SSA and LATAM led 5G deployments in 1H 2024, while 5G standalone launches slowed despite growth in WE

According to the latest edition of Analysys Mason’s 5G deployment tracker, there were 17 new 5G network launches across 11 countries in 1H 2024, with an additional 51 networks either in deployment or scheduled for launch later this year.

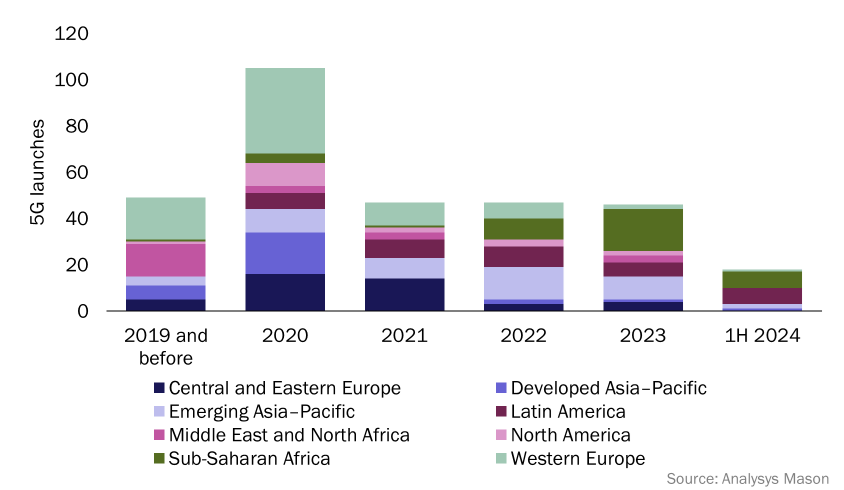

Operators in Sub-Saharan Africa (SSA) have continued to lead launch figures so far in 2024, with seven 5G launches in 1H 2024 across four countries (see Figure 1). SSA was followed closely by Latin America (LATAM), which recorded the second-highest launch figures of any region during 1H 2024, with six 5G launches. Emerging Asia–Pacific (EMAP) recorded two 5G launches in 2023, while Developed Asia–Pacific (DVAP) and Western Europe (WE) recorded only one 5G launch each. There were no 5G launches in Central and Eastern Europe (CEE), the Middle East and North Africa (MENA) or North America (NA). 5G standalone (SA) launches showed slow progress in 1H 2024, with a total of four launches in 1H 2024, primarily in WE.

Our 5G deployment tracker includes 364 entries from 2018 to July 2024, with 312 confirmed commercial launches of 5G networks and 50 confirmed commercial launches of 5G SA networks, worldwide.

Figure 1: 5G network launches, by geographical region

SSA continued to lead 5G launch figures in 1H 2024, while LATAM matched its FY2023 launch figures in just 6 months

Sub-Saharan Africa once again recorded the highest 5G launch figures of any region in 1H 2024; a leading position it has consistently held since the beginning of 1H 2023. SSA has accounted for 39% of 5G launches worldwide since the beginning of 1H 2023, as operators in the region have continued to invest in 5G networks despite high numbers of users on legacy networks like 2G/3G. SSA now has 40 operational 5G networks in 21 countries as of 1H 2024.

5G launches in SSA in 1H 2024 are listed below.

- Gambia: Africell became the second operator to launch a 5G network in Gambia in February 2024, following QCell’s 5G launch in June 2023.

- Lesotho: Econet Telecom Lesotho (ETL) became the first operator to launch 5G in Lesotho in March 2024. Initial coverage includes Maseru’s central business district.

- Senegal: Sonatel (Orange) launched Senegal’s first 5G network in March 2024 in areas including Dakar, Thies and Saint-Louis, with a total of 176 sites deployed. Free Senegal then launched the country’s second 5G network in June 2024, with five sites installed in Dakar and plans to expand coverage with 50 more sites.

- Somalia: Following Somtel and Telesom’s 5G launches in January 2023, Hormuud Telecom launched 5G services in March 2024, with coverage in areas including Baidoa, Galkayo, Kismayo and Mogadishu.

LATAM demonstrated the most significant increase in new 5G networks during 1H 2024, with six new launches across four countries, equalling its total launch figures for the entirety of 2023 (six). An additional 5G network has already been launched in Costa Rica in July 2024, and with a further eight 5G networks scheduled for launch this year, LATAM looks set to record its highest annual 5G launch figures in 2024. As of 1H 2024, LATAM had 36 operational 5G networks in 14 countries.

5G launches in LATAM in 1H 2024 are listed below.

- Argentina: Telefónica Argentina (Movistar) launched 5G services in La Plata, Mar Del Plata, Pinamar, Retiro and Recoleta, in early 2024. Movistar became the second operator to launch 5G in Argentina after Telecom Personal (2021).

- Cayman Islands: Digicel and Flow became the first operators to launch 5G in the Cayman Islands in June 2024.

- Colombia: Claro, Telefónica Colombia (Movistar) and Une EPM Telecomunicaciones (Tigo Colombia) all launched 5G networks in 1H 2024, with coverage offered across major cities. Colombia now has four operational 5G networks, following DirecTV’s launch of 5G SA fixed–wireless access (FWA) services in 2020.

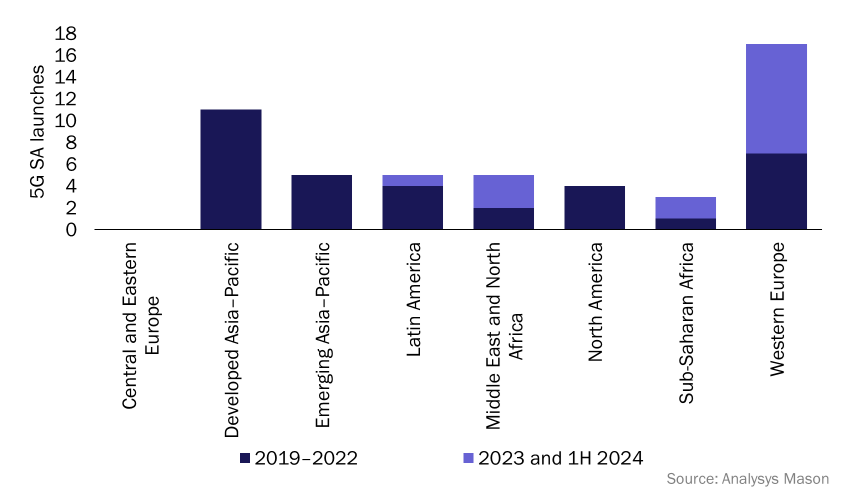

5G SA deployments have grown slowly in 1H 2024, as WE continues to dominate 5G SA launch figures

5G SA launches have had a slow start in 1H 2024, with a total of four launches across four different countries. This demonstrates the increasing hesitancy from operators relating to the business case for 5G SA adoption. Many operators still have concerns surrounding 5G SA monetisation opportunities, its technical maturity and the disruption of migration. These concerns have been exacerbated by limited returns from 5G non-standalone so far and the economic challenges of recent years. Despite this, 5G SA is expected to regain momentum over the coming years as early-movers densify their 5G SA networks and deliver further proof-points for its business case.

Despite slow growth worldwide, 5G SA launches in WE reached record levels in 2023. This trend has continued in 2024, with one new 5G SA network launched in each of the following: Finland, Greece and the UK. WE now accounts for 32% of all operational 5G SA networks worldwide, the most of any region.

Figure 2: 5G SA network launches, worldwide

There are now 50 operational 5G SA networks worldwide. Notable launches in 1H 2024 include the following.

- Finland: Elisa became the second operator in Finland to launch 5G SA in March 2024, following Telia’s launch in 2020. Elisa’s 5G SA network covers 90% of the country.

- Greece: Cosmote become the first operator in Greece to launch 5G SA in June 2024, branding it ‘5G+’. Cosmote’s network covers 50% of the country’s population, with the operator targeting 60% coverage by the end of 2024.

- Nigeria: Mafab Communications launched Nigeria’s first 5G SA network in January 2024, making Nigeria the second nation in SSA to have an operational 5G SA network following Multisource (Rain)’s launch in South Africa (2020). Mafab’s 5G SA coverage includes Abuja, Kano, Lagos and Port-Harcourt.

- UK: Virgin Media O2 (VMO2) announced it had launched 5G SA in 14 UK cities in February 2024, with a target of 100% coverage of populated areas by 2030. VMO2 was the second operator to launch 5G SA in the UK, following Vodafone’s launch in June 2023.

Article (PDF)

DownloadAuthor

Stephen Burton

AnalystRelated items

Survey report

Operators’ requirements for their next-generation RANs: survey results and analysis

Article

Stakeholders must collaborate to prove the security benefits of Open RAN and de-risk early deployments

Forecast report

Mobile packet core: worldwide forecast 2024–2030