in the next 12 months, all countries surveyed, by company size

Source: Analysys Mason, 2021

The rising demand for mobility has made 2-in-1 PCs an attractive option for SMBs because they combine the computing power of notebooks and the portability of tablets. Many 2-in-1 PCs offer fast multi-core CPUs that are comparable to those in top-end notebooks, as well as touchscreens, detachable keyboards or 360-degree hinge mechanisms and other tablet-style conveniences (such as being lightweight).

Vendors such as Dell, HP, Lenovo and Microsoft are hoping to capitalise on the opportunities the 2-in-1 PC market. Various 2-in-1 PCs are tailored towards business professionals, such as Dell Latitude, HP ProBook and EliteBook, Lenovo ThinkPad and Microsoft Surface for Business. Apple does not offer a 2-in-1 PC, but its iPad Pro is a close competitor; its added trackpad brings it closer to providing a laptop experience than previous generations. These business-grade 2-in-1 machines offer premium-quality components and are suitable for heavy (40+ hours per week) use. They also have the storage, memory, security features and IT manageability that many businesses need.

Vendors should offer flexible payment plans and use segmented marketing strategies to target potential 2-in-1 PC users

28% of the SMBs in our survey plan to spend more on PC hardware (such as notebooks and tablets) in 2021 than in 2020, and a further 58% indicated that they plan to maintain their current spending level. This demonstrates that there is a clear opportunity for all PC vendors and partners.

Vendors need to identify market segments that have a high propensity to invest in PC hardware (such as notebooks and tablets). 41%, 30% and 30% of the SMBs surveyed in the IT and telecoms, FIRE and manufacturing verticals, respectively, anticipate spending more on PC hardware in 2021 than in 2020.5 A large proportion of the SMBs in these segments have taken proactive steps to respond to the pandemic. For example, many have changed the way in which they deliver products and services, some have increased the amount of working from home and others have implemented remote working for the first time. As such, SMBs in these segments are likely to spend on PC hardware to implement new business models and support remote working.

Vendors should also consider which customer segments are the most likely to use 2-in-1 PCs. Our research shows that senior executives, sales staff, creative staff, service support and technical staff are the top users of 2-in-1 PCs.6 Employees in these business roles tend to require a high level of mobility, which makes 2-in-1 PCs an attractive option. Vendors need to influence both end users and SMB purchase decision makers using targeted messaging.

Finally, our survey findings show that SMBs ranked flexible payment terms as one of the top three most helpful services that their technology vendors can offer in the next 12 months. Some vendors are already offering such deals, for example, Dell’s Flexible Payment Solutions for small, medium-sized and enterprise organisations and LenovoPro For Small Business, which offers discounts and business financing for small businesses. These financial perks may incentivise SMBs to upgrade to 2-in-1 devices.

1 Small businesses are those with fewer than 100 employees; medium-sized businesses have 100–999 employees.

2 2-in-1 PCs are also known as convertibles or detachables. We define 2-in-1 PCs as hybrid devices that combine the features of a tablet with those of a laptop. 2-in-1 PCs come with a keyboard or a keyboard cover that is detachable from the monitor or convertible, with touchscreen capabilities. Examples include Microsoft Surface Book, Microsoft Surface Pro, Asus Transformer Book and Lenovo Yoga. This category does not include tablet-only devices such as Apple iPads.

3 Notebook PCs are defined as mobile computers that provide similar functions and performance to desktop computers. Examples include Apple MacBook, Dell Inspiron Laptop, and Toshiba Satellite. Ultrabooks such as HP EliteBook are also included.

4 Spending on desktop PCs includes that on PC hardware systems intended for use at a single location, including all-in-one (AIO) PCs. All components except the keyboard and mouse are housed inside the same case as the monitor in AIO PCs. Our spending figures include spending on monitors, bundled operating systems and bundled productivity suites. Examples include Dell Inspiron, HP Pavilion and Apple iMac.

5 FIRE stands for finance, insurance and real estate.

6 According to Analysys Mason’s quantitative survey on PCs and mobility in Australia, Brazil, Canada, China, France, Germany, India, Japan, New Zealand, Sweden, the UK and the USA in 4Q 2018; n = 2921.

Article (PDF)

DownloadAuthor