5G alone is unlikely to be sufficient to drive mobile ARPU growth

24 October 2022 | Research

Article | PDF (4 pages) | Global Telecoms Data and Financial KPIs

A key question for the telecoms industry is whether the launch of 5G mobile services will enable mobile network operators (MNOs) to increase their revenue (or at least mitigate revenue loss).

Data from South Korea shows that there is a positive correlation between the launch of 5G services and mobile ARPU growth (in nominal terms and in local currency), at least in the short term. Around 40 MNOs in Asia–Pacific launched 5G services between 2019 and 2021. Some have reported that customers spend at least 10–30% more when they upgrade from 4G to 5G.1 However, it is not clear if this uplift will extend to the mass market.

This article draws on Analysys Mason’s Global telecoms market: trends and forecasts 2021–2026. The report examines telecoms trends on a global and regional level, provides key insights into the future of these regions and includes forecasts for around 200 metrics.

12% of all mobile connections worldwide used 5G technology in 2021

The first MNOs introduced 5G mobile services in 2019. The COVID-19 pandemic then limited the take-up of 5G services in 2020 and 2021 because several auctions were cancelled or postponed and the 5G handset supply chain was disrupted. Indeed, we forecast that the 5G share of mobile connections worldwide would have been above 12% by 2021 if there had not been a pandemic.

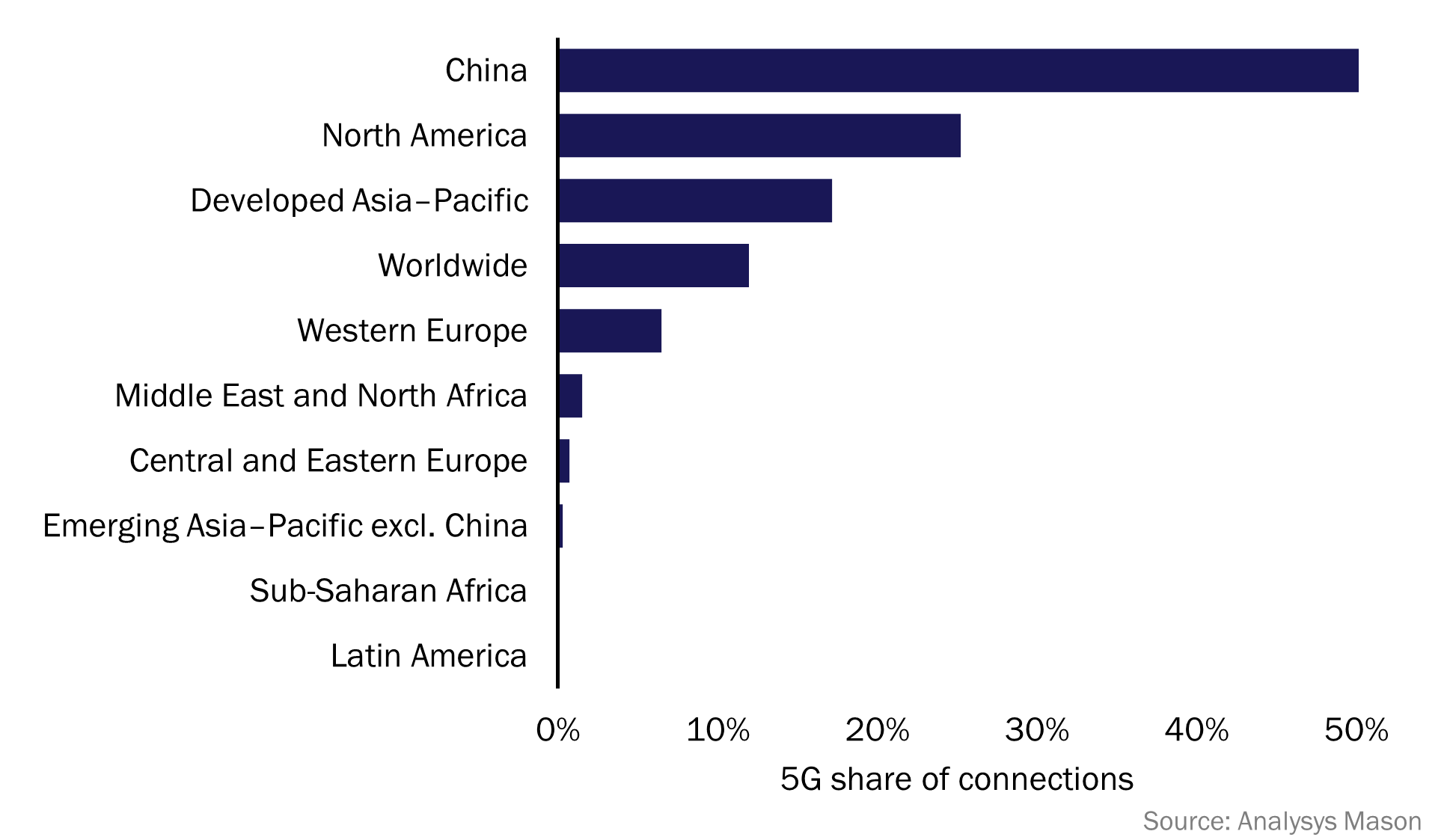

The take-up of 5G varied significantly by region in 2021. North America and developed Asia–Pacific were the leading regions in terms of 5G adoption and the 5G share of connections was the highest in China (Figure 1).

Figure 1: 5G share of mobile connections by region, worldwide, 2021

Data from South Korea provides early evidence of an ARPU uplift when customers upgrade to 5G

MNOs in South Korea were the first in the world to launch 5G mobile services, and South Korea had the second-highest 5G share of connections in 2Q 2022. As such, it can be taken as a bellwether to understand the potential impact of 5G on MNOs’ ARPU.

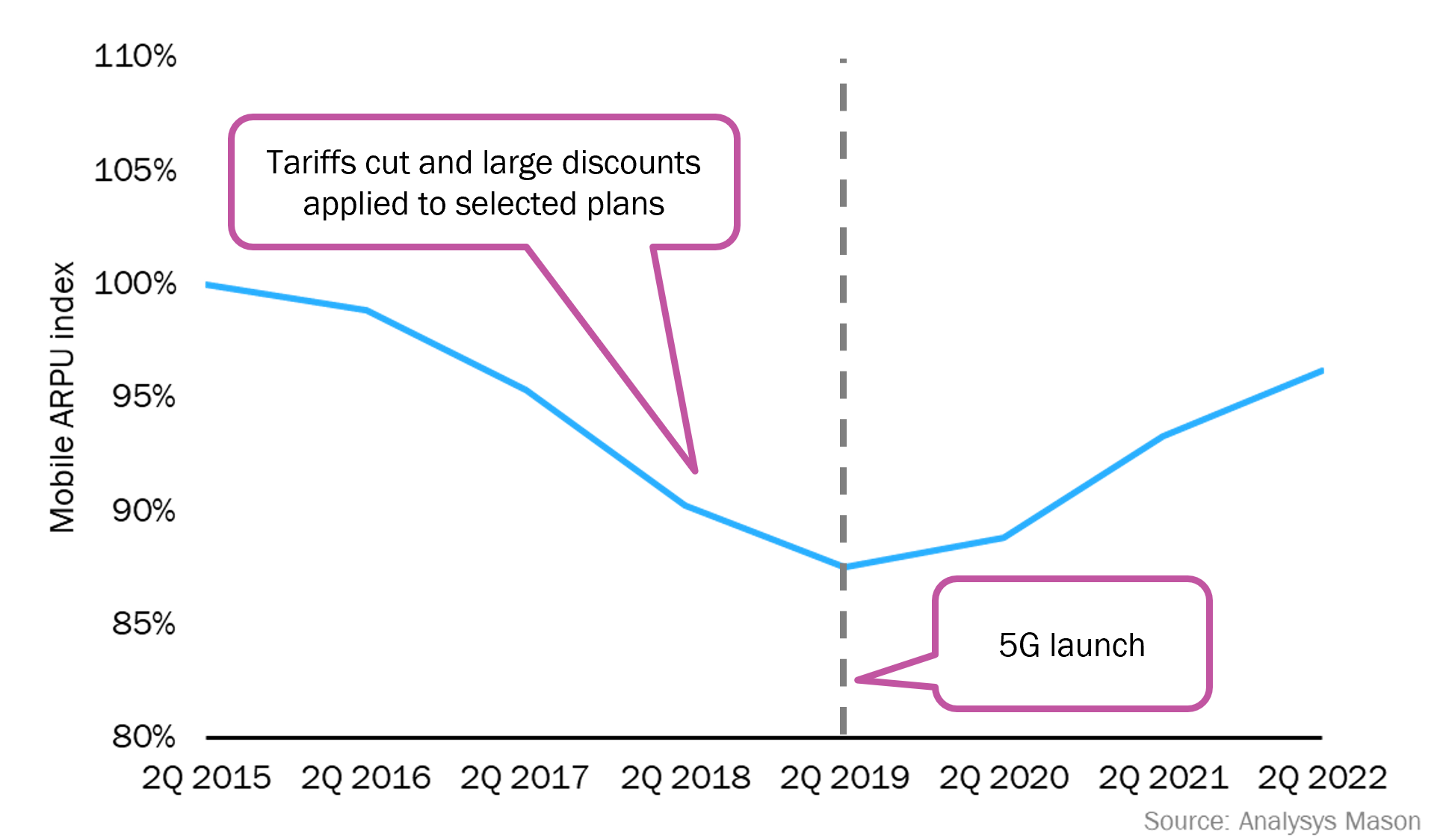

Mobile ARPU returned to growth in South Korea following the launch of 5G in 2Q 2019 after years of continuous decline (Figure 2). Indeed, mobile ARPU (in nominal terms and in local currency) increased by 9.9% between 2Q 2019 and 2Q 2022, compared to a decline of 11.4% during the previous 3 years.2

Figure 2: Mobile ARPU index using 2Q 2015 as the base quarter, South Korea, 2Q 2015–2Q 2022

This mobile ARPU growth was driven by an improving market environment (MNOs in South Korea stopped competing heavily on price) and the migration of a large share of customers to 5G plans. All three MNOs in the country (KT, LG Uplus and SK Telecom) followed a similar 5G pricing strategy. They offered several 5G tariffs, but each had either a relatively low monthly data allowance (up to 15GB) or a very large data allowance (more than 100GB or unlimited data).

The MNOs managed to quickly migrate a large share of 4G customers to low-tier 5G plans (the monthly cost of which was similar to that of comparable 4G plans). They included exclusive, additional benefits in top-tier 5G plans to encourage customers to upgrade. These benefits included faster download speeds, discounts on equipment and free subscriptions to video services.

SK Telecom introduced mid-tier 5G tariffs in August 2022. We expect that the other two MNOs will follow suit by the end of 2022. The impact of the new mid-tier plans will be mixed. They are likely to encourage some 4G customers to upgrade to 5G, but inevitably, some existing 5G customers will downgrade to the new, lower-cost 5G plans.

The three South Korean MNOs are developing new value-added services for 5G plans in order to maintain ARPU growth. KT’s CEO stated, in 2Q 2022, that the company was “developing and preparing various different value-added services that satisfies our customer needs” and that “through such provision of value-added services, we wish to bring additional revenue.” These strategies align with what we are seeing from other operators worldwide.

MNOs must differentiate their 5G tariffs on more than just speeds to achieve ARPU uplift

MNOs worldwide are exploring the use of gaming, VR and/or AI applications and video content to monetise 5G. For example, SK Telecom launched a 5G-based metaverse platform called ifland in 3Q 2021 that reached 1.63 million active users by 2Q 2022. Deutsche Telekom started to negotiate a partnership with SK Telecom in 1H 2022 to launch the metaverse platform in Europe. e& has similar plans.

The current challenging economic conditions are likely to slow down the migration of consumer customers to 5G and may limit their willingness to pay extra for such services. However, the business segment could provide more opportunities. MNOs can target businesses that require reliable and low-latency connectivity services. The early success of 5G private networks is helping to prove the demand for these services, but products that depend on the extra capabilities of public 5G networks are emerging only slowly and are unlikely to provide extra revenue in the near term.

MNOs are looking for new sources of revenue due to limited growth prospects from traditional connectivity services.3 It will be critical for them to develop a broad strategy to incrementally grow the ARPU from their existing consumer customers. 5G can be an important lever for this strategy, but 5G alone is unlikely to be sufficient.

1 This is based on data from selected MNOs in Hong Kong, Singapore, South Korea, Taiwan and Thailand in 2021.

2 This data is available in Analysys Mason’s online database DataHub.

3 For more information and data, see Analysys Mason’s Global telecoms market: trends and forecasts.

Article (PDF)

DownloadAuthor