Mastering cloud-native network transformation is a must for 5G service delivery

11 July 2023 | Research and Insights

Article | PDF (3 pages) | Cloud and AI Infrastructure

Listen to or download the podcast

The capex and opex savings benefits of cloud-native networks were once promoted as the key reason for their adoption. However, market-leading operators now believe that the cloud-native transformation of their networks is necessary if they are to generate service revenue in future. These operators realise that they risk missing out on the new service opportunities that the transformation of the software layers of the network into a cloud-native platform will deliver unless they push ahead with cloud-native network adoption.

The ability to support service innovation is the key reason for operators to migrate to cloud-native networks

As one European Tier-1 operator told us, “We don’t know what (digital) services will emerge in the future. So we must have an infrastructure that is flexible and agile enough to support anything.” Services will be built using software that is run on the cloud – an IT infrastructure that is becoming distributed to ‘edge’ locations. Developers are forming different expectations about connectivity now that services are increasingly developed and deployed across multiple cloud sites. Indeed, developers are increasingly intolerant of ‘black box’ networking that is opaque and static, which prevents them from automating network changes in the same way that they remotely manage cloud infrastructure and applications. They must ask network operations teams to make changes, which creates delays in achieving business goals.

Cloud-native networks enable network capabilities to be programmed through the same API code that digital services use to communicate with each other. The network becomes a peer of the cloud and converges with it. The resulting, seamless network/IT infrastructure-as-code can be manipulated by developers together, rather than as two different and unequal environments.

Operators will be able to charge developers for their use of cloud-native network features. A survey of 67 developers, conducted by Analysys Mason in 1Q 2023, found that 73% of developers want access to advanced network APIs to allow them to control quality of service, deploy applications to edge locations according to network performance and to customise connectivity and security features. Cloud-native technologies support the automated lifecycle management, at scale, of the sets of network functions that fulfil different service needs. The availability of virtual networks with differentiated characteristics will enable developers to innovate new services, and this will enrich those operators that are best-placed to support them.

Operators must take three actions to ensure that they have a cloud-native network fit for future services

Operators and vendors typically focus on cloud-native network functions as the key to cloud-native networks. However, there are three key steps that operators must take if they are to run cloud-native network functions in a way that delivers business flexibility and agility in future.

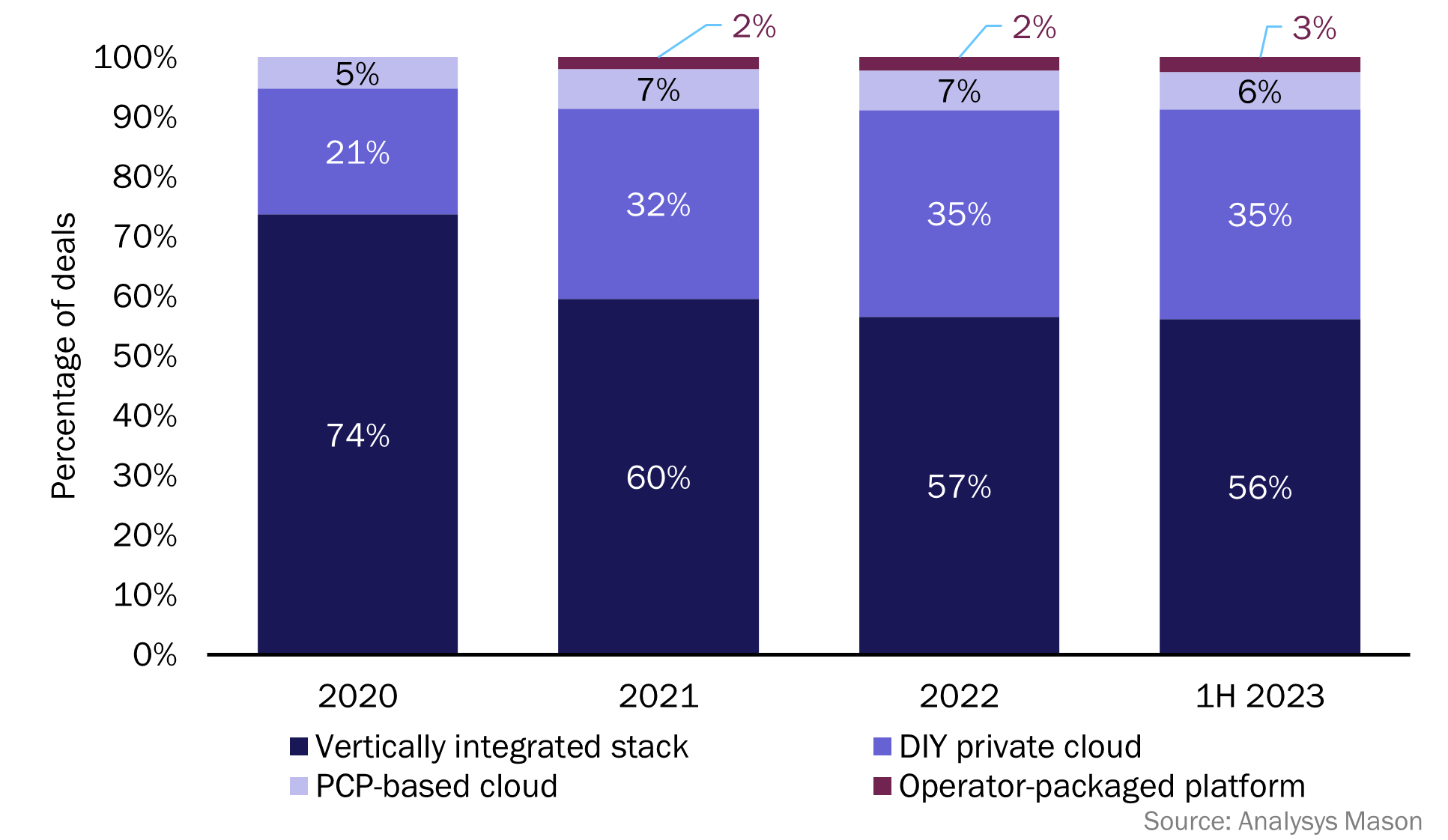

- Deploy a horizontal telecoms cloud that can support multiple functions from multiple vendors. This is still an unrealised industry goal, even though some operators are building their second- or even third-generation network cloud. Our research shows a slow march towards the disaggregation of cloud from network functions but most operators still buy virtualised functions integrated with dedicated cloud infrastructure. They therefore operate multiple cloud silos that hamper the development of end-to-end services such as network slicing and add significantly to the cost of their delivery, even when the silos run on cloud-native technologies. Operators that take a siloed cloud approach will have more overheads than competitors with horizontal clouds. It is expensive for network function vendors to develop cloud-native technology, and the providers of IT cloud platforms have better economies of scale and deeper R&D pockets than function vendors do. Nokia recently acknowledged this fact when it announced its partnership with Red Hat.

Figure 1: Percentage of network cloud deployments by type of deployment model, 2020–2023

- Prepare for cross-functional cloud-native automation. The duplication of automation environments across multiple cloud silos also creates cost. A horizontal network cloud that applies common cloud-native automation across cloud infrastructure and multiple network functions promises eye-catching opex savings: it was these that drove AT&T to partner with Microsoft. Cloud-native automation is based on commodity technologies that are also being adopted by IT application developers. Converged cloud-native automation for IT applications and network functions will make the lifecycle management of new services, and the connectivity that supports them, easier and more cost-efficient. Cloud-native approaches to automation must still be adjusted for the needs of complex network functions but the Nephio project shows promise here.

- Use the monetisation opportunity presented by the cloud-native 5G environment to drive larger cloud-native goals. The fact that 29 operators are now members of the Open Gateway Initiative demonstrates the level of market interest in providing cloud-native network APIs. However, the ability to monetise network APIs in cost-effective and agile ways is greatly enhanced for those operators with horizontal network clouds and cloud-native network automation. Such operators are likely to be able to respond faster and in a more joined-up and scalable way to cloud-native developer demands than operators tied to individual function vendors’ roadmaps. Operators can use the business interest in network APIs to help build the business case for the first two actions that we recommend.;

Operators must accelerate cloud-native network transformation and automation despite the challenges that they face

There is no alternative to cloud-native networking. Operator networks must adapt to the pace of digital service innovation or become irrelevant, displaced by public cloud and other new entrant network providers. Operators must become operationally efficient or risk becoming uncompetitive. Operators face a raft of challenges, including sunk costs in the first generation of telco clouds and technologies that are rapidly being superseded, lack of in-house skills and capabilities to take on a cloud-native network, and vendors and standards organisations that are either slow to adapt to the new cloud-native reality or too quick to ignore legitimate operator concerns over the sovereignty, security and support issues raised by disaggregated, platform-based networks.

The network landscape is changing. We expect the pace of cloud-native 5G standalone (SA) core deployments to increase in 2023 and to become a key driver of telco cloud growth, while vRAN/Open RAN cloud spend will account for 37% of total telco cloud spending by 2027. The cloud-native drumbeat will only get louder as the decade progresses and 6G looms. Operators and vendors need to be part of the momentum towards cloud-native networks or risk future service revenue and their market position.

Author

Gorkem Yigit

Research DirectorRelated items

Perspective

Broadcom supports cloud-native networks and automation through the VMware Telco Cloud Platform

Perspective

Cloud-native networks: telecoms operator readiness and strategies for deployment and operations

Report

Analysys Mason research and insights topics for 2026