5G deployment numbers are growing in EMAP and SSA despite regulatory barriers

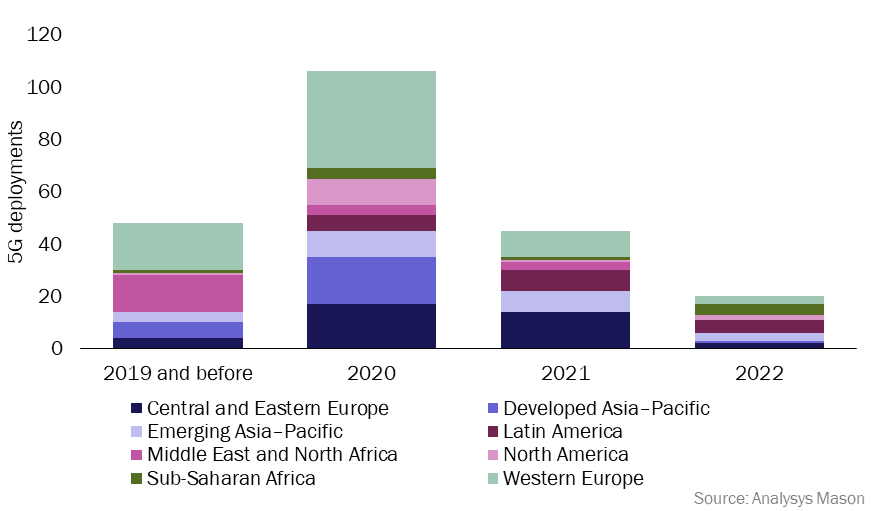

According to the latest version of Analysys Mason’s 5G deployment tracker, 20 operators worldwide commercially launched 5G networks (Figure 1). An additional 62 operators are either planning their networks or are expecting to launch by the end of 2022 or at the start of 2023. Most 5G network launches between 2019 and 2020 took place in Europe and developed Asia–Pacific. However, from 2021, operators in sub-Saharan Africa (SSA), Latin America and emerging Asia–Pacific (EMAP) have become increasingly active, despite regulatory barriers that have hindered deployment. To date, a lack of regulatory clarity regarding the price and availability of additional spectrum for 5G services has forced delays and the withholding of investment decisions in these regions.

Our 5G deployment tracker now includes information on the commercial 5G deployments, both planned and ongoing, of 281 operators worldwide and highlights commercially launched 5G standalone networks.

Figure 1: Operational 5G network launches by region, 2019–2022

Operators in SSA are increasingly planning and trialling 5G networks

Most operators in SSA have prioritised 4G network investment and the region had just six commercial 5G networks in 2021. Large parts of SSA are affected by a lack of clarity regarding long-term licensing of 5G spectrum bands and spectrum prices, which has hindered 5G development within the region. However, countries such as Réunion, South Africa and Zimbabwe have since made progress with deploying 5G. Compared with other operators in SSA, South Africa has reasonable amounts of legacy 2G and 3G spectrum that can be re-farmed to 5G technology, and this has influenced the speed of deployment.

Examples of commercial launches in SSA include the following.

- South Africa. South Africa has led the way with 5G deployments in SSA; Rain, MTN and Vodacom deployed commercial 5G networks in 2020. In March 2022, South Africa’s regulator, ICASA, allocated long-term, permanent 5G spectrum licences for the first time in the700MHz and 3.5GHz bands.

- Zimbabwe. Econet commercially launched its 5G network in Harare in February 2022, after partnering with ZTE and Ericsson. The 5G network is expected to increase internet speeds by up to 10 times of those achieved by legacy 4G technology. Econet is the first operator to offer 5G services in the country.

- Réunion. SFR Réunion officially launched its 5G network in selected locations as of August 2022. SFR selected Huawei to provide the equipment for its network.

Operators in SSA have also been planning and trialling 5G networks in preparation for commercial launch. Examples of this include the following.

- Angola. Unitel partnered with Ericsson to trial a 5G network in urban and industrial centres in regions of Angola. A full deployment is expected to take place by the end of 2022. Unitel will use Ericsson’s 5G RAN and core solutions for its non-standalone network.

- Uganda. MTN partnered with ZTE in Uganda to trial a 5G network in Kampala. A full deployment is expected in 2022.

- Kenya. Airtel Africa partnered with Nokia to upgrade 600 mobile sites to be 5G-ready across Kenya. The operator plans to switch on the network in the next 2 years.

- Nigeria. After 3 years of preparation, MTN switched on its pilot 5G network for selected customers in August 2022, ahead of commercial use. MTN Nigeria partnered with a range of vendors including, Ericsson, Huawei and ZTE.

These 5G trials have demonstrated the technical competence and eagerness of the operators to launch 5G services and how operators have been proactive in building vital relationships with 5G equipment manufacturers.

We expect the number of 5G connections in SSA to increase at a CAGR of 160% between 2021 to 2024.

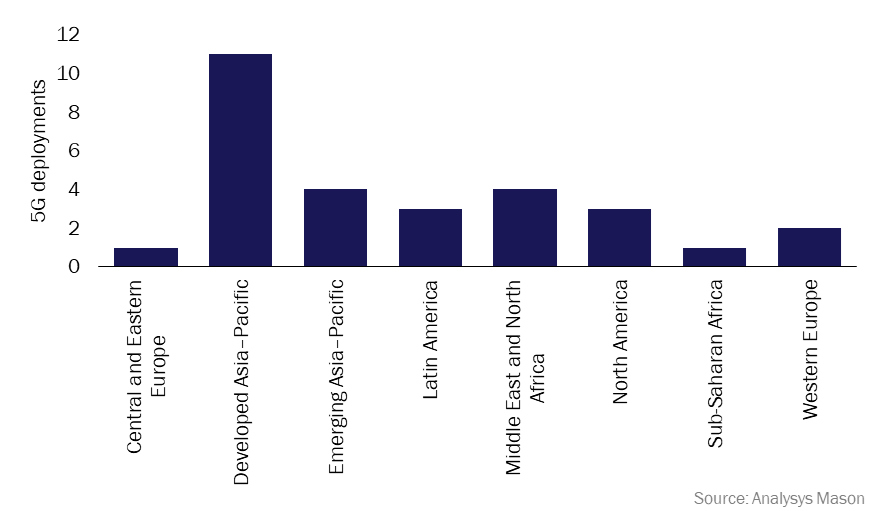

Most commercial 5G SA deployments between 2018 and 2022 took place in developed Asia–Pacific

The investment in standalone 5G networks has been relatively slow; just 29 operators launched a 5G SA commercial network between 2018 and 2023. This corresponds to just 10% of the total 5G deployment activity worldwide in this period. However, we do expect operators to continue to deploy 5G standalone core networks because they unlock the capabilities needed to support new traffic and service demands, such as network slicing and multi-access edge computing. Most standalone networks have been launched in developed Asia–Pacific (Figure 2) and most of this activity occurred between 2019 and 2021. Until now, the business case for deploying 5G SA networks has been weak, particularly in Europe, because operator ARPU has increased minimally after launching 5G services.

Figure 2: 5G standalone deployments by region, 2018–2022

Countries in Asia–Pacific, including China, Japan, Singapore and South Korea, account for most of the 5G standalone networks deployments. Other significant 5G standalone deployments worldwide include the following.

- Brazil. Claro, TIM and Vivo Brazil launched 5G standalone networks in the capital, Brasilia, in July 2022. This was after receiving government approval for 3.5GHz spectrum to be used for 5G. Apart from Brazil, Latin America has recorded no other major 5G standalone network activity.

- Kuwait. STC commercially launched its end-to-end 5G SA network in 2019, using sub-3GHz 5G spectrum, which was the first of its kind in the Middle East region. As part of Kuwait’s 2035 goals, the standalone network supports the transformation of its telecoms industry into an as-a-service model.

- Australia. In August 2022, Optus confirmed it had commercially switched on its 5G SA network to support end-to-end network slicing; optimising speed and latency for next-generation technologies such as driverless cars. Vodafone launched its 5G standalone network in July 2022.

Article (PDF)

DownloadAuthor

Grace Langham

Analyst, expert in sustainability and ESGRelated items

Survey report

Operators’ requirements for their next-generation RANs: survey results and analysis

Article

Stakeholders must collaborate to prove the security benefits of Open RAN and de-risk early deployments

Forecast report

Mobile packet core: worldwide forecast 2024–2030